The number of revoked insurance claims for the three months to December last year increased by about 246 per cent to 6,591 on fraud and delayed filing.

This is an increase from 1,904 recorded in the previous quarter, according to the latest data from the Insurance Regulatory Authority (IRA).

Most rejects emanated from the medical and motor sectors which continues to lead insurance fraud in the country.

Insurers have in the past cited cases of fraud in the form of fictitious accidents, multiple insurance contracts and claims on a single vehicle.

Some motorists are also short-changing insurers by using their vehicles for purposes different from those insured against, meaning risk exposure is higher.

Last year, the regulator indicated that the malpractices that included false motor accident (injury) claim, stealing by agents, conspiracy to defraud and fraudulent motor theft claims were inflating insurance premiums in Kenya by up to 25 per cent.

However, revoked liability claims by third parties recorded a slight decline of 17 claims from 70 in quarter three to 53 claims in the review period.

Nonetheless, claims that did not meet the criteria stood at 4,098 amounting to Sh1.16 billion and 23,573 of non-liability claims amounting to Sh1.35 billion.

Even so, non-liability claims, direct from policyholders, increased to 6,365 in the quarter under review worth Sh226.5 million from 1,794 claims worth Sh211.7 million in the previous quarter.

Long-term claims which involve costs of long-term care due to a chronic illness or injuries that require extended rehabilitation and care increased to 173 claims in the review period from 40 in the third quarter the same year.

These were worth Sh225.7 million and 19 million receptively.

This points towards the transformation drive by the sector in its strive to tackle insurance fraud, enhance consumer protection and address the issue of premium undercutting by underwriters promoting unfair competition.

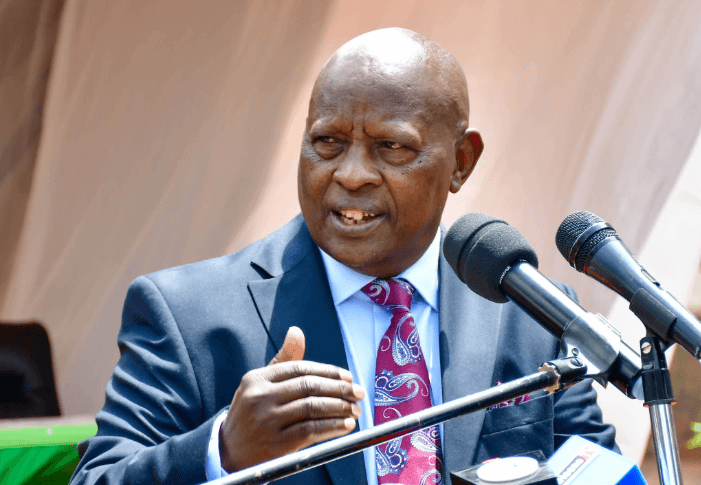

This was reiterated by the new Insurance Regulatory Authority (IRA) chairman Moses Mabonga who said he is keen in ensuring the sector is transformed.

"I'm looking forward to lead the board and management to enhance more integration of ICT into the sector to improve consumer trust hence driving the insurance penetration in the country," Mabonga said.

He was speaking during the handover ceremony last week when he took over the role from the outgoing Mohammed Sheikh Amin.

Insurance penetration in the country is at a low of 2.43 per cent, despite being the leading in the region on uptake of insurance.

It is followed by Rwanda with a 1.70 per cent penetration, Uganda (0.84 per cent), Burundi (0.77 per cent) while Tanzania has a 0.53 per cent penetration.

Generally in Africa, insurance penetration stands at 0.3 per cent.

Also in the review period, according to IRA, insurers paid claims worth Sh40.6 billion representing a three per cent increase compared to the previous quarter that paid claims worth Sh39.16 billion.

This was on the back of increased number of claims reported to the insurers which rose by about 12.6 per cent to 2.1 million from 1.8 million reported in the previous quarter.