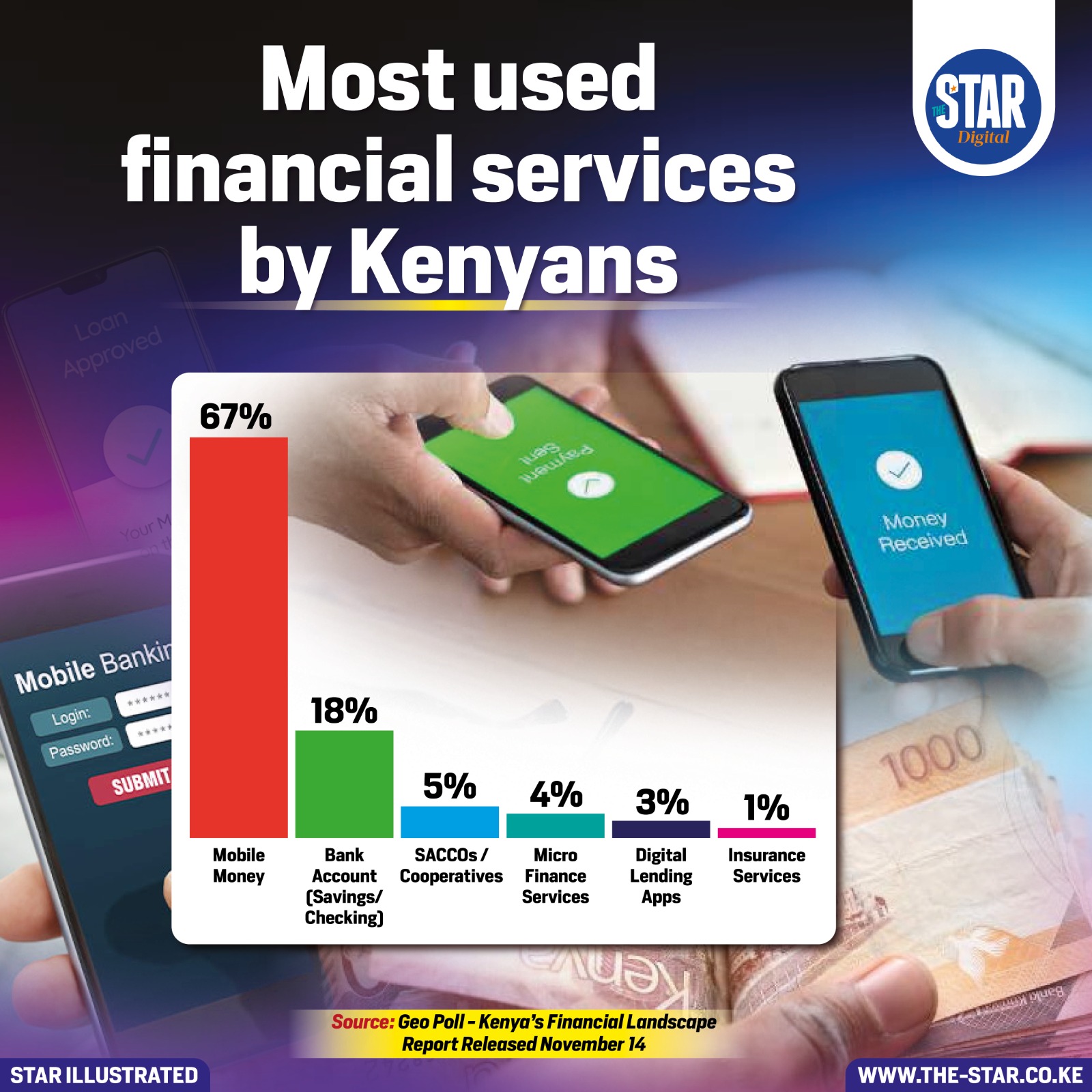

New data from GeoPoll’s Kenya Financial Landscape Report shows that mobile money remains the dominant financial service in the country, used by 67 per cent of respondents.

The findings underscore Kenya’s reputation as a global mobile-money pioneer, largely driven by platforms such as M-Pesa that enable fast transactions, digital payments, and cash-light economies.

Traditional bank accounts come a distant second at 18 per cent, highlighting a continued preference for digital wallets over formal banking institutions.

While banks remain crucial for savings and formal credit access, many Kenyans rely on mobile money for daily financial needs due to accessibility, lower transaction barriers, and wide agent networks.

SACCOs and cooperative societies account for 5 per cent of usage, reflecting their role in savings and community-based lending. Microfinance services follow at 4 per cent, catering mainly to informal traders and small-scale entrepreneurs.

Digital lending apps, despite their popularity for quick loans, represent only 3 per cent—possibly due to high interest rates, stricter regulation, and growing public caution. Insurance services rank lowest at 1 per cent, signalling limited penetration driven by affordability challenges, low awareness, and mistrust of claims processes.

The data illustrates Kenya’s evolving financial behaviour, where convenience drives adoption. It also highlights gaps in long-term financial planning, including savings stability, credit safety and risk protection.