The government has unveiled a reform programme in the tea sector aimed at stabilising prices, improving quality, and increasing farmers’ earnings to Sh100 per kilogramme of green leaf by 2027.

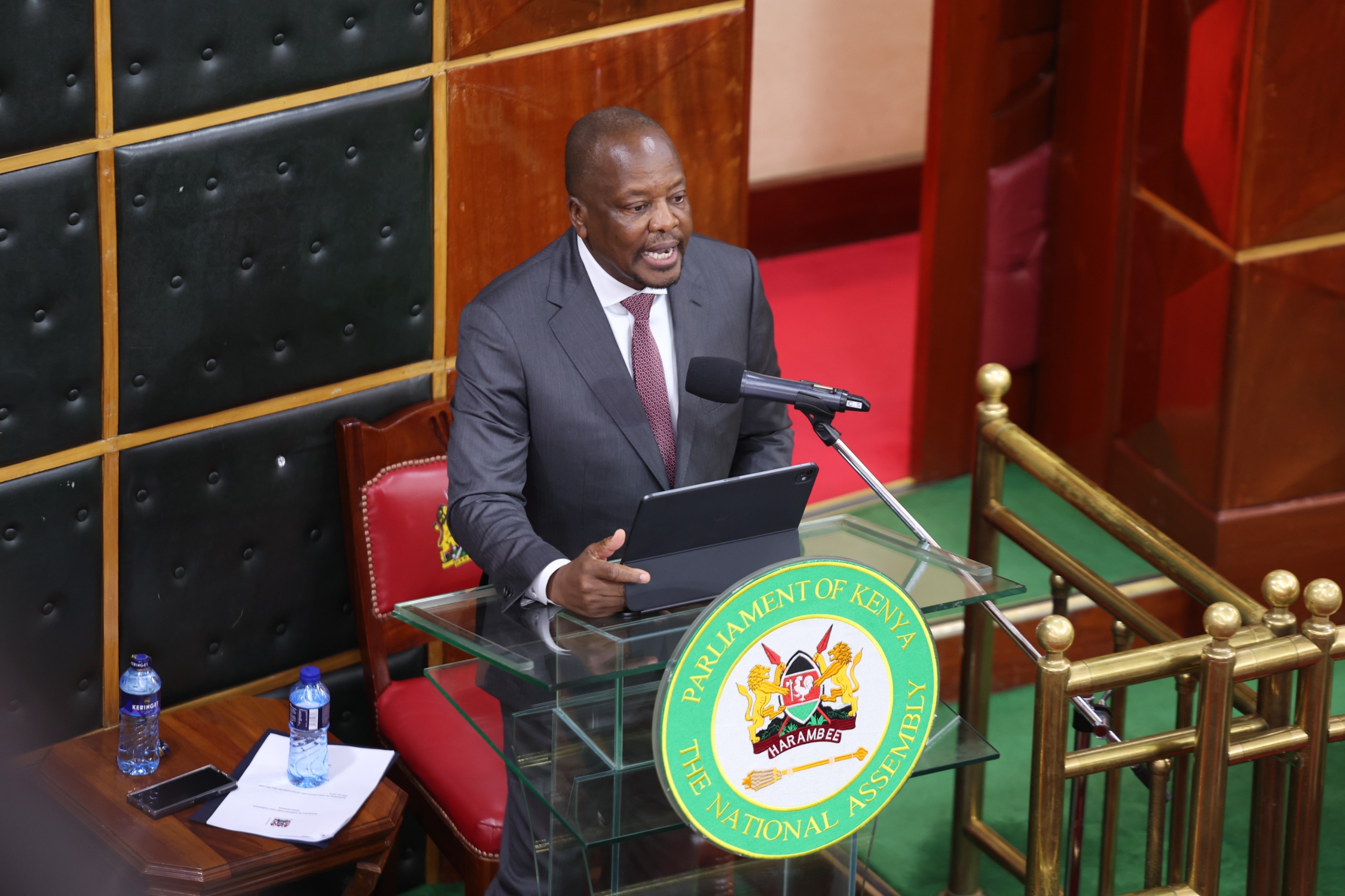

Agriculture Cabinet Secretary Mutahi Kagwe said the ministry has rolled out a package of interventions, including stricter enforcement of greenleaf quality standards, establishment of a Tea Quality Laboratory in Mombasa, and implementation of a Strategic Tea Quality Improvement Programme.

He added that the government is also supporting factory modernisation through a Sh3.7 billion concessional loan facility, abolishing the reserve price to stimulate market demand, and intensifying efforts to curb greenleaf hawking and theft.

Other measures include governance and financial audits for underperforming factories, expansion into digital tea-marketing platforms, strengthened international market engagement under the AfCFTA framework, and the introduction of the Tea Levy Regulations, 2024, to support sustainable sector financing.

Kagwe said the ministry is further reviewing the bonus payment model to allow farmers to receive bonuses quarterly instead of annually, a move he said would ease liquidity pressures at household level.

“These reforms are meant to ensure fair, transparent and uniform earnings for all tea farmers across the country, regardless of region,” he said.

Responding to questions in Parliament on tea bonuses, Kagwe said farmers are currently paid through a two-tier model comprising a monthly initial payment and an annual second payment.

“Our goal is to ensure every tea farmer earns a dignified, predictable income. These reforms are not cosmetic; they are structural,” he told legislators.

Farmers currently receive between Sh23 and Sh25 per kilogramme as the initial payment, while the annual bonus varies depending on auction prices, exchange rates and production costs.

In the 2024/25 financial year, average auction prices declined to USD 2.41 per kilogramme of made tea from USD 2.54, a drop attributed to factors such as forex shortages in Pakistan and Egypt, instability in Sudan, and trade-access challenges in Iran—markets that collectively absorb about 70 per cent of Kenya’s tea exports.

Kagwe said external market shocks had affected earnings and demonstrated the need for reforms.

Regional disparities in earnings also persisted.

Factories east of the Rift Valley averaged USD 2.95 per kilogramme, while those in the west averaged USD 1.78, attributed by the ministry to differences in tea quality.

As a result, farmers in the East earned an average of Sh69 per kilogramme of green leaf, compared to Sh38 in the West, against a national average of Sh56.

Rising production costs have added further pressure.

The average cost of producing a kilogramme of made tea rose to Sh112.96, with West of Rift factories facing higher costs of Sh134.34.

The ministry linked these costs to factors such as staffing levels and operational inefficiencies.

“Some factories are not operating optimally, and this affects farmers’ returns,” Kagwe said.