Kenya’s tax landscape in 2025 is shaped by a mix of long-standing and newly introduced levies aimed at strengthening public revenue, reducing inequality, and supporting national development goals.

According to recent analyses, including findings from Oxfam’s “Kenya’s Inequality Crisis,” taxes will continue to play a central role in financing essential services such as healthcare, education, and infrastructure.

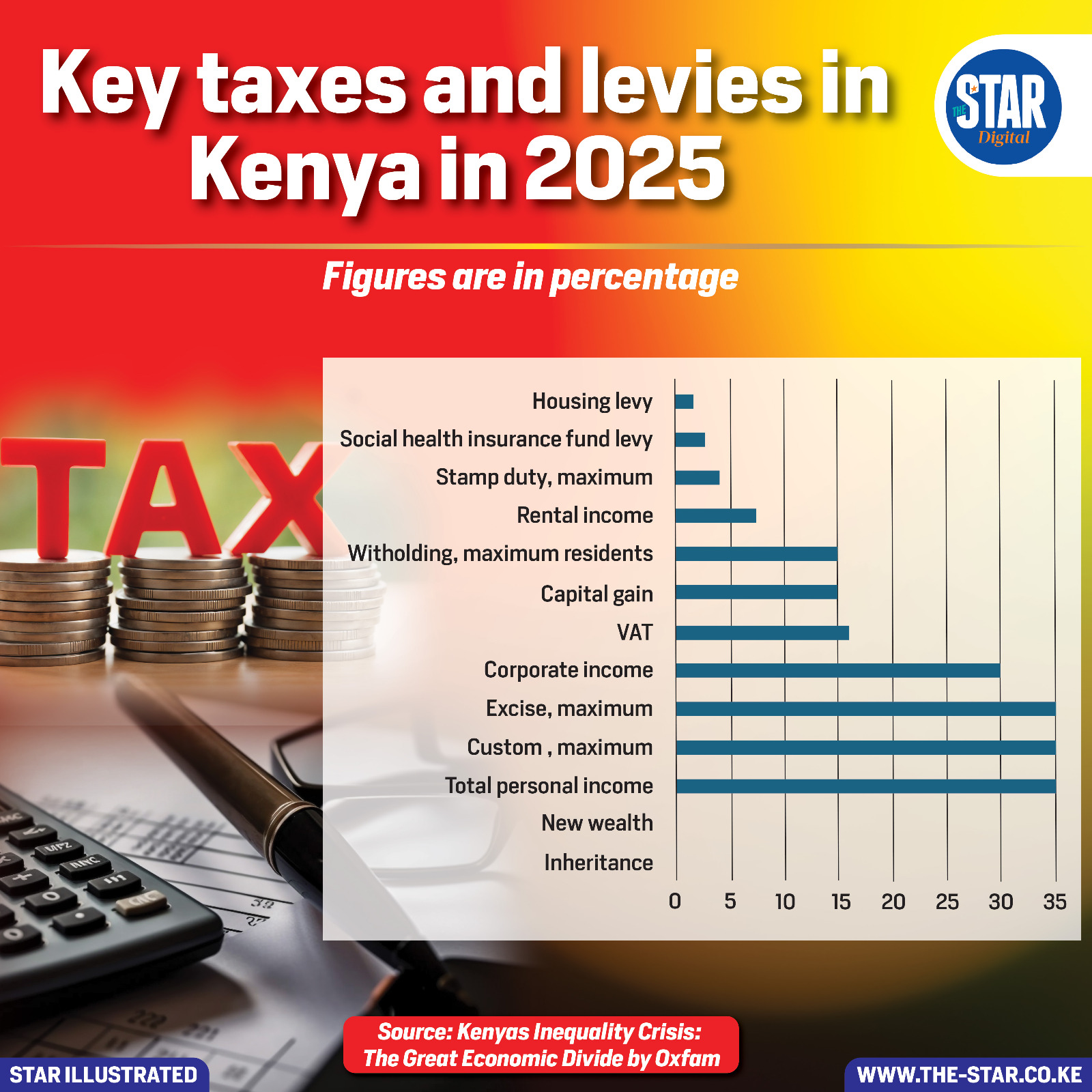

The data highlights a range of taxes and their maximum percentages, offering insight into how households and businesses may be affected.

Among the smaller levies is the housing levy, followed closely by the Social Health Insurance Fund (SHIF) levy, reflecting government efforts to enhance social protection and affordable housing.

Taxes such as stamp duty, rental income tax, and capital gains tax fall in the mid-range and directly impact property owners, investors, and individuals involved in real estate transactions.

Withholding tax for resident individuals is also a notable component, influencing freelance and contract-based work.

At the higher end of the scale are major revenue generators such as corporate income tax, customs duty, excise tax, and total personal income tax, each reaching up to the 30%–35% bracket.

These significantly shape Kenya’s economic environment by regulating business profitability, consumer spending, and imports. Taxes on new wealth and inheritance reflect ongoing discussions around wealth redistribution as the country attempts to narrow its economic divide.