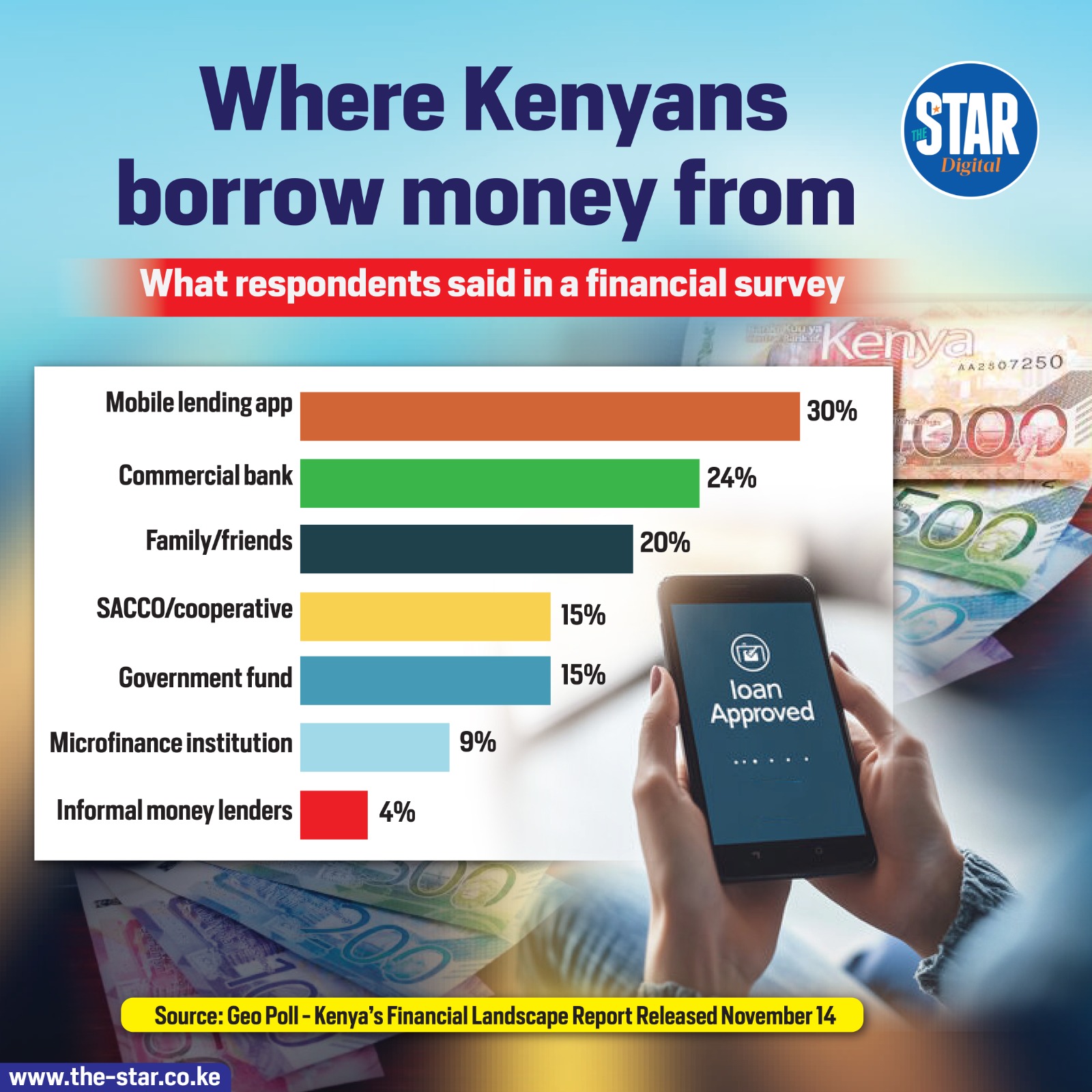

Mobile lending apps have become the leading source of credit for Kenyans, with 30% of respondents saying they prefer borrowing through digital platforms such as M-Shwari, Tala, and Branch. Their appeal lies in fast approvals, accessibility, and minimal paperwork, making them especially attractive to users without formal banking histories.

Commercial banks trail slightly at 24%, showing that traditional lenders still hold significant influence, particularly among salaried individuals and borrowers seeking structured, regulated credit products.

Informal borrowing remains notable as well, with 20% turning to family and friends for financial support—highlighting the role of social networks in times of need.

SACCOs and cooperatives, long trusted for affordable lending, account for 15% of borrowing, while government funds also stand at 15%, reflecting continued reliance on state-backed financial initiatives.

Smaller shares borrowed from microfinance institutions (12%) and informal moneylenders (9%), indicating that while credit is widely accessible, cost and regulatory oversight remain key concerns across the landscape.