General savings habit of working Kenyans

Other than pensions, how would you describe your general savings habit?

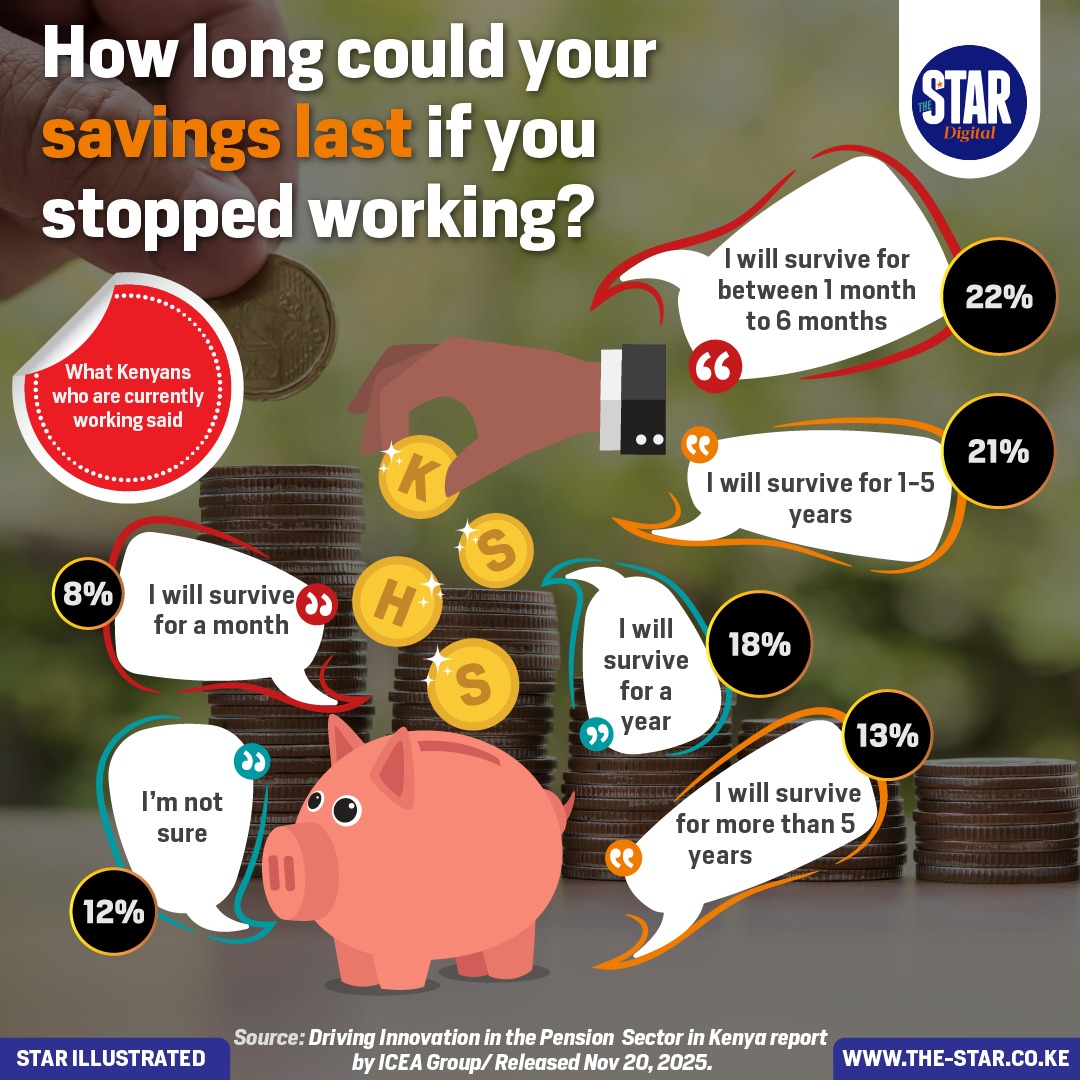

What Kenyans who are currently working said in a survey.

In Summary

Audio By Vocalize

Many Kenyans currently working are uncertain or concerned about how long their savings would last if they suddenly stopped earning an income. The data reveals a significant portion of the workforce has a short financial runway.

Alarmingly, the largest single group, accounting for 22%, believes their savings would only allow them to survive for between 1 and 6 months.

An additional 8% estimate their savings would be depleted in just one month. This means a total of 30% of respondents could only sustain themselves for six months or less without a salary.

Conversely, a smaller but substantial group has a longer-term financial outlook. 21% estimate their savings would last for 1 to 5 years, while 13% are confident their savings would sustain them for more than 5 years.

In the middle, 18% believe they would survive for one year. A concerning 12% are simply not sure how long their savings would last, highlighting a lack of financial planning or awareness regarding their current reserves. These findings underscore a prevalent need for stronger financial planning and savings strategies across the Kenyan workforce.

Other than pensions, how would you describe your general savings habit?

What retirees in Kenya said in a survey.