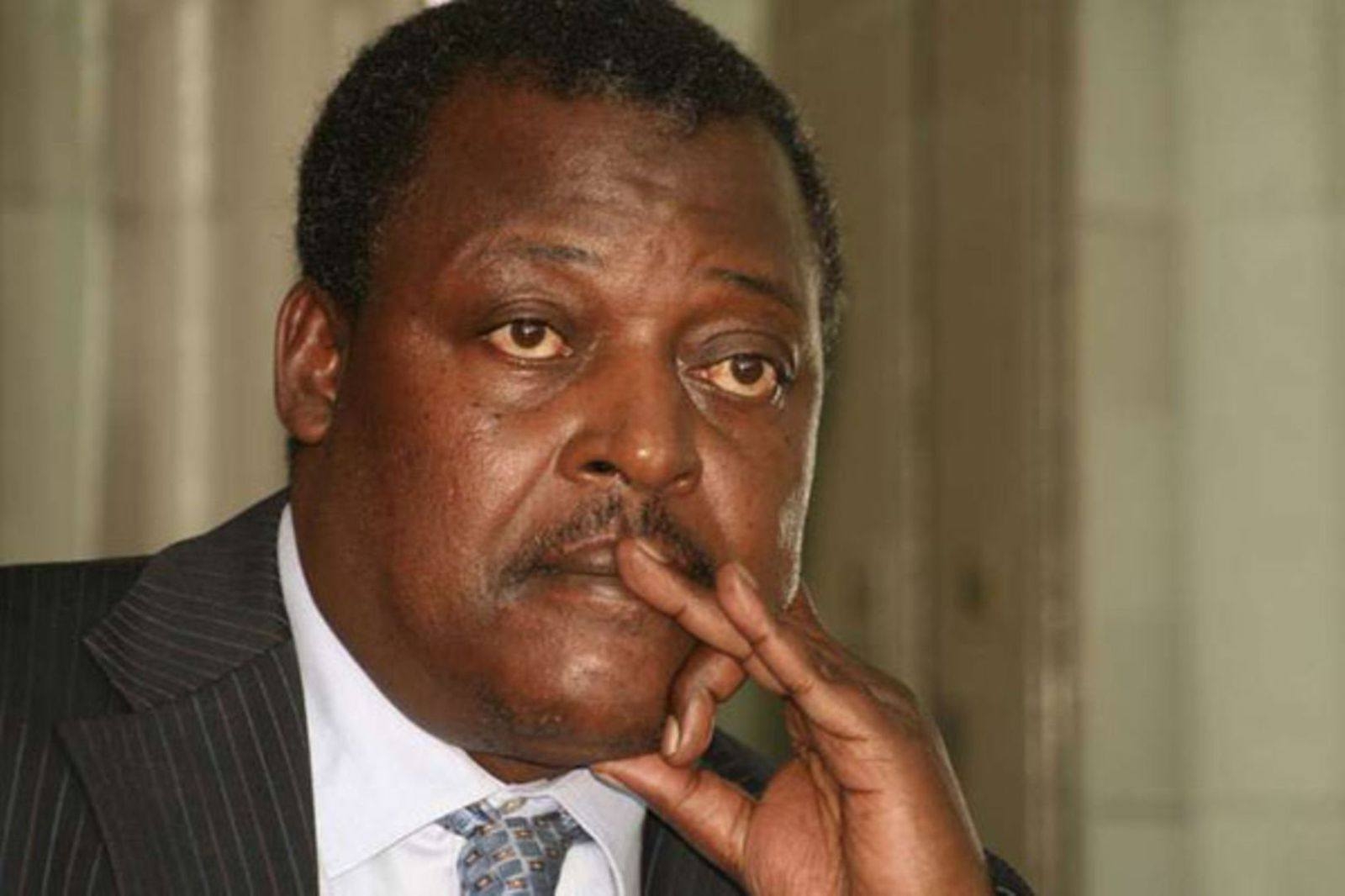

National Treasury CS John Mbadi speaking during the release of KIPPRA’s Kenya Economic Report 2025/ HANDOUT

National Treasury CS John Mbadi speaking during the release of KIPPRA’s Kenya Economic Report 2025/ HANDOUTKenya’s economic expansion is failing to deliver enough decent, well-paying jobs and deliver meaningful livelihoods, particularly for young people and vulnerable groups, new data by government's public policy think tank shows.

The findings by Kenya Institute for Public Policy Research and Analysis (KIPPRA), shows that the economy grew by 4.7 per cent in 2024, driven largely by agriculture and services.

While formal wage employment expanded by just 2.4 per cent, adding fewer than 80,000 jobs.

