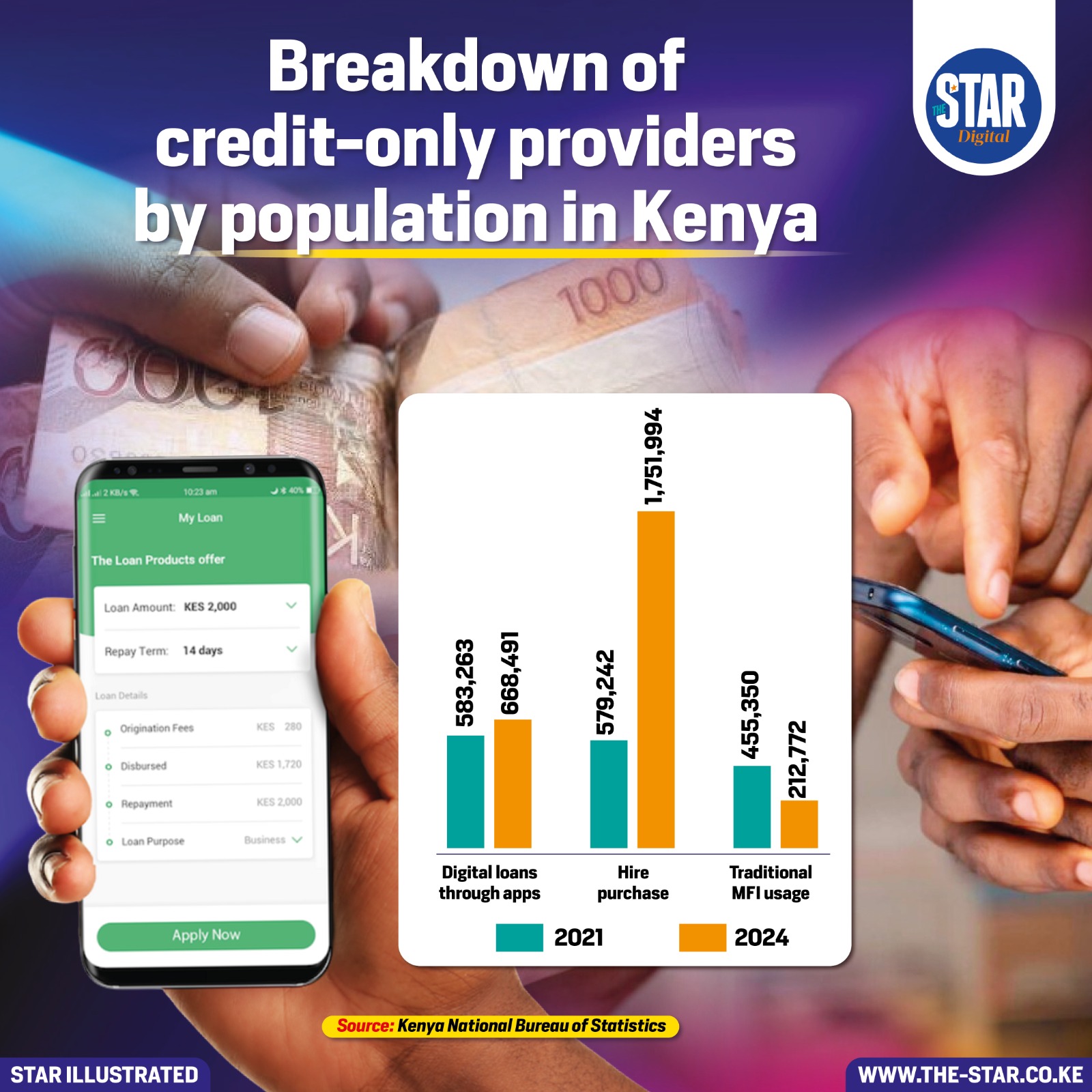

Kenya’s credit landscape is shifting, with hire purchase emerging as the dominant credit-only provider.

In 2021, 579,242 Kenyans used hire purchase, a figure projected to triple to 1,751,994 by 2024.

Digital loans through apps show modest growth, rising from 583,263 users in 2021 to 668,491 in 2024.

In contrast, traditional microfinance institution (MFI) usage is declining sharply—from 455,350 users in 2021 to just 212,772 by 2024.

As digital and asset-based credit models expand, traditional MFIs face mounting pressure to innovate or risk obsolescence.