Getting online in Kenya often starts with one thing: owning a smartphone. But for many, especially those earning day to day, buying one outright simply isn’t an option.

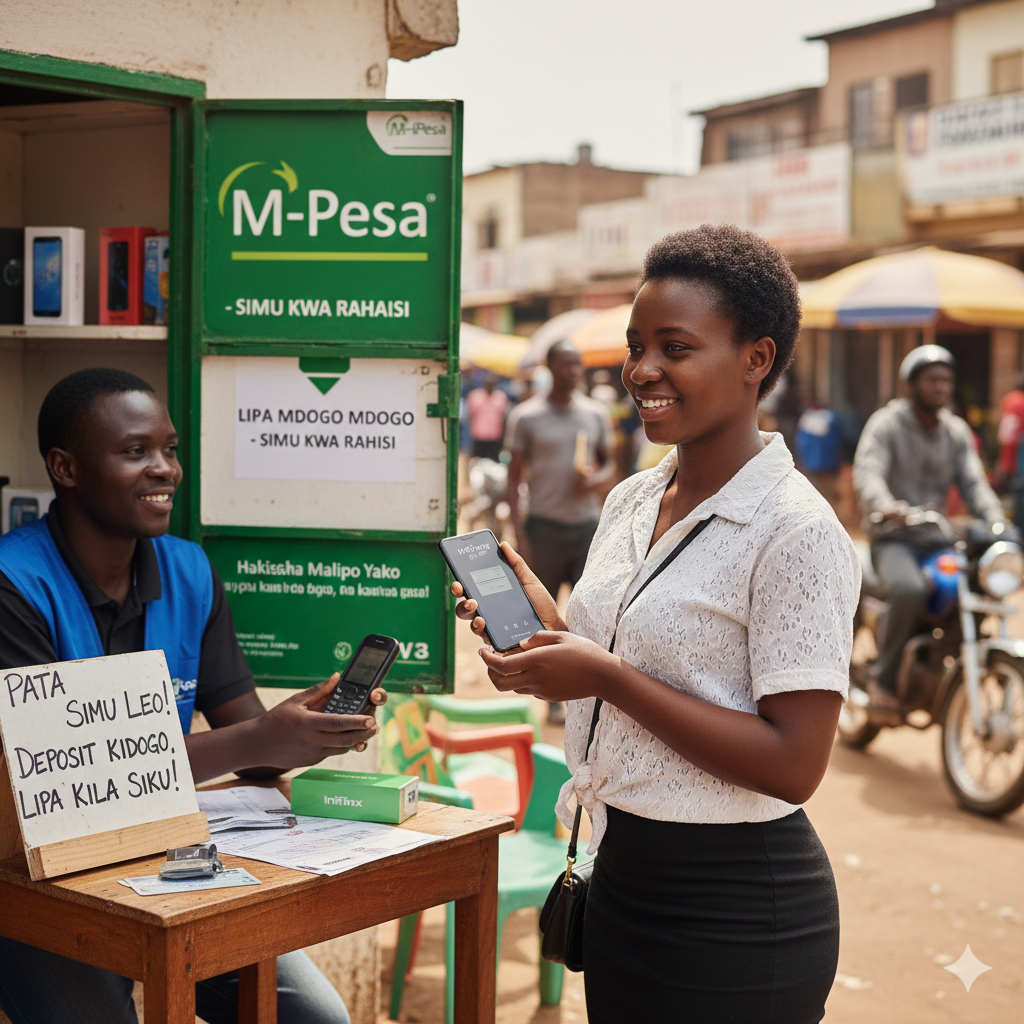

So people are turning to a solution that’s becoming part of everyday life — lipa mdogo mdogo, or pay little by little. It’s not new, but it’s booming.

And companies are noticing.

A new kind of credit

Earlier this month, asset financing firm Mogo jumped into the smartphone loan business. The offer? Pick a phone, pay a deposit, and cover the rest in small daily instalments, for up to 12 months.

No payslip needed. Just your ID and an M-Pesa statement.

The firm says over 45,000 phones have already been financed through the plan — mostly entry- to mid-range models from brands like Infinix and Tecno.

Their goal? Make smartphones reachable for people who might not qualify for formal loans, but still need to be connected.

Demand is growing fast

According to the Communications Authority of Kenya, more than 42 million Kenyans now use smartphones. But behind that number is a tougher reality: a lot of people still struggle to afford one.

A 2024 GSMA survey found that more than half of mobile users in the country point to device cost as their main barrier to going online.

And it’s not just talk — the numbers back it up. In 2021, about 580,000 Kenyans had smartphone financing accounts. By 2024? That figure shot up to 1.7 million, according to the Central Bank of Kenya.

What people use their phones for

Smartphones today aren’t just for calling or texting. They’ve become business tools, classrooms, banks, marketplaces — and for many, sources of entertainment.

Streaming, gaming, betting, and social media are just as important as school apps or mobile money. And now that more people can afford better phones, how they spend time online is changing.

One example is this Swiss casino jackpot platform that runs smoothly on mobile. It’s the kind of service that’s gaining traction as smartphone access expands, especially among younger users looking for international, mobile-optimised content and new forms of leisure.

What’s the catch?

Any loan carries risk — and this is no different. If a user misses payments, they might lose access to their device. Over time, small daily fees can add up.

Mogo says it’s taking steps to prevent over-indebtedness, like setting age limits and limiting users to one active device loan at a time. They also offer flexible restructuring when people run into trouble.

Still, there’s more to digital inclusion than just owning a device. Experts warn that users also need guidance — not just on money, but on data privacy, app usage, and avoiding online scams.

More than a phone

What smartphone financing is really doing is shifting the line between those who can participate in Kenya’s digital economy — and those left out.

For many, Lipa Mdogo Mdogo isn’t just a payment model. It’s what gets them online. And once there, the possibilities — work, learning, even play — expand in every direction.