Speaking during the release of KPPRA’s Kenya Economic Report 2025, National Treasury CS John Mbadi said that while Kenya’s economy has shown resilience and steady recovery, the central challenge now lies in ensuring that growth delivers meaningful livelihoods, particularly for young people and vulnerable groups.

“While economic growth remains important, the true measure of success lies in the quality of jobs created. prosperity can only be sustained if growth translates into secure, productive and inclusive employment opportunities,” said Mbadi

In the past year, inflation fell to 4.5 per cent from 7.7 per cent a year earlier, while the Central Bank of Kenya cut its policy rate from 13 per cent in early 2024 to 10.75 per cent in early 2025, easing borrowing costs and supporting private sector activity.

Yet KIPPRA findings show that this was not enough to translate to the quality of jobs created. Of the 782,300 new jobs generated in 2024, about 90 per cent were in the informal sector.

Mbadi acknowledged that job creation has not kept pace with the needs of a growing and youthful population, nor has it delivered sufficient income security.

“A strong industrial base remains indispensable for creating high-quality jobs, enhancing competitiveness, and sustaining long-term growth.”

More than 80 per cent of Kenya’s workforce remains in informal employment, characterised by low productivity, income insecurity and limited social protection.

This disconnect between growth and job quality is emerging as a critical concern for businesses, investors and policymakers alike.

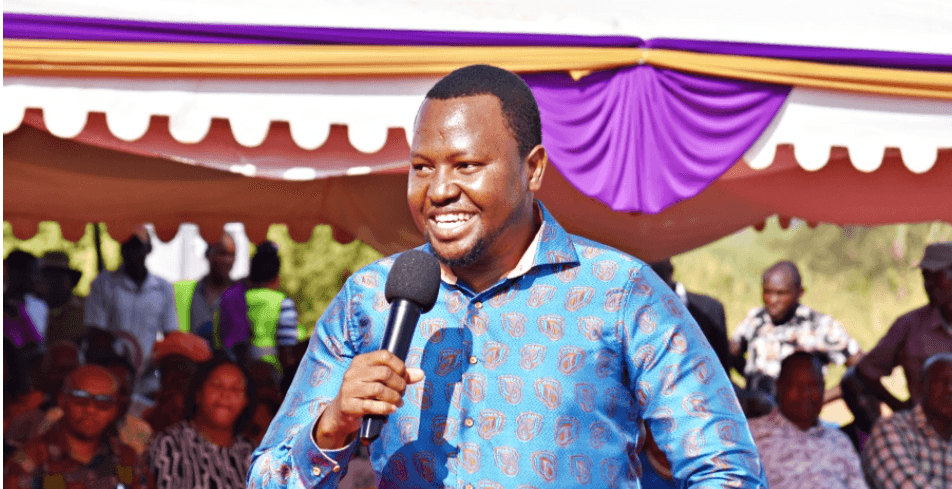

“Kenya is creating jobs, but not the kind that sustainably support consumption, savings or tax revenues,” KIPPRA executive director Eldah Onsomu said.

It further warns that that persistent informality risks undermining the country’s long-term growth prospects.

Agriculture and services, the two biggest drivers of recent expansion are also the most labour-intensive but least formalised sectors.

Wholesale and retail trade alone accounts for nearly half of all employment, yet more than 80 per cent of jobs in the sector are informal.

Manufacturing, traditionally viewed as the backbone of formal job creation, continues to underperform. While it contributes significantly to value addition, its capacity to absorb labour is constrained by high electricity costs, illicit trade, regulatory burdens and rising input prices.

As a result, much of the employment growth linked to manufacturing occurs in small, informal enterprises rather than in large-scale, high-productivity firms.

Limited access to affordable credit, compliance costs and weak market linkages prevent many businesses from scaling up and transitioning workers into formal arrangements.

“The result is an economy where businesses are operating and even expanding, but are doing so cautiously, often relying on casual labour and informal contracts to manage costs and uncertainty,” the report observes.

The report says that for businesses, the implications of this employment paradox are already being felt. While inflation has eased, weak real wage growth and job insecurity are constraining household purchasing power.

The report shows that real wages have stagnated or declined across major sectors in recent years, particularly in agriculture, where earnings remain the lowest.

This limits the depth and sustainability of consumer demand — a critical engine of growth for sectors such as retail, housing, financial services and manufacturing. Without steady incomes and job security, households are less likely to spend, borrow or invest, dampening the multiplier effects of economic growth.

The dominance of informal work also reduces the tax base. Informal enterprises and workers contribute far less in income tax, PAYE and social security contributions, placing additional strain on public finances at a time when debt servicing costs are rising.