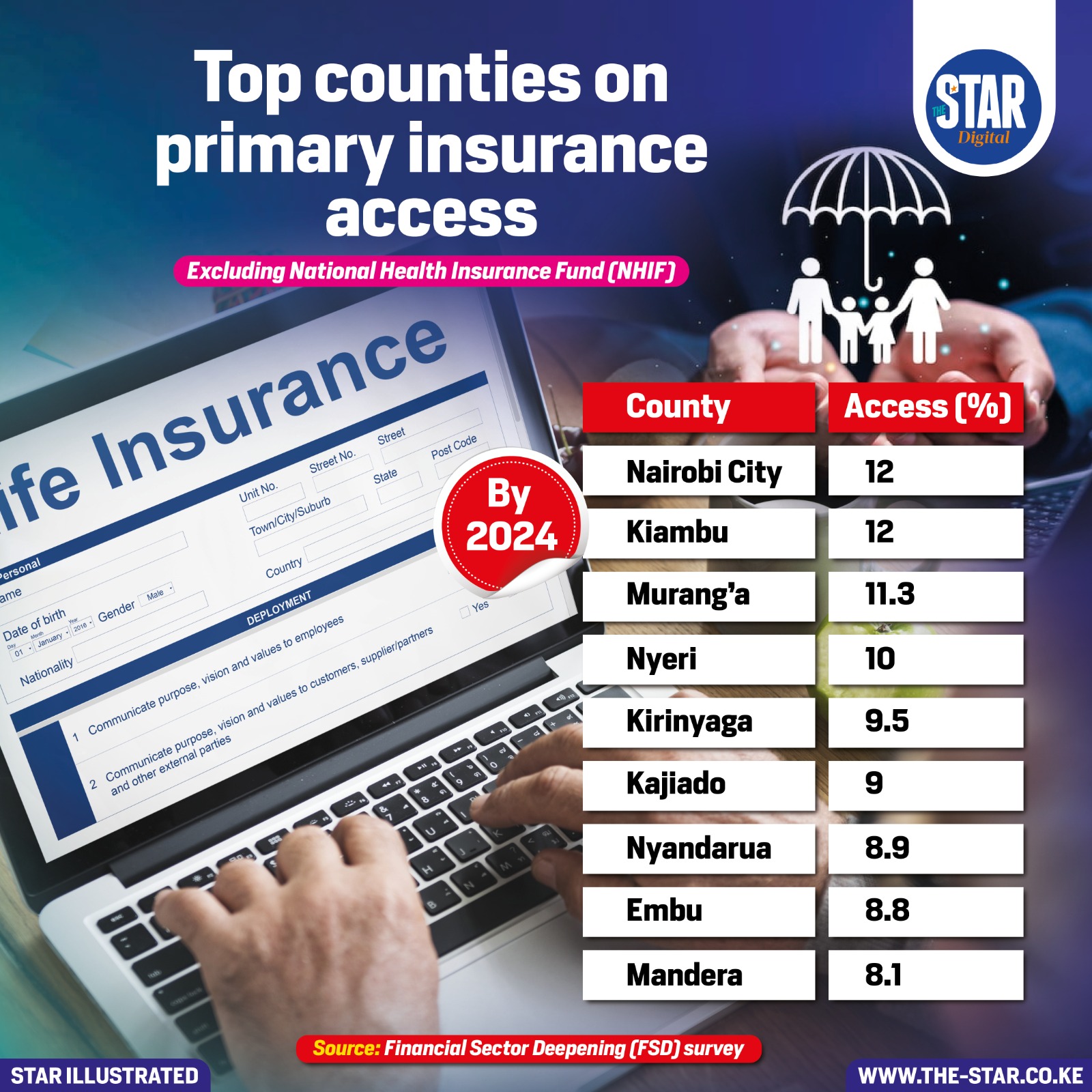

By 2024, Nairobi and Kiambu lead the country in primary insurance access, each recording a 12% uptake outside the National Health Insurance Fund.

Murang’a follows closely at 11.3%, with Nyeri and Kirinyaga rounding out the top five at 10% and 9.5% respectively. These figures reflect a concentration of insurance penetration in central Kenya and urbanised zones, where financial literacy, employment formality, and proximity to insurance providers are relatively higher. Kajiado, Nyandarua, and Embu also show promising figures, all hovering near the 9% mark.

Notably, Mandera appears in the top tier with 8.1%, suggesting that targeted outreach or localised insurance schemes may be gaining traction even in historically underserved regions. The pattern underscores a broader socioeconomic divide, where counties with stronger infrastructure, diversified economies, and higher urbanization tend to fare better in insurance uptake.

It also raises questions about the role of private insurers and microinsurance models in bridging the gap left by NHIF, especially in areas with informal employment and limited access to traditional financial services.

As Kenya pushes toward universal health and financial protection, these counties offer a glimpse into what’s working—and where replication might be possible. The challenge remains in scaling these successes to more remote and economically marginalised areas, where insurance remains a distant concept rather than a lived reality.