Pension saving medium amongst retirees

Pension saving medium amongst retirees

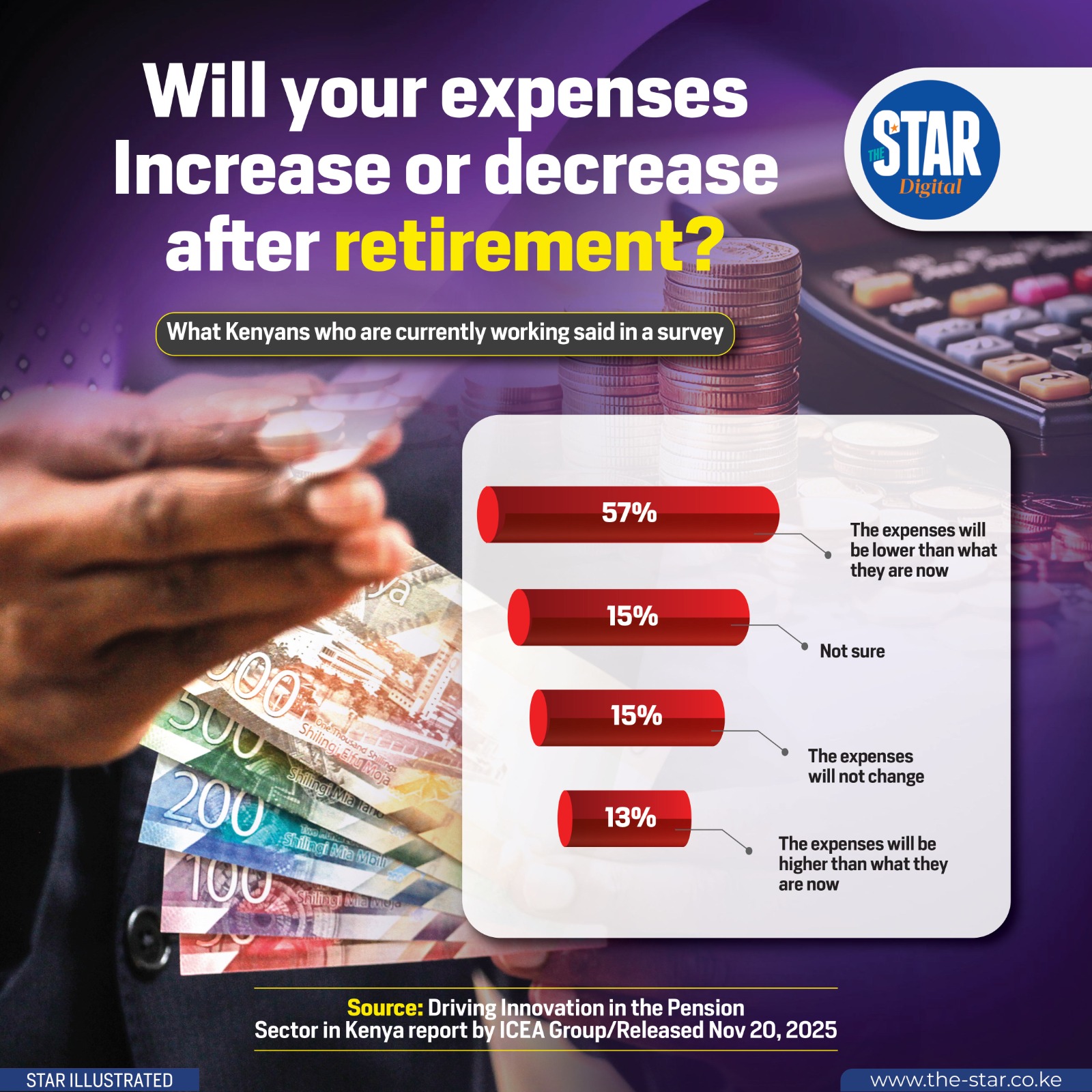

What Kenyans who are currently working said in a survey.

In Summary

Audio By Vocalize

A new survey on retirement expectations shows that most working Kenyans believe their expenses will reduce once they leave active employment.

The findings, published in the Driving Innovation in the Pension Sector in Kenya report by ICEA Group and released on November 20, 2025, offer a glimpse into how the workforce is preparing—mentally and financially—for life after work.

According to the report, 57 per cent of the respondents expect their spending to be lower in retirement than it is today. This suggests that many Kenyans assume their cost of living will decline when they stop working, possibly due to expectations of fewer daily expenses such as commuting and work-related costs.

However, financial experts often caution that retirement can introduce new or increased expenses, particularly in healthcare.

The survey also shows that 15 per cent of respondents are unsure about what will happen to their expenses after retirement. This uncertainty highlights a significant gap in retirement planning and points to the need for more public education on long-term financial management.

Another 15 per cent believe their expenses will remain unchanged, indicating a segment of workers who foresee a stable lifestyle even after they stop earning a full-time income.

Only 13 per cent of those surveyed expect their expenses to be higher during retirement. While this is a minority, it may reflect growing awareness of rising medical costs, extended family responsibilities, and the impact of inflation on essential goods and services.

The findings underscore the importance of structured retirement planning in Kenya, especially as more citizens join pension schemes and financial institutions push for greater savings culture.

The data also signals an opportunity for the pensions sector to tailor products that match the expectations and realities of future retirees.

Pension saving medium amongst retirees

Currently working population