President William Ruto accompanied by, from left, CS Labour and Social Protection Alfred Mutua, Government Spokesperson Isaac Mwaura and the PS MSMEs Development Susan Mangeni (Right) among other government officials during an exhibition at the KICC by women being funded by Hustler fund under the Ushanga initiative. (Photos by Mathew Gwendo)

As

I grew up in the slopes of Mt. Kenya, a story was frequently told of

a situation back in 1985, when there was severe famine in Kenya, prompting the Government to import yellow maize in a bid to save

lives.

During the time, the storytellers narrate, people had money in their pockets but no food in the market to buy and everyone, like in the case of the biblical Israelites’ exodus from Egypt, was grumbling, pointing fingers at no one.

This made the hunger to be christened “Mwing’anania” in my mother tongue, meaning society on a “social equilibrium.”

On a positive note, a similar situation appears to be in the making in the country through the Financial Inclusion Fund, otherwise known as the Hustler Fund, under the State Department for Micro, Small and Medium Enterprises (MSMEs).

Established by the Kenya Kwanza Administration immediately it came to power under the stewardship of President William Ruto, the Hustler Fund aims to aid in cushioning and mitigating financial shocks for specifically the small traders in the informal sector.

The fund was conceptualised with the understanding that the majority of Kenyans work in the informal sector, encompassing Micro, Small and Medium Enterprises (MSMEs) with limited access to credit.

It was launched on November 30, 2022 and promises to provide funds, 500 times cheaper, with a daily interest rate of 0.002 per cent.

The principal objective of Hustler Fund is to offer holistic financial solutions targeting people at the bottom of the social structure to bring them up the ladder for the attainment of the long-time elusive equity.

Economic transformation in Kenya is underway, with the aim of addressing the poor share of employment in low-productivity sectors and firms that has for long remained high, stifling livelihoods and limiting inclusive growth.

This is, in effect, going by the success stories from the fund’s beneficiaries, causing a revolution of some sort in the economic strata of our society as those disregarded for years begin to gain some semblance of financial independence.

John Kamau, a pineapple vendor in Makongeni Estate, Thika town, is full of praise for the Hustler Fund, citing its inclusive empowerment.

Kamau is elated as he recounts how he has been able to rise from a pauper to a stable small-scale trader in a Kibanda and now looks forward to owning a permanent shop for his produce.

He says he began by borrowing from the individual loans’ product, rising from Sh800 to his current limit of Sh24,000, which he can borrow at will within a span of two weeks without undergoing the rough-and-tumble of raising collateral to attain credit.

In a few years, “hata sisi watu wa mapato ya chini tutakuwa kwa meza na wadosi” (it is just a matter of time before we the less fortunate catches up with the rich) brags Kamau as he goes about peeling his pineapples ready for his customers.

Government Delivery Unit reports that between 2022 and 2025, Kshs.63.5 billion was disbursed to 26.3 million individuals, and Sh196.8 million to 58,630 micro and small groups with 312,350 members benefiting. During the same period, individual subscribers saved Sh3.4 billion, while micro and small groups saved Sh9.8 million.

As Kamau attests, credit profiles have been established for beneficiaries, improving their credit visibility and enabling access to mainstream financial services.

This has served to deepen financial inclusion, promoted a savings culture and created credit visibility of majority of Kenyans at the bottom of the economic pyramid.

For inclusivity, the fund incorporates a five-pillar framework integrating; Affordable Credit, Competitive Savings and Pensions Products, Comprehensive Insurance Solutions, Access to Affordable Housing, Market Linkages and Financial Literacy.

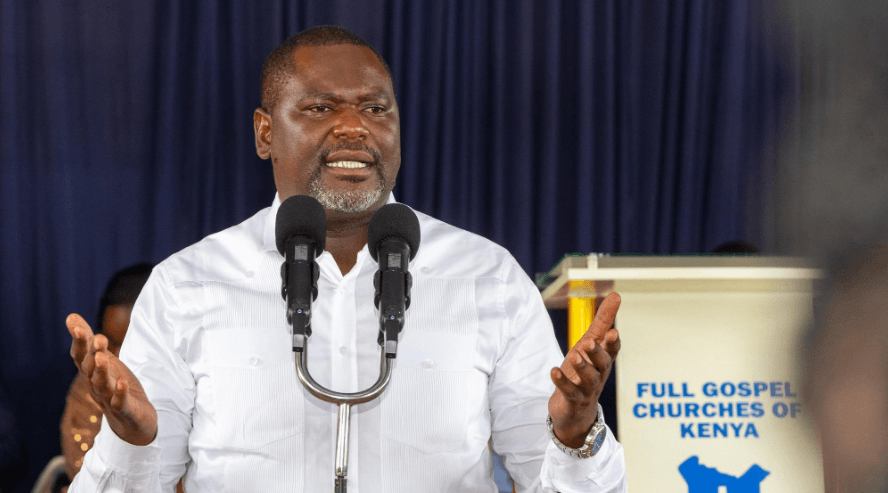

Government Spokesman Dr Isaac Mwaura confirms the beneficiaries’ success stories observing that Hustler Fund was spurring economic growth, boosting job creation and enabling financial resilience across the board.

To sustain this tempo, the Government plans to waive debts for 10 million borrowers who are struggling to repay backed with reasonable measures to improve future loan recovery, including financial literacy programs for beneficiaries and restructuring repayment terms to enhance compliance and sustainability of the fund.

Beneficiaries of the Hustler Fund in attendance at the Second Anniversary of Hustler Fund at the KICC, which gave birth to the third product of the fund, the Bridge Loan. (Photos by Mathew Gwendo)

Dr. Mwaura adds that loan limits have grown progressively to benefit the more than 1.3 million repeat customers and that the fund was being integrated with National Youth Opportunities towards Advancement (NYOTA) launched by President Ruto under the Hustler Fund platform with the aim to empower young Kenyans through skills training, business support, and job creation.

“NYOTA has already attracted over 1 million business support applicants,” the Spokesperson observes adding that the project aims to nurture entrepreneurship among the youth aged between 18 and 29 years.

The program will be rolled out in each ward across the 47 counties and at least 70 youth per ward will benefit from grants, business training and market access.

By August this year, 100,000 youth are expected to receive Sh50,000 in seed capital, with the government allocating Sh5 billion to support their ventures.

In the same vein, the Government spokesperson notes that program to implement a 10-year Kenya Jobs and Economic Transformation (KJET) project funded by the World Bank has been mooted at a cost of close to Sh19.5 billion targeted to benefit at least 45,000 Kenyans, including 6,800 women through new or improved job opportunities.

The KJET, he adds, aims to increase private sector investments, access to markets and sustainable finance to create and improve jobs in turn enhancing capacities of the concerned firms and efficiency, translating into increased hiring and improved worker productivity.

Lucy Waithira works as a PSIP Intern at the Office of Government Spokesperson.