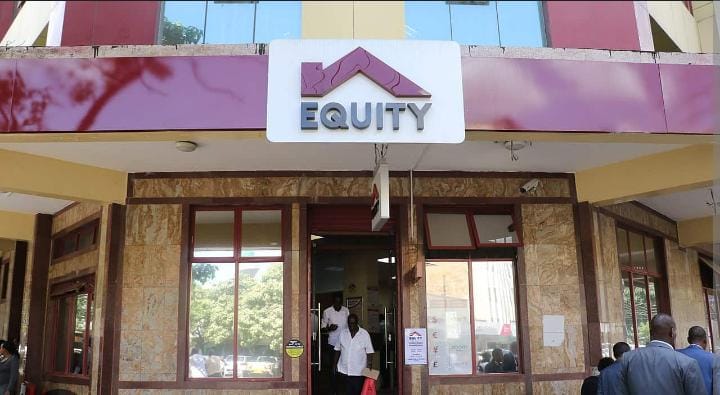

Equity Bank branch in Nairobi County

Equity Bank branch in Nairobi County Equity Bank Kenya has announced a temporary disruption in its bank-to-mobile wallet transfer service, affecting users who rely on the feature for day-to-day transactions.

In a statement shared on Saturday, October 25, 2025, the lender said it was experiencing a system interruption that had impacted transactions from bank accounts to mobile money platforms.

The bank assured users that its technical team was working to resolve the issue and restore services within the shortest time possible.

“We are experiencing a service interruption affecting bank-to-mobile wallet transactions. Kindly bear with us as the technical team works to restore the services,” Equity said in its official notice.

The bank apologised to users for the inconvenience caused by the outage and urged them to remain patient as restoration efforts continued.

“We apologise for the inconvenience,” the notice read, adding that normal services would resume once the technical issues are resolved.

Equity also used the opportunity to remind its customers to remain vigilant against fraudsters who might take advantage of the disruption to impersonate bank officials.

The lender reiterated that it only communicates with clients through its verified number, and warned customers not to share personal banking information such as PINs, passwords, or one-time passwords (OTPs).

“Please remember, Equity calls you from only ONE number — 0763 000 000. Do not engage with anyone asking for your personal banking details. Equity will never ask for your bank details, PIN, password, OTP, or card information on phone or SMS,” the statement emphasised.

The notice comes amid increased reliance on digital banking and mobile money services across the country, where millions of Kenyans use mobile wallets such as M-Pesa, Airtel Money, and T-Kash to send, receive, and withdraw funds daily.

The bank-to-mobile wallet transfer service allows Equity Bank users to move funds directly from their bank accounts to mobile money platforms in real-time.

This integration makes it possible for users to access money instantly without visiting a physical branch or ATM.

The temporary outage is expected to affect various real-time

transfers and may cause delays in payments until the issue is fully resolved.

Equity Bank is one of East and Central Africa’s leading financial institutions, licensed under the Kenya Banking Act and incorporated under the Companies Act. O

ver the years, it has become synonymous with inclusive and accessible banking, offering services ranging from retail banking to microfinance.

The bank has expanded its operations across the region, with subsidiaries in Uganda, South Sudan, Rwanda, Tanzania and the Democratic Republic of Congo, as well as a commercial representative office in Ethiopia.

Equity says its mission is to transform lives, promote dignity, and expand opportunities for wealth creation through integrated financial services that empower individuals, businesses and communities