Mobile money has revolutionised how business and personal finance operate across Kenya, becoming deeply ingrained in daily life. Despite this widespread adoption, the user experience is far from seamless.

A closer look at the current financial landscape reveals that the cost of convenience is the primary sticking point for the majority of subscribers.

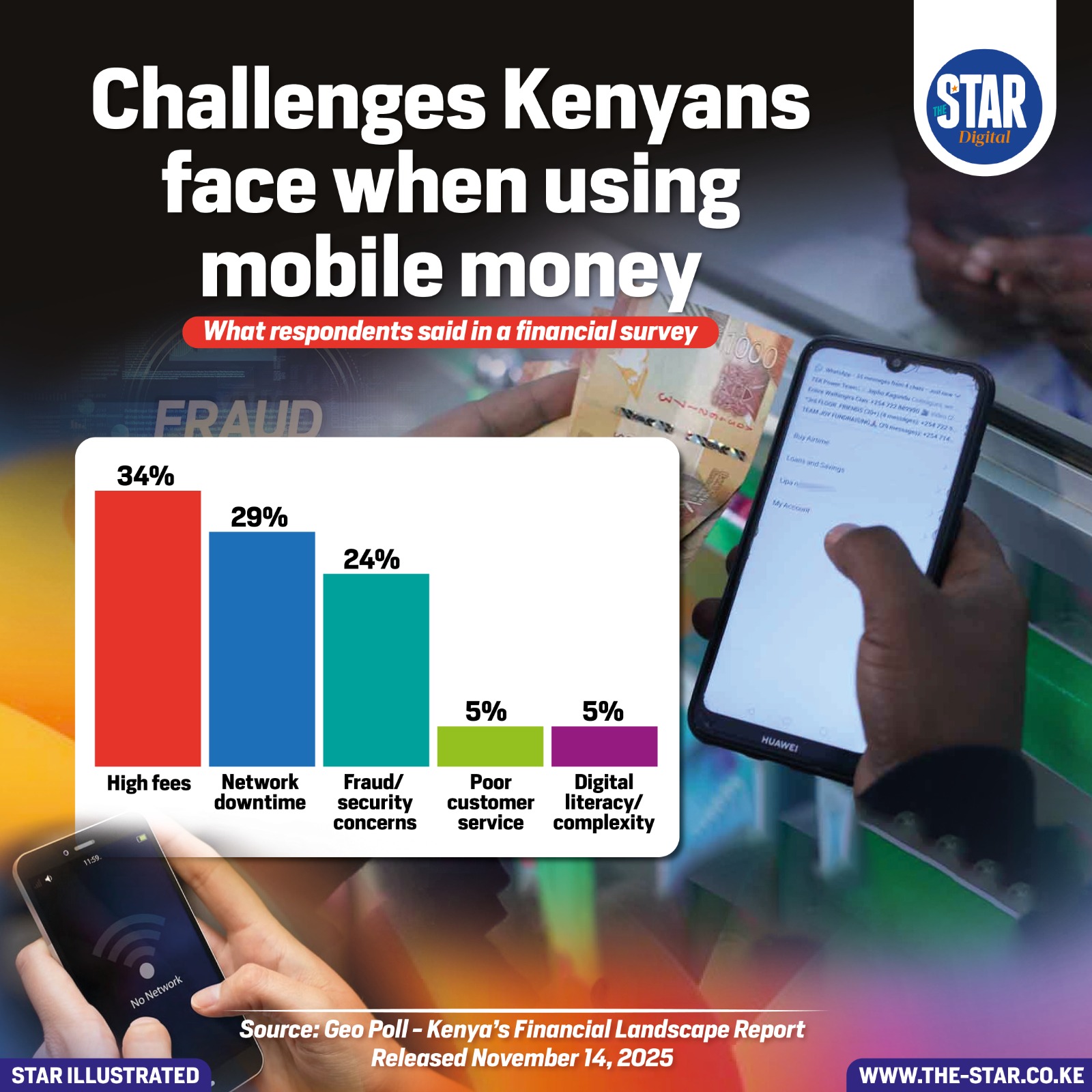

According to the "Kenya’s Financial Landscape Report" released by Geo Poll in November 2025, the most pressing issue facing consumers is the financial burden of using these platforms.

High fees top the list of complaints, cited by 34% of users as their biggest hurdle. Whether sending cash to family or paying for goods, the cumulative expense of transaction charges remains a significant weight on the consumer's wallet.

Beyond the cost, reliability and safety are major sources of friction. Network downtime disrupts services for 29% of the population, leaving users unable to transact during critical moments. This technical instability is compounded by anxiety over security.

Fraud and security concerns account for 24% of the reported challenges, as users navigate an environment increasingly targeted by scammers and digital theft.

While these structural and technical issues dominate the conversation, the human element remains a factor for others.

A smaller segment of the demographic struggles with the systems themselves. Poor customer service and challenges related to digital literacy or system complexity each impact 5% of users.