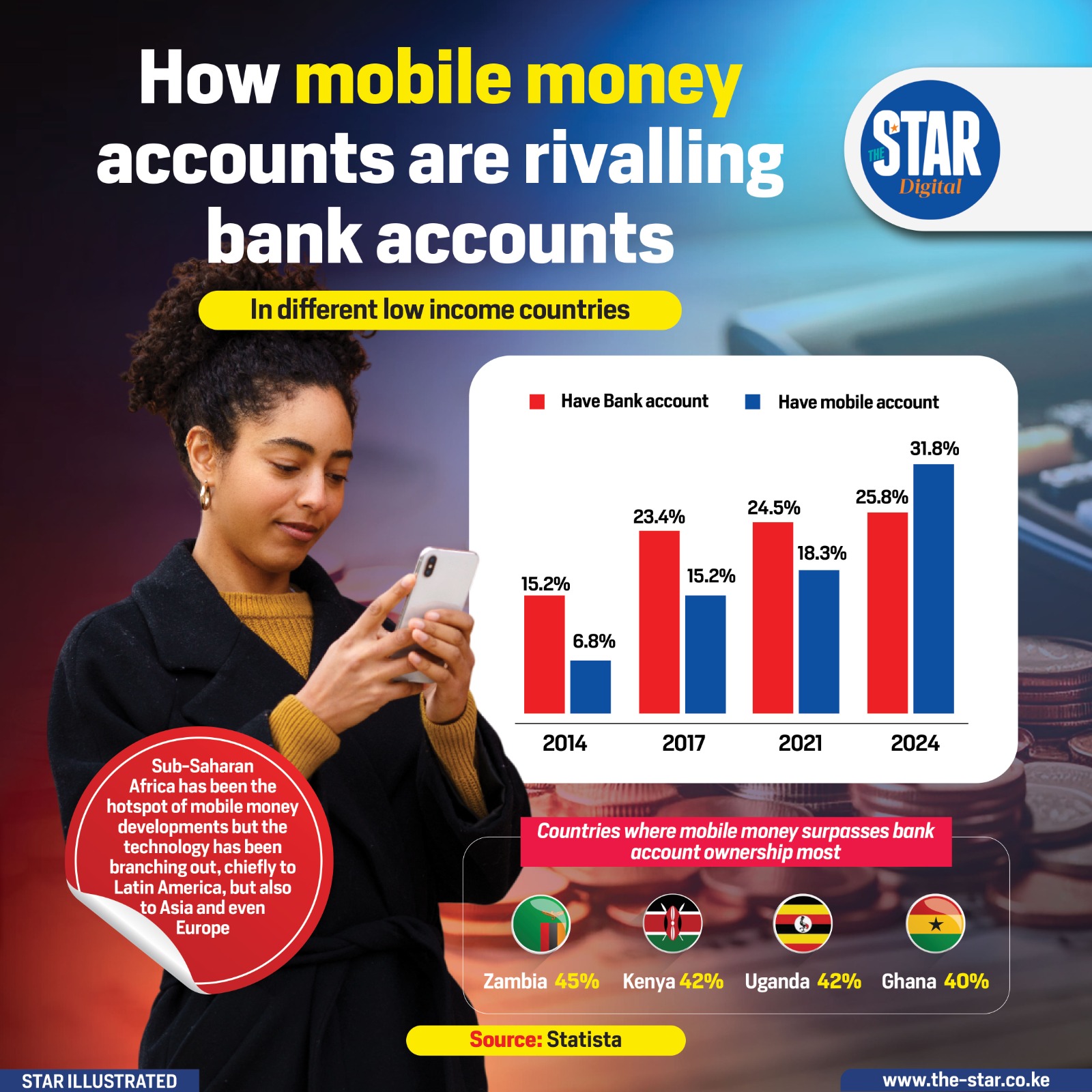

Mobile money is rapidly transforming financial access in low-income countries, rivalling traditional bank accounts.

A Statista report shows mobile account ownership rose from 6.8% in 2014 to a projected 31.8% in 2024, outpacing bank accounts.

Sub-Saharan Africa leads this shift, with Zambia (45%), Kenya (42%), Uganda (42%) and Ghana (40%) recording the highest mobile money uptake over bank accounts.

The trend is now spreading to Latin America, Asia, and parts of Europe, highlighting the global impact of mobile financial services.