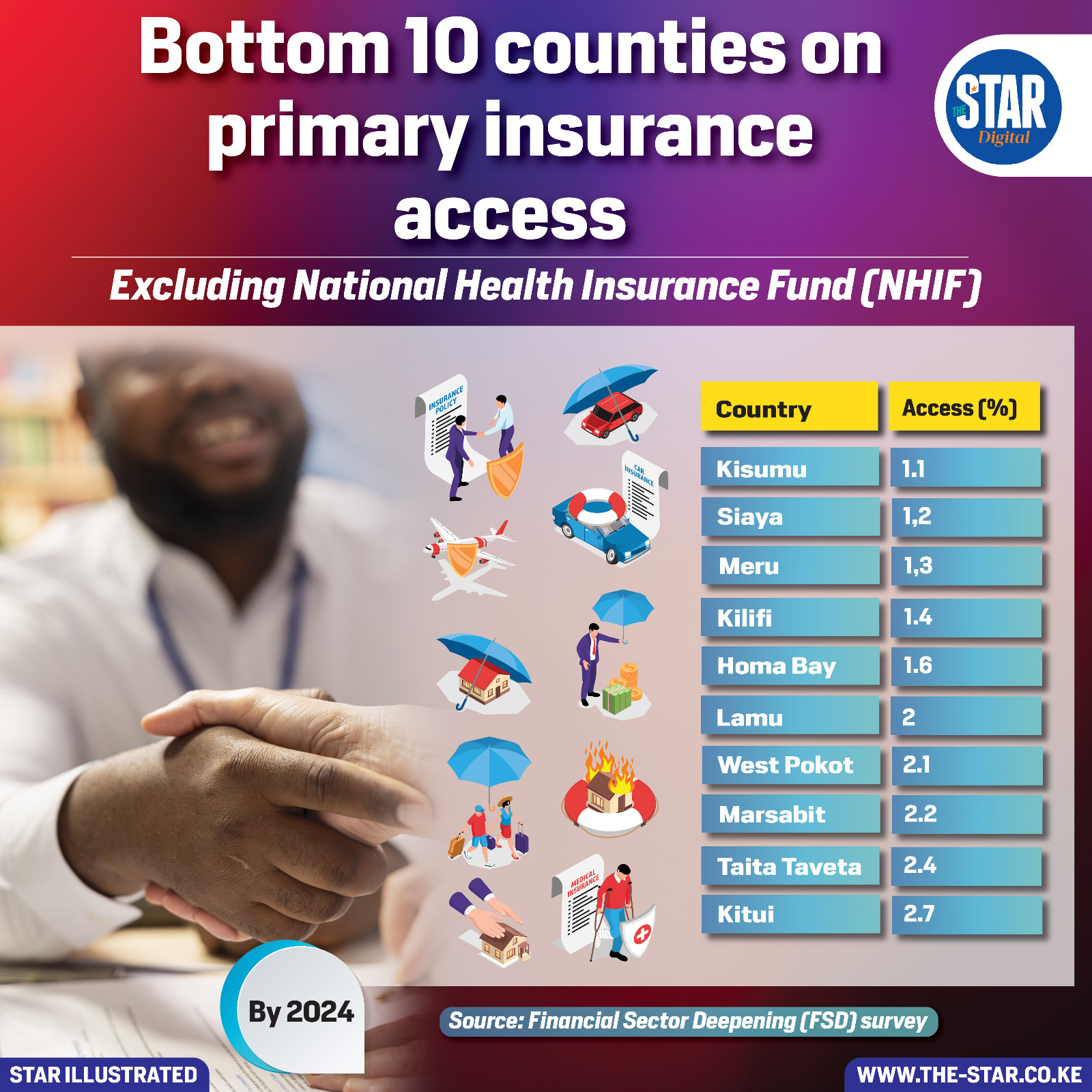

Kisumu ranks lowest in primary insurance access by 2024, with only 1.1% of residents covered outside NHIF.

Siaya and Meru follow at 1.2% and 1.3% respectively, while Kilifi and Homa Bay barely cross the 1.5% threshold. These figures point to a stark insurance gap in counties with large informal sectors, rural populations, and limited penetration of private insurance providers.

Lamu, West Pokot, and Marsabit—despite their geographic diversity—share similarly low access rates, ranging between 2% and 2.2%. Taita Taveta and Kitui close out the bottom ten, with Kitui recording the highest among them at 2.7%.

The numbers suggest that insurance remains largely inaccessible or unattractive in these regions, possibly due to low trust in providers, affordability issues, or lack of tailored products.

The exclusion of NHIF from these figures highlights the limited reach of private and community-based insurance schemes. It also reflects the broader challenge of financial inclusion, where insurance is often the last frontier after banking and mobile money adoption.

For counties like Kisumu and Siaya, which have vibrant populations and active economic sectors, the low uptake is particularly striking. Efforts to expand insurance access must go beyond urban-centric models.

Community-based microinsurance, mobile platforms, and localized awareness campaigns could play a pivotal role in reversing these trends. Without deliberate intervention, the insurance divide risks entrenching existing inequalities, leaving millions vulnerable to financial shocks and health emergencies.