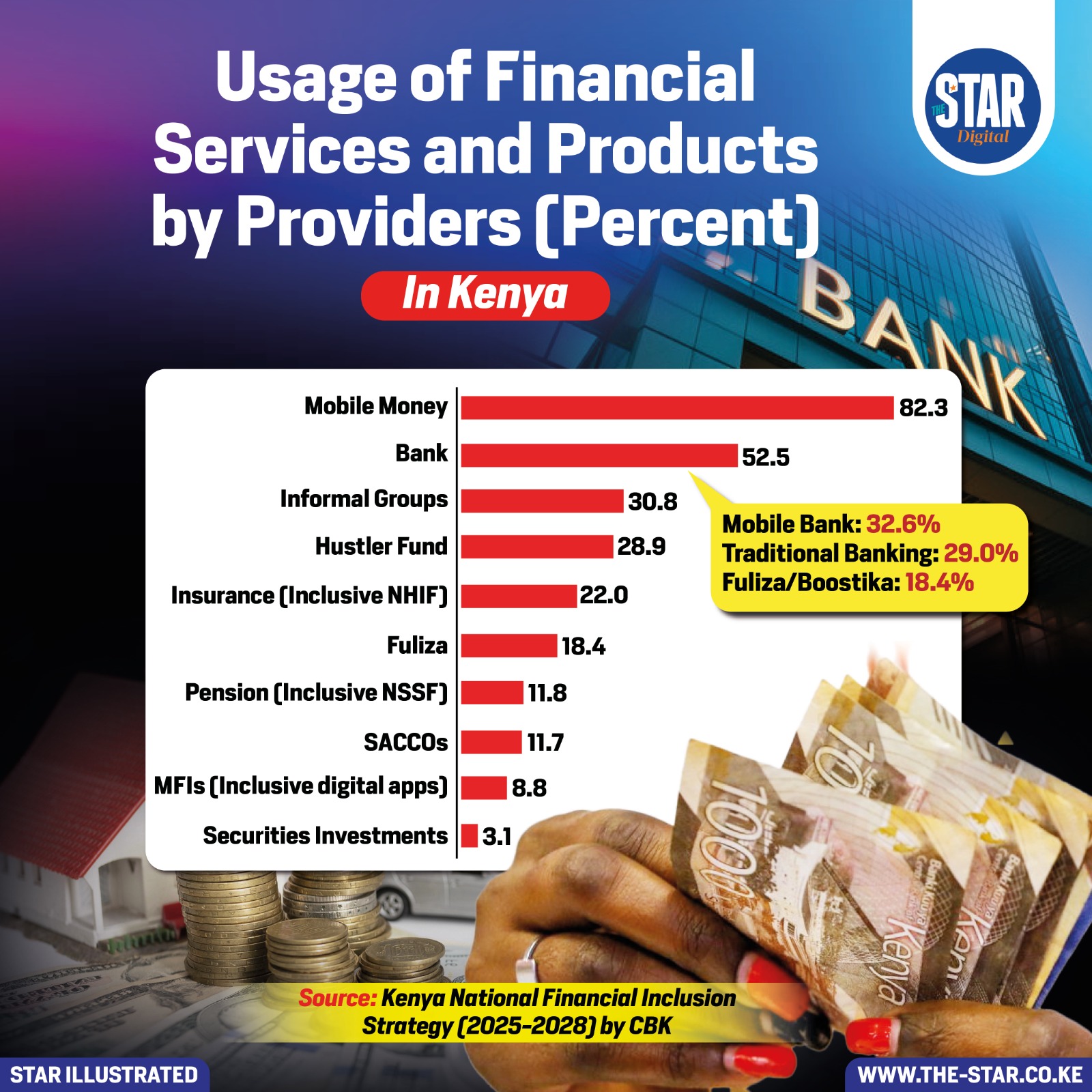

Financial services and products are widely utilised by Kenyans, with Mobile Money dominating the market at 82.3% usage.

This highlights the transformative impact of mobile banking technologies on financial inclusion in the country.

Traditional Bank usage follows at 52.5%, showing that established institutions maintain a significant presence, though they are outpaced by mobile platforms.

The reliance on Informal Groups for financial activities remains strong at 30.8%, reflecting the importance of community-based financial networks.

New government initiatives are also gaining traction, with the Hustler Fund seeing 28.9% usage.

Insurance (Inclusive NHIF) uptake stands at 22.0%, indicating a growing awareness of risk protection.

Digital credit is highly popular, with Fuliza (a key digital lending product) used by 18.4% of the population.

Other providers include Pension (Inclusive NSSF) at 11.8%, SACCOs at 11.7%, and MFIs (Inclusive digital apps) at 8.8%.

Securities Investments represent the smallest segment at 3.1%, suggesting a lower level of participation in capital markets.

Within the banking sector, Mobile Bank services are preferred at 32.6%, slightly ahead of Traditional Banking at 29.0%.