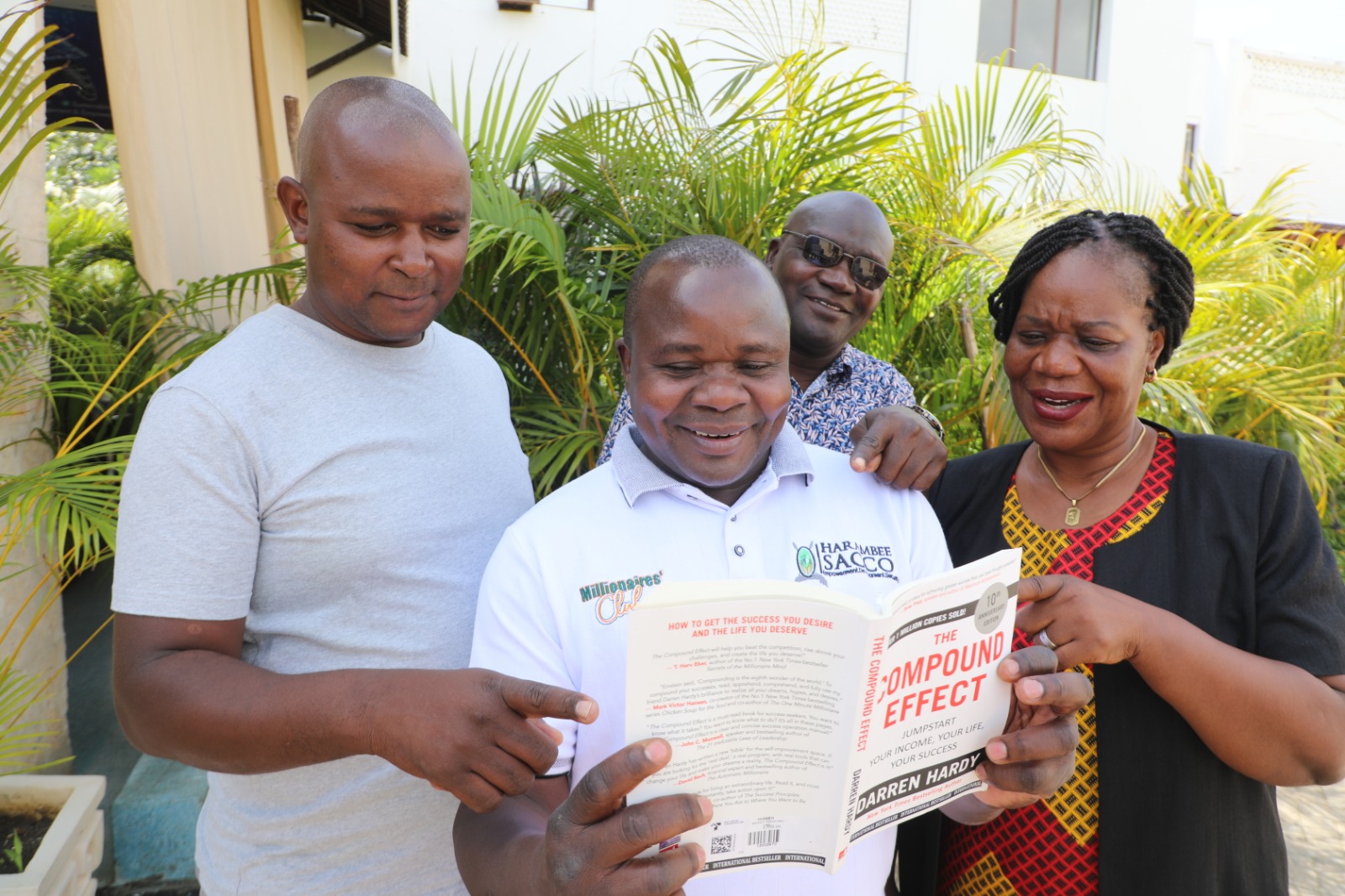

Harambee Sacco CEO George Ochiri has urged Kenyans to invest in saccos, where they are guaranteed maximum returns.

He said the strength of saccos lies in members' savings.

“We have a share drive and we are telling members there is no way a sacco can borrow from external financial institutions and give good returns given the current turbulence," Ochiri said.

“So, we are better off with members buying share capital and investing in Harambee Sacco just like they would do in agriculture, property and farming. And there are guaranteed returns."

He spoke on Tuesday in Mombasa during the sixth edition of the sacco’s annual delegates training whose theme was “Exceeding Expectations”.

One member, who had share capital valued at Sh14.3 billion, was paid Sh2 million last year in dividends.

Ochiri said the member’s target is to get to Sh20 million in dividends before he retires.

“He doesn’t need to have a matatu, he doesn’t need to have rental houses, he only needs to wait for the Sacco to hold an AGM and get his returns,” the CEO said.

The training for the 318 delegates will go on for the next three weeks.

Harambee Sacco currently has an asset base worth Sh38.9 billion.

The target, Ochiri said, is to close this year at Sh7.2 billion.

“We’ve been able to rejuvenate the sacco and bring it to stability and our expectation now is to go beyond the normal performance,” he said.

Ochiri urged retirees and those about to retire not to leave the sacco.

“Even those who took their savings and left the society, this is the message form the leadership of Harambee Sacco – come back, you are still a member of Harambee Sacco. We have your membership number, your shares and your dividends – in case you have not come for them,” he said.

The CEO urged the youth, especially Gen Z to join saccos.

He said mama mbogas’ and hustlers’ successes are pegged on financial institutions.

“I therefore urge all the youth to join saccos, and if possible, Harambee,” Ochiri said.

Dolphine Aremo, the Nairobi county director of cooperatives, said saccos have designed products to suit the youth.

“The youth don’t want to be told to wait for three months to get a loan. I know they want loans on arrival and that is why cooperatives have designed products such as Karibu Loans that give instant loans but take part of it to savings," she said.

The Karibu Loan product is designed to save money that would have otherwise been spent on parties.

“Therefore, save first so you can get dividends, part of which you can use to unwind. It is also important to know that you will not be Gen Zs forever," Aremo said.

Harambee Sacco is one of the key saccos in the country.

Millicent Simiyu, the Harambee Sacco national vice chairperson urged borrowers to also pay back loans.

Neslon Nyoro, the Mombasa county director of cooperatives, said the delegates are the transformative engines saccos.

He said trainings on innovation, technology, governance and leadership and inputs on personal lives that focuses on retirement planning, are crucial for the success of the saccos and the wellbeing of their members.

He said Harambee Sacco has become one of the case studies of transformation.

“We are proud the investment we have put in education is paying dividends,” Nyoro said.