A section of Mrima hill in Lunga-Lunga, Kwale county /FILE

A section of Mrima hill in Lunga-Lunga, Kwale county /FILE

Mirima Hill in Kenya’s coastal region is emerging as a central ground for global power play, with the US and China showing interest in the $62 billion (Sh8 trillion) rich mineral forest that locals regard as a shrine.

In 2013, an assessment report by Cortec Mining Kenya, a subsidiary of the UK and Canada-based Pacific Wildcat Resources, revealed that deposits of rare earth minerals lie beneath its lush forest, vital for producing smartphones, electric vehicles and renewable energy systems.

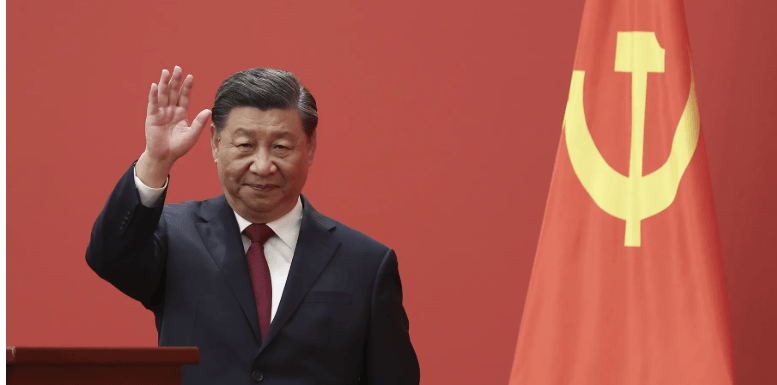

This year, officials from the two global superpowers have visited the hill in Kwale county, believed to hold key minerals vital for producing smartphones, electric vehicles and renewable energy systems, according to an assessment report by Cortec Mining Kenya.

In June, US official, Marc Dillard, visited the hill while serving as the interim ambassador to Kenya. Political and international trade analysts have termed the visit as ‘significant’ in the ongoing scramble for Africa by major global players.

Some are even linking the envoy’s abrupt visit to the planned three-day tour of US Vice President JD Vance to Nairobi between November 24-27.

“A top official of the United States cannot wake up and visit a hill for no reason. Look keenly, Donald Trump’s administration is doubling efforts to hold a grip on the continent’s social and economic affairs. No more freebies,’’ Samson Kegode, an international relations lecturer at a local university, told the Star.

“The US has realised that its competitors (China, Russia and the European league) have a give and take relationship with the continent. They are either lending, selling goods or buying stakes in the continent’s natural resources.”

According to him, no powerful country won’t be intrigued by mineral deposits valued at more than Sh8 trillion.

” The US’s interest in Mrima Hills, true or rumor, cannot be dismissed,” Kegode said.

His counterpart, Carolyne Akoth, said that the US’s increased involvement in Congo's mineral sector through deals that leverage security and stability illustrates Trump’s interest to have a pie of Africa’s wealth.

According to her, the US government under President Trump has made securing critical minerals central to its diplomacy in Africa, including through a peace deal in the resource-rich Democratic Republic of Congo.

This strategy aims to secure critical minerals for US industries and counter China's influence. However, critics raise concerns that it prioritises corporate interests over the needs of the Congolese people and may not lead to sustainable peace.

“The decision to introduce reciprocal trade tariffs mid this year betrays the US’s deep slumber as China increases its dominance in the region through infrastructure collaborations, debts and expanding market for its goods and services.”

Other foreigners also attempted to visit in recent months, including Chinese nationals who were turned away, according to Juma Koja, a guard for the Mrima Hill community.

Recently, Australian companies RareX and Iluka Resources announced plans to explore rare earth mining in the region, further intensifying the international competition.

As major powers salivate for Africa’s resources, local governments are repositioning their mineral policies as competition for critical resources accelerates.

President William Ruto's administration is heavily focused on reforming the mining sector to position it as a key driver of Kenya's economic growth, with an ambitious target to increase its contribution to the GDP from 0.8 per cent to 10 per cent by 2030.

This year, the Ministry of Mining announced a major reform programme to restore investor confidence and strengthen regulation. The reforms include tax incentives, simplified licensing procedures and promises of greater transparency in the approval process.

“There is a romantic view that mining is an easy way to get rich,” Professor Daniel Weru Ichang’i, a retired economic geologist at the University of Nairobi, noted, “But corruption and weak governance make it risky. If Kenya wants to benefit, it must strengthen institutions and ensure national interests come first.”

He added that competition between the West and China is pushing prices higher, but Kenya’s long-term gains will depend on adherence to the law and the prioritisation of collective national interests over personal gain.

While the international race for these resources intensifies, local communities are torn on whether those minerals will bring curses or blessings.

“For generations, the forest has provided food, medicine and spiritual refuge to our people. We see many people are now interested in the hill, with some buying land and establishing businesses around. I hope it won’t lead us into trouble,’’ a local, Daniel Jibbo told the Star.

Others like Musa Koja worry that they will lose their land or receive nothing from the profits that foreign companies hope to make.

“People come here with big cars, but we turn them away,” Koja said.

His words reflect a deep mistrust that stems from years of failed promises and opaque deals. Kenya’s mining sector has long struggled with corruption, poor regulation and lack of transparency.

In 2019, the government temporarily banned new mining licenses to combat illegal activities and environmental damage. However, the rising global demand for rare earths, combined with China’s restrictions on mineral exports, has renewed Kenya’s interest in reviving the sector.

Despite these fears, not everyone in the community opposes mining. Some see it as a rare opportunity to escape poverty.

Domitilla Mueni, treasurer of the local community forest association, has been improving her land by planting trees and crops to increase its value in anticipation of potential land purchases by mining companies.

“Why should we die poor while we have minerals?” she posed, expressing the hopes of those who believe mining could bring development, schools and better infrastructure to the region.

![[PHOTOS] How Suluhu’s swearing in went down](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F11%2F9cbad8a5-9bff-410e-b157-a335c61d6d8d.jpg&w=3840&q=100)