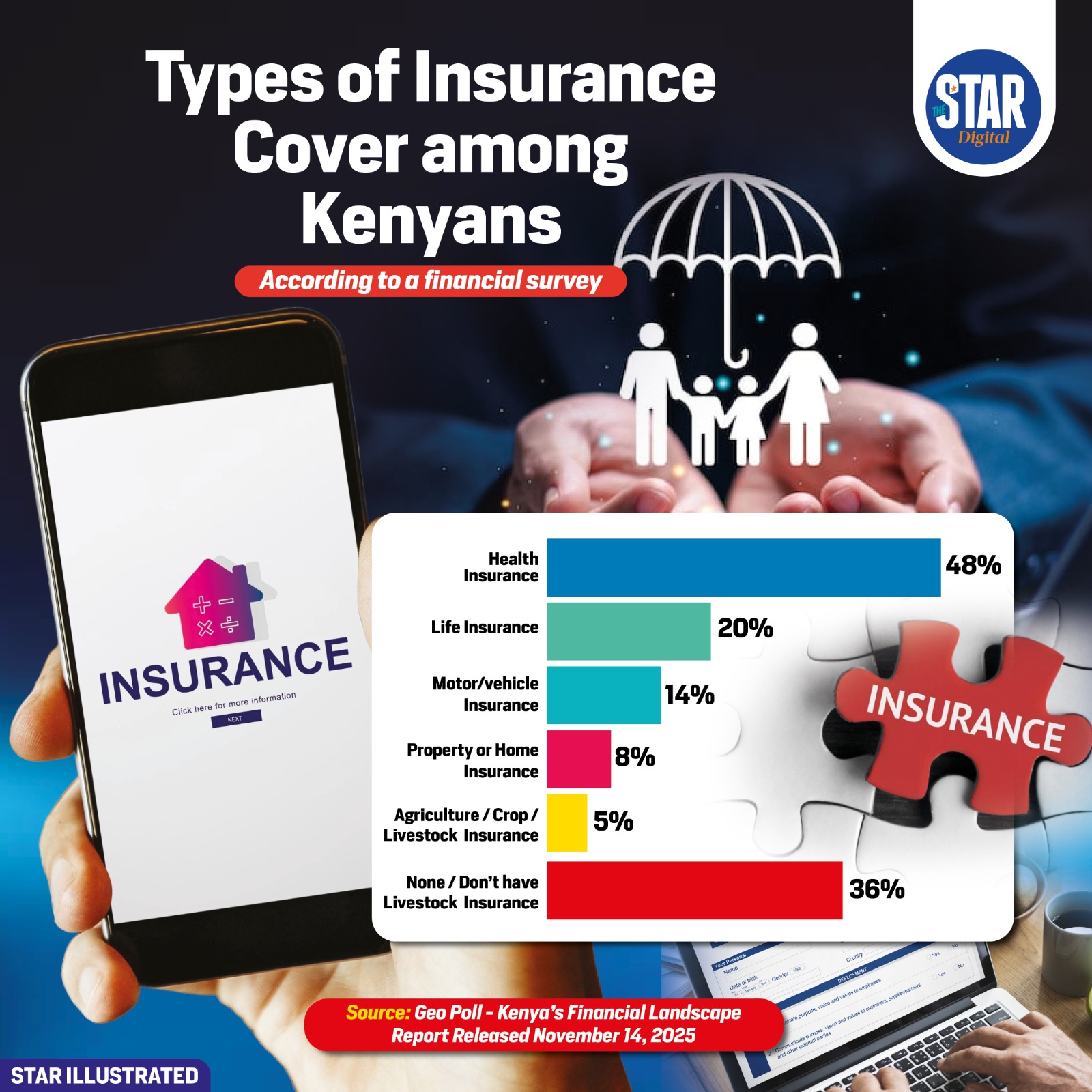

Health insurance leads the pack among Kenyan insurance holders, with nearly half of the surveyed individuals reporting coverage. This reflects growing awareness of medical risks and the financial burden of healthcare, especially in urban and semi-urban areas where access to hospitals and clinics is more prevalent.

Life insurance follows at a distant 20%, suggesting a moderate uptake of long-term financial planning tools, often linked to employment benefits or personal savings strategies.

Motor insurance, at 14%, likely mirrors vehicle ownership trends, which remain concentrated among middle-income earners and urban dwellers.

Property and home insurance stands at 8%, indicating limited penetration in a market where informal housing and land tenure issues may deter uptake.

Agricultural insurance, covering crops and livestock, lags at 5%, despite Kenya’s heavy reliance on farming. This points to structural challenges in reaching rural communities and tailoring products to smallholder needs.

Strikingly, 36% of respondents report having no insurance at all.