The National Taxpayers Association’s latest perception survey highlights why many Kenyans struggle—or refuse—to comply with tax obligations.

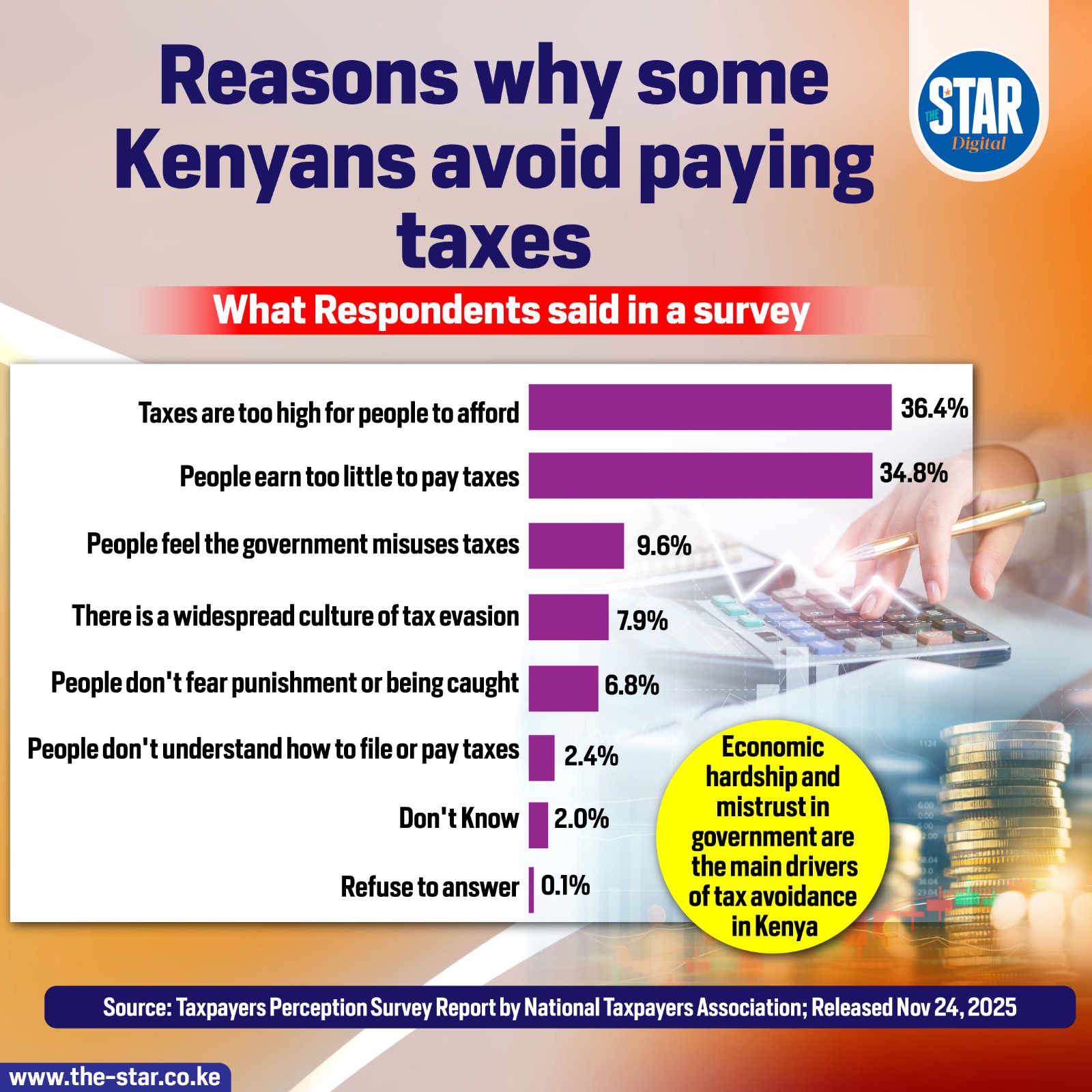

The most cited reason is affordability: 36.4 per cent of respondents say taxes are simply too high for people to manage. With the rising cost of living and stagnant incomes, many households feel they cannot meet their basic needs and still pay taxes.

Another 34.8 per cent of respondents say they earn too little to pay taxes, pointing to the harsh economic realities facing low-income earners. This economic strain is compounded by mistrust in government, with 9.6 per cent saying they believe taxes are misused. For these respondents, non-compliance is driven by frustration over corruption and lack of transparency in public spending.

A further 7.9 per cent cite a culture of tax evasion, suggesting that many people avoid taxes because “everyone else does.” Another 6.8 per cent say they do not fear punishment or being caught, an indication that enforcement mechanisms remain weak or inconsistent.

Meanwhile, 2.4 per cent admit they do not understand how to file or pay taxes, revealing gaps in tax education, especially for first-time taxpayers or informal workers. A small proportion responded with “don’t know” (2 per cent) or refused to answer (0.1 per cent).

Overall, the findings show that tax avoidance in Kenya is shaped by a combination of economic hardship, mistrust in government, and limited awareness of tax processes.