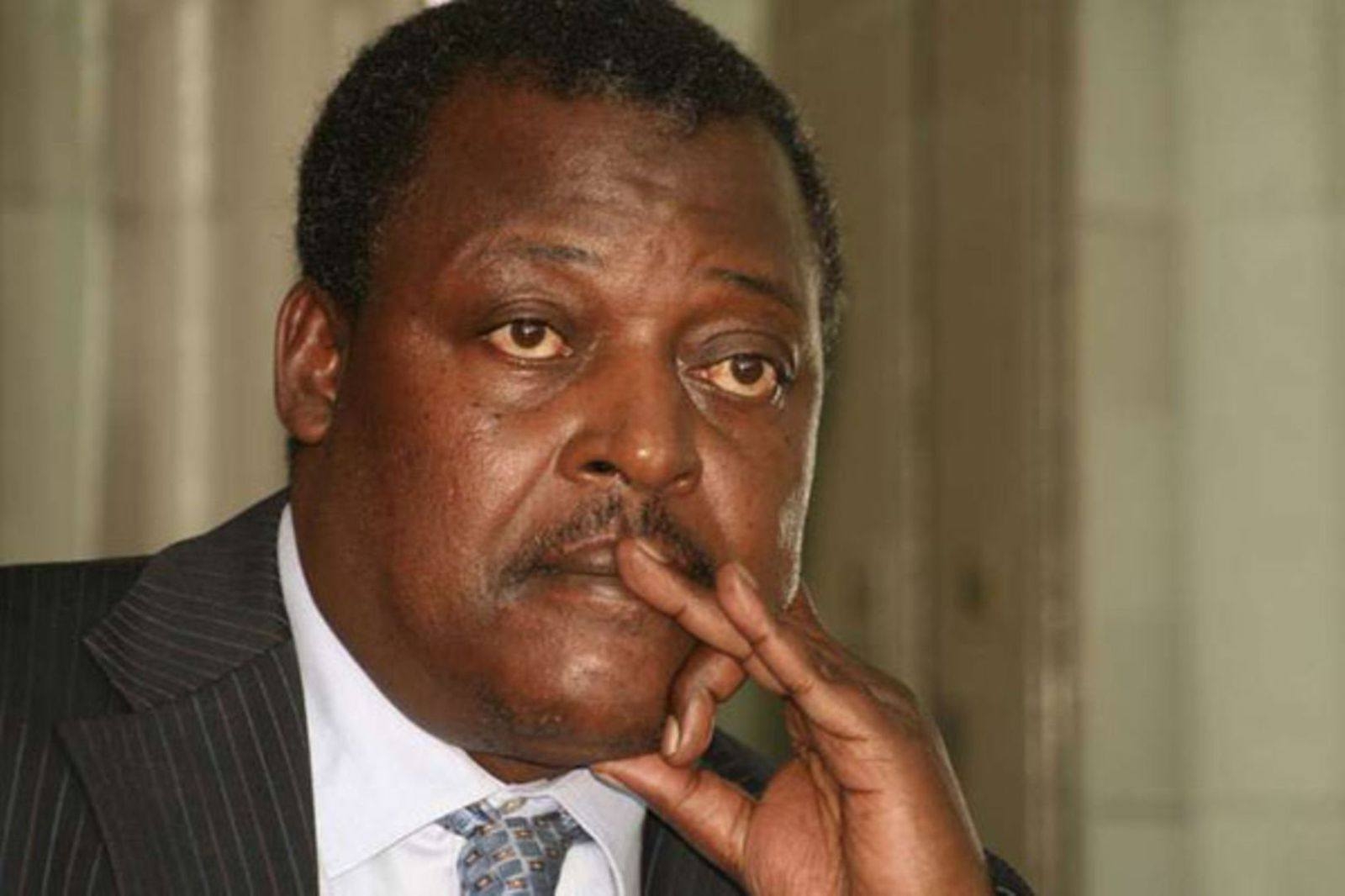

Controller of Budget

Margaret Nyakang’o/FILE

Controller of Budget

Margaret Nyakang’o/FILE

County governments could soon be barred from issuing bursaries to needy students, disbursing empowerment funds to special interest groups, or offering car loans and mortgage facilities to their staff.

According to the latest report by Controller of Budget Margaret Nyakang’o, the legal lifespan of 79 county public funds has either lapsed or is nearing expiry, putting billions of shillings and critical social support programmes at risk.

“As of September 30, 2025, 79 regulations governing established County Funds have either lapsed or are nearing expiration,” Nyakang’o said in the report.

She warned that the expiry of these regulations renders the affected funds ineligible for further withdrawals from the Exchequer.

Nyakang’o said counties risk paralysing key services if urgent remedial action is not taken.

She advised the county governments to immediately extend the lifespan of their existing funds or establish new ones in line with the law to avoid service disruption.

Many counties have continued to rely on funds whose legal frameworks have already run out, Nyakang’o said, exposing them to audit queries and potential legal challenges.

Section 116 of the Public Finance Management (PFM) Act, 2012 allows county governments to establish additional public funds, provided they are approved by both the county executive committee and the county assembly.

Further, Regulation 197(1)(i) of the PFM (County Governments) Regulations, 2015 stipulates that such funds may only exist for a maximum of 10 years unless the county assembly formally extends their lifespan.

These provisions have enabled counties to establish a wide range of funds, including Education and Bursary Funds, Biashara and Enterprise Funds, Cooperative Funds and Car Loan and Mortgage Schemes for staff and elected leaders.

However, once the 10-year period elapses, the funds automatically expire unless renewed by the county assembly.

“The Controller of Budget recommends that county governments urgently review and extend these regulations to prevent operational disruptions,” Nyakang’o said.

She further advised that all expenditures from lapsed funds should cease immediately and that counties should take legal steps to either re-establish or formally wind up the affected funds in accordance with the PFM Act.

The problem cuts across several counties. In Baringo, seven funds established in 2014 have all expired.

They include the Small and Medium Enterprise Fund, Baringo County Bursary Fund, Youth and Women Fund, Corporate Development Fund, Persons with Disabilities (PWD) Fund, Lake Bogoria Grants, and the County Assembly Car and Mortgage Fund.

In Bomet, the Bomet County Executive Car Loan and Mortgage Fund has expired.

Bungoma County has seen the expiry of several key funds, including the Scholarship and Other Educational Benefits Fund, Trade Loan Fund, Women Empowerment Fund, Youth Empowerment Fund, and the MCA Car Loan and Mortgage Scheme Fund.

Busia county can no longer withdraw money from its Agriculture Development Fund, Bursaries and Scholarships Fund and Cooperative Enterprise Fund following the expiry of their legal frameworks.

In Turkana, five funds have expired, among them the Turkana County Biashara Fund, Education Fund, Youth and Women Fund, Cooperative Enterprise Fund, and the County Assembly Car Loan and Mortgage Scheme Fund.

Marsabit county is also affected, with five expired funds including the Emergency Fund, Executive Car Loan and Mortgage Scheme Funds, Enterprise Fund and County Assembly Members’ Car Loan and Mortgage Scheme.

Kericho County has five expired funds, including the Car Loan Fund, Mortgage Fund, County Bursary Fund, Assembly Staff Car Loan and Mortgage Fund, and Assembly Members’ Car Loan and Mortgage Fund.

Other affected counties include Kitui, Machakos, Migori, Nakuru and Siaya, where bursary schemes and car loan and mortgage funds for county executives, staff and assembly members have all expired.

The revelations raise concerns over the continuity of critical support programmes, particularly bursaries and empowerment funds that many vulnerable households rely on, as counties scramble to regularise the affected funds.