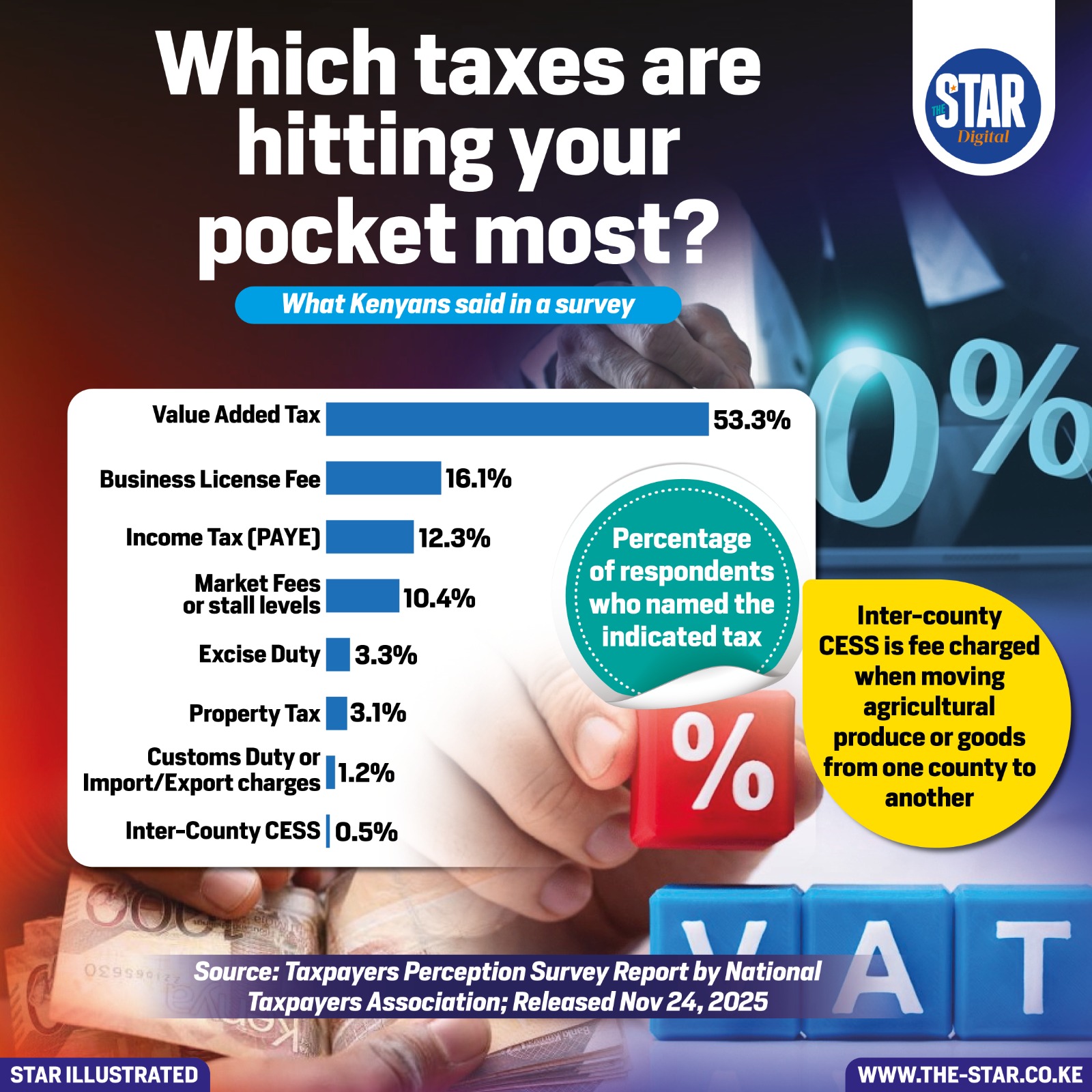

A new Taxpayers Perception Survey by the National Taxpayers Association reveals that Kenyans feel the weight of taxation most sharply through the Value Added Tax (VAT), which more than half of respondents—53.3 per cent—named as the tax that strains their finances the most.

VAT affects almost every purchase, from food to basic household items, making it the most visible and unavoidable tax for many households.

The Business License Fee follows at 16.1 per cent, pointing to the burden faced by entrepreneurs and small business owners who struggle with compliance costs, especially in a challenging economic climate.

Income Tax (PAYE) was cited by 12.3 per cent of respondents, a reflection of how salaried workers feel their earnings are significantly reduced before reaching their pockets.

Market fees and stall levies, which hit traders directly, came in at 10.4 per cent. These charges often pile up on informal sector workers, many of whom already operate with thin profit margins.

Excise duty (3.3 per cent), property tax (3.1 per cent), import/export charges (1.2 per cent), and Inter-County CESS (0.5 per cent) ranked lower, largely because fewer people interact with these taxes regularly.

The findings highlight a broader concern about affordability, pressure on household budgets, and frustration with the growing cost of living. As Kenyans grapple with economic uncertainty, understanding which taxes bite hardest provides useful insight for policymakers reviewing the country’s taxation framework.