Increased activities by Saccos in the year ended December 2024 reflected in Co-operative Group’s financial results for the first three months of the year, with net earnings growing to Sh6.9 billion.

This was a 5.3 per cent growth compared to the Sh6.6 billion reported during the corresponding quarter last year, attributed to the lender’s Soaring Eagle’ Transformation Agenda that largely embeds the bank’s future on the growth and transformation of the sacco movement in Kenya.

Last week, the lender announced linking 135 more Saccos to its banking platform, expanding ties with thrift institutions that grew total asset base to Sh1.08 trillion in 2024. So far, it has commercial ties with 619 Saccos in the country.

The lender’s gross earnings for the period under review rose by 6.8 per cent to Sh9.63 billion, up from Sh9 billion in the corresponding quarter last year.

Customer deposits grew to Sh525.2 billion, a nine per cent increase from Sh481.8 billion.

Shareholders’ funds have grown to Sh155.9 billion, a 22.7 per cent increase from Sh127.1 billion in Q12024 driven by the strong growth in retained earnings of Sh16.7 billion.

Total assets grew to Sh774.1 billion, an 8.3 per cent growth from Sh714.7 billion in the same period last year. Net loans and advances grew by 1.7 per cent to Sh384.5 billion compared to Sh378.1 billion in Q12024.

During the period under review, the Nairobi Securities Exchange listed lender’s net loans and advances to customers grew by 1.7 per cent to Sh384.5 billion compared to Sh378.1 billion in Q1, 2024.

Total operating income grew by 12.8 per cent from Sh18.8 billion to Sh21.2 billion, with the net interest income growing 21.7 per cent from Sh11.7 billion to Sh14.2 billion.

The group’s total non-interest income retreated marginally by 1.9 per cent from Sh7.1 billion to Sh6.9 billion.

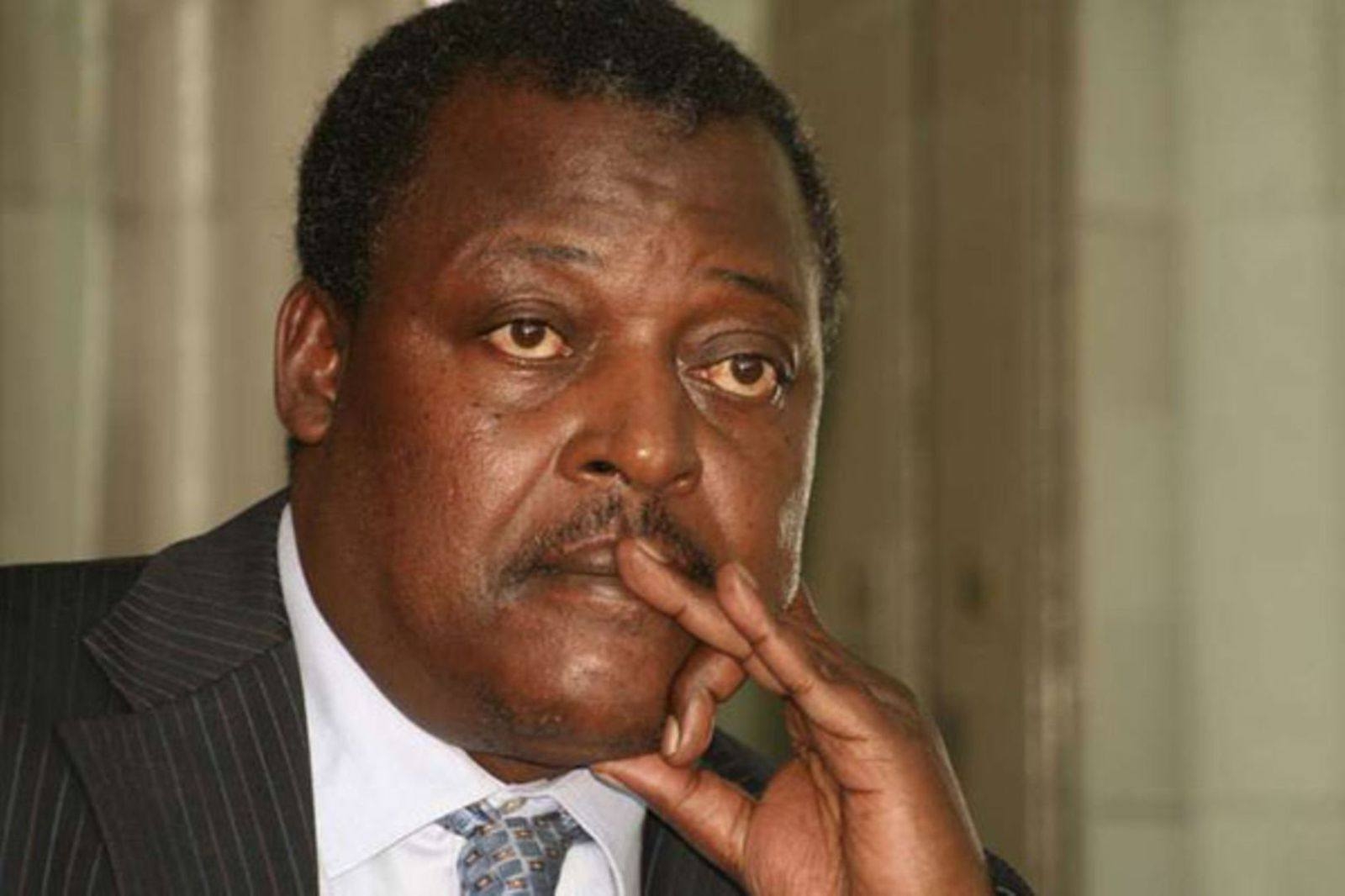

“The Group reports efficiency gains from various initiatives to record a Cost-to-Income Ratio of 45.5 per cent in Q12025, from 59 per cent in financial year when we began our growth and efficiency journey,” managing director and CEO Gideon Muriuki said on Thursday.

The Group, he noted, continues to leverage its core banking system (latest version of Finale from Infosys–one of the best rated globally) to support its digital synergy.

This, as Mco-op Cash mobile wallet continues to drive substantial non-funded income streams with Sh19.1 billion in loans disbursed in Q1,2025, averaging Sh6.37 billion per month.

Over 243,155 customers have taken up the MSME packages rolled out in 2018, and 67,000 have been trained on business management skills.

Co-op’s model of retail banking services avails access to cash for Front Office Service Activity (FOSA) operations, a banking service offered by many Savings and Credit Cooperative Organisations (Saccos), enabling 619 FOSA outlets to support over 15 million Sacco members access banking services even in rural and remote areas.

Its subsidiary, Kingdom Bank (a niche MSME bank) contributed a profit before tax of Sh224.7 million, while Kingdom Securities Limited contributed Sh41.8 million, while Co-op Bancassurance Intermediary Ltd posted a profit before tax of Sh402.1 million, riding on strong penetration of Bancassurance business.

Co-operative Bank of South Sudan that is a unique joint venture (JV) partnership with the government of South Sudan (Co-op Bank 51% and GOSS 49%), made a profit before tax of Sh80.7 million.

This performance was, however, restated to reflect the changes in the general purchasing power of the South Sudanese Pound, resulting in a loss of Sh47 million.