How Kenyans access crucial tax information is undergoing a massive digital transformation, signalling a shift in how the public interacts with the state.

Recent findings from the National Taxpayers Association highlight that the days of waiting for a newspaper update or a town hall meeting to understand fiscal obligations are fading. Instead, technology has become the primary bridge between the taxman and the taxpayer.

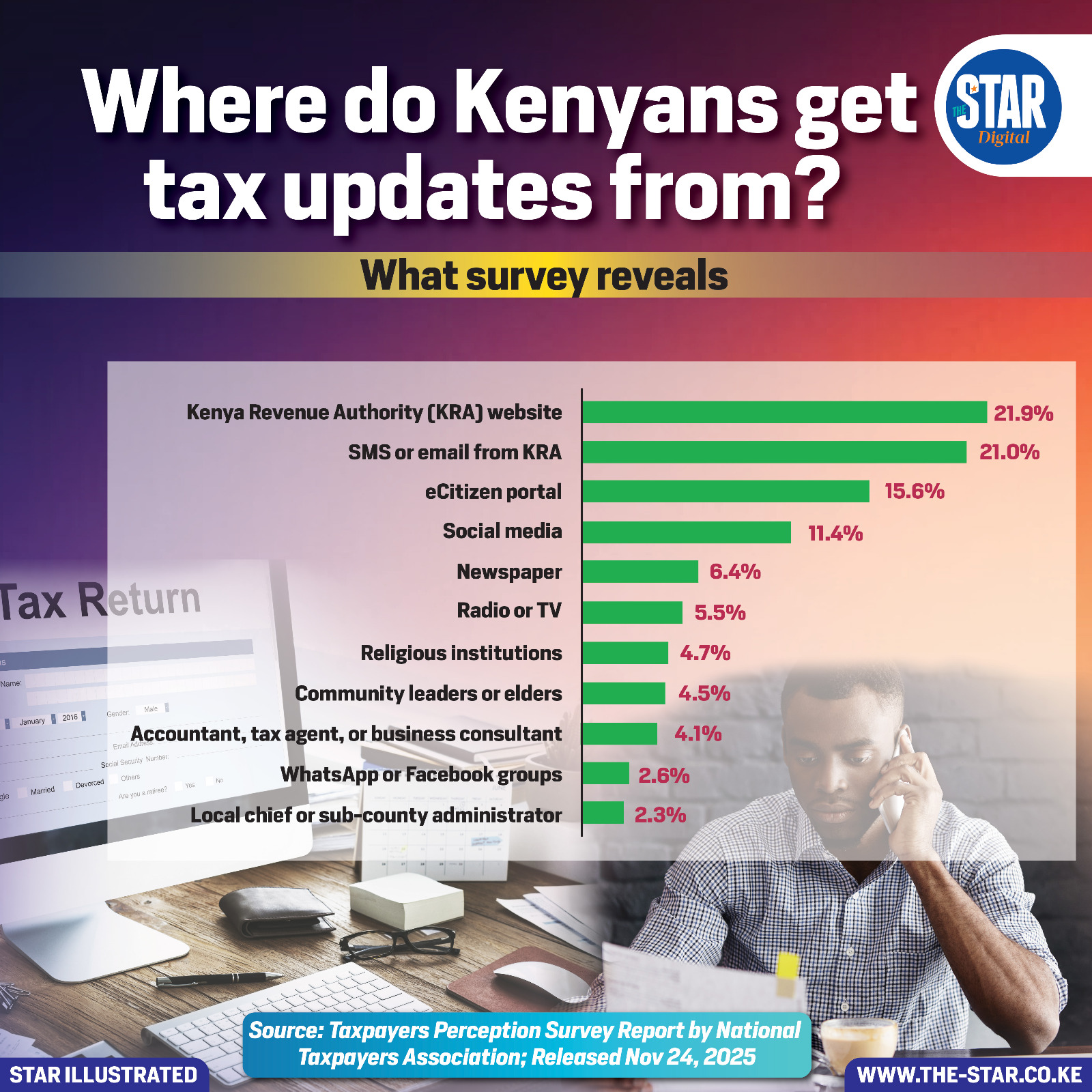

The Kenya Revenue Authority (KRA) website has emerged as the leading source of information, with nearly 22% of citizens relying on it as their primary reference point. This is closely followed by direct communication channels, such as SMS and emails from the authority, which serve 21% of the population. The rise of the eCitizen portal further cements this trend, capturing a significant portion of the demographic that prefers centralized digital government services.

Interestingly, social media has overtaken traditional mass media in this specific domain. While newspapers, radio, and TV were once the undisputed kings of information dissemination, they now trail behind online platforms. This suggests that taxpayers prefer real-time, on-demand information over scheduled broadcasts or print publications.

Despite the digital dominance, grassroots channels remain active, albeit with a smaller reach. Religious institutions, community elders, and local administrators still play a role in educating specific segments of the population, ensuring that those outside the digital grid are not entirely left behind.