Pension saving medium amongst retirees

Pension saving medium amongst retirees

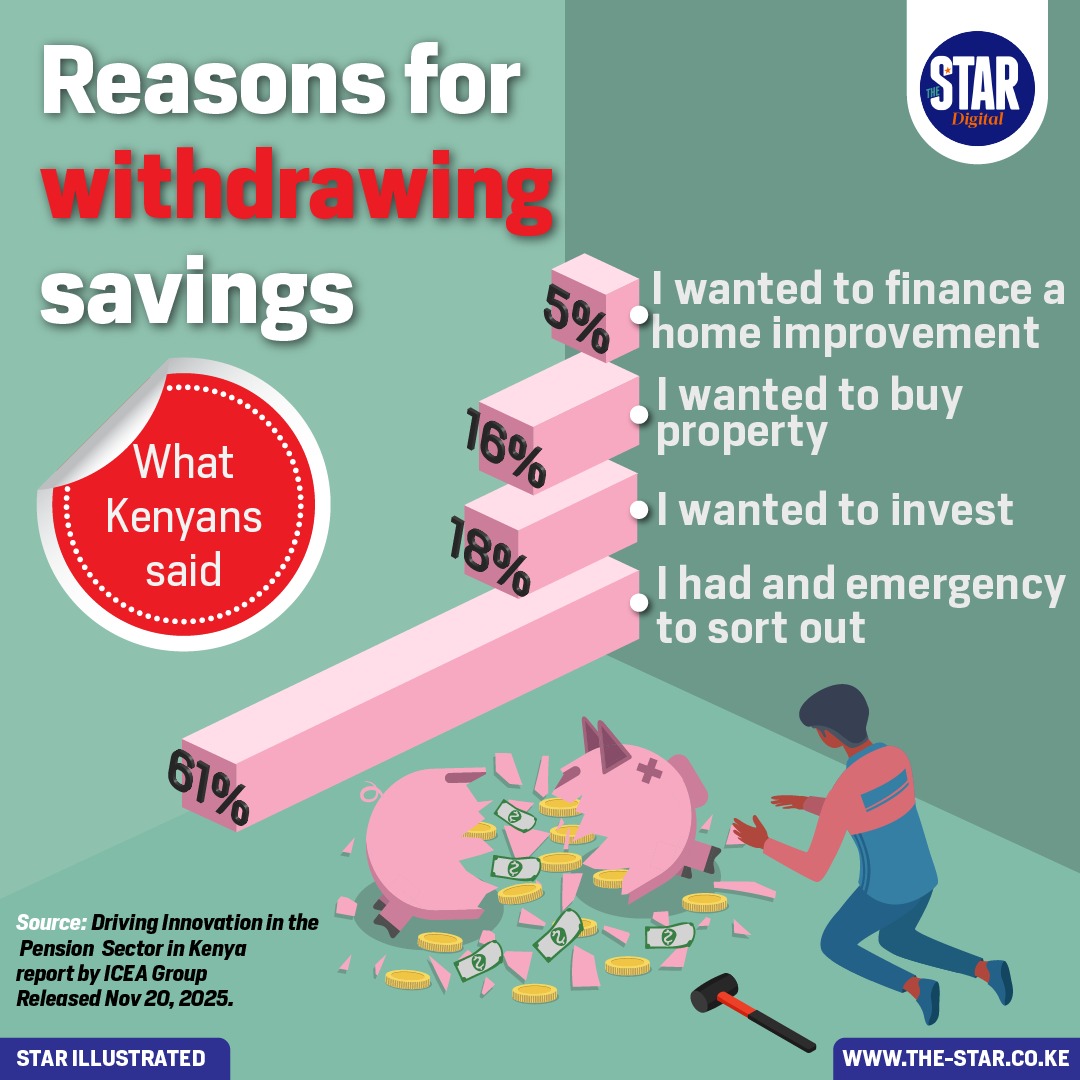

According to findings, 61% of respondents withdrew their savings to address emergencies.

In Summary

Audio By Vocalize

A new report on pension and savings behaviour has revealed compelling insights into why Kenyans are increasingly withdrawing their savings.

The study, titled Driving Innovation in the Pension Sector in Kenya, was compiled by ICEA Group and released on November 20, 2025. It highlights a worrying trend: most savers are tapping into their retirement funds to deal with financial shocks rather than long-term planning.

According to the findings, 61% of respondents withdrew their savings to address emergencies. This overwhelming majority reflects the harsh economic realities many households face, including job losses, medical crises, and unexpected expenses that leave families with few alternatives.

Another 18% said they withdrew their savings to invest. While investment can be a positive use of pension funds, analysts warn that premature withdrawals reduce long-term financial security.

Meanwhile, 16% of respondents indicated that they took out their savings to buy property, pointing to increased appetite for home ownership amid rising rental costs. A smaller proportion, 5%, withdrew funds to finance home improvements.

The data signals deeper structural issues, such as insufficient income, limited access to affordable credit, and weak household financial buffers. Experts say the trend underscores the urgent need for innovative pension products that allow flexible access during emergencies without compromising future benefits.

Overall, the report paints a picture of Kenyans relying on their savings as a lifeline in difficult times, highlighting the pressure on households and the need for stronger social and financial protection mechanisms.

Pension saving medium amongst retirees