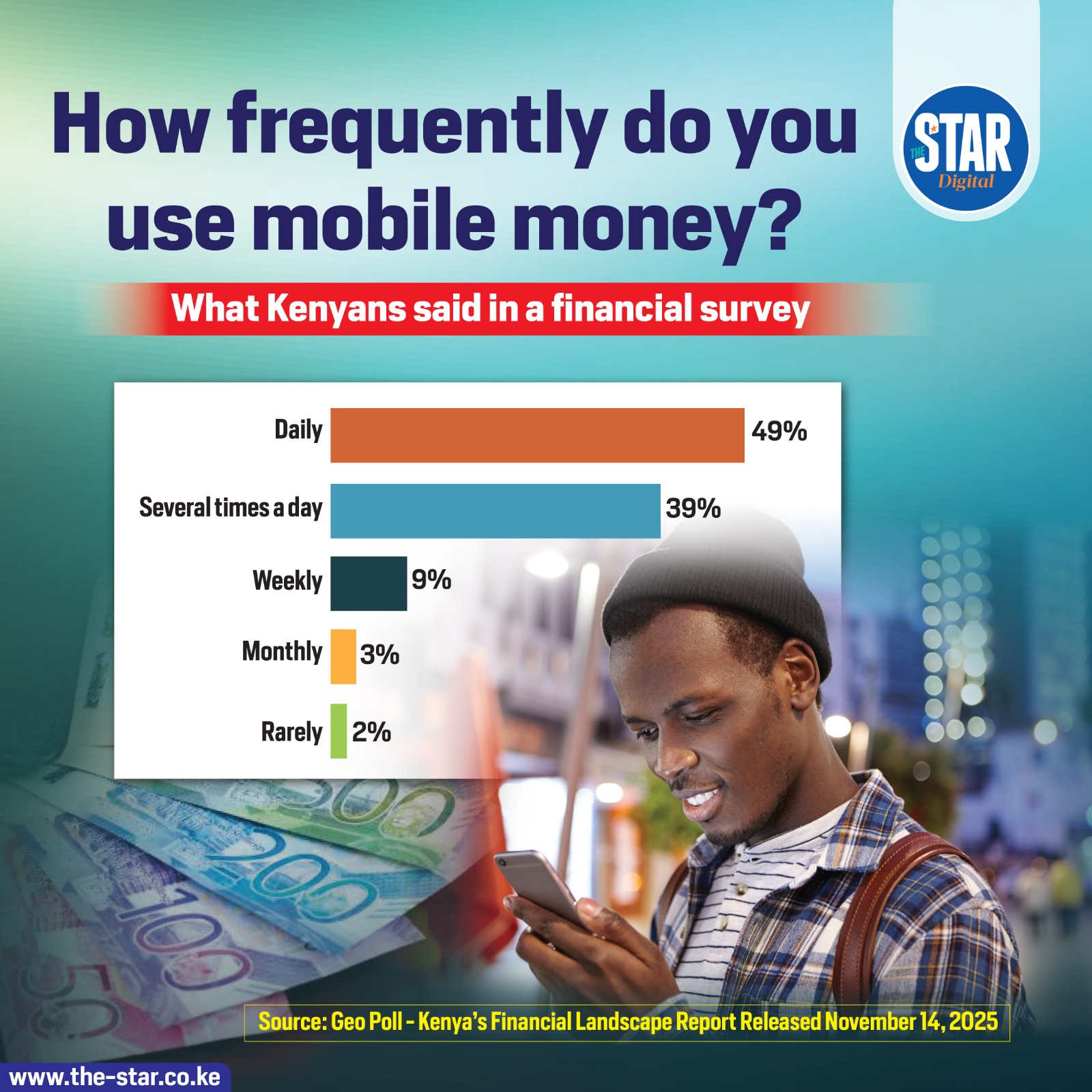

Mobile money has become deeply embedded in daily life across Kenya, with usage patterns reflecting a high level of digital financial engagement.

Nearly half of respondents reported using mobile money services every day, while an additional 39% said they transact several times a day. This indicates that close to nine in ten Kenyans rely on mobile money for frequent financial activities, whether for sending funds, paying bills, or making purchases.

Weekly users accounted for 9%, suggesting a smaller segment that engages with mobile money for periodic needs such as salary transfers or scheduled payments.

Monthly users made up 3%, likely representing individuals who use the service for specific obligations like rent or loan repayments. Only 2% said they rarely use mobile money, pointing to minimal reliance or possible barriers such as access, literacy, or trust.

The dominance of daily and multiple-times-a-day usage underscores the central role mobile money plays in Kenya’s financial ecosystem. It reflects a shift from traditional banking to mobile-first solutions, especially in urban and peri-urban areas where mobile penetration is high.

The survey was conducted as part of Kenya’s Financial Landscape Report, released in November 2025 by GeoPoll, capturing the evolving habits of a digitally connected population.