Senate in session/FILE

Senate in session/FILE

The controversial award of a Sh14.5 billion tender for printing new currency has sparked fresh scrutiny, with the Senate launching its own investigation into the deal.

The move follows a report by Auditor General Nancy Gathungu, who flagged serious flaws in the award of the contract to German firm Giesecke+Devrient Currency Technologies (G+D).

The National Assembly’s Finance Committee is already probing the same tender.

Busia Senator and veteran activist Okiya Omtatah triggered the Senate inquiry through a petition to the Finance and Budget Committee, citing massive illegalities and irregularities.

“The 2024 Auditor General's report flagged irregularities, including failure to appoint a special procurement committee, lack of oversight by the Public Procurement Regulatory Authority (PPRA) and absence of supplier vetting or market assessment,” Omtatah said.

He further argued that while the Central Bank of Kenya cited approvals from the National Security Council and other agencies, those explanations were unconvincing, as the CBK is not a national security organ under Article 239 of the constitution.

“Notably, in 2005, an open tender for currency printing saved costs when it was competitively awarded to De La Rue over Giesecke+Devrient. Yet in this case, the CBK single-sourced G+D at a higher cost,” Omtatah noted.

The Senate committee, chaired by Ali Roba (Mandera) is investigating whether the CBK obtained approval from the Treasury Cabinet Secretary for classified procurement and whether the tender was listed under Section 90 of the Public Procurement and Asset Disposal Act (2015).

It will also establish whether CBK complied with Regulation 84 of the Public Procurement Regulations (2020), including the submission of justification for classified procurement, detailed cost breakdowns, and appointment of a special procurement committee.

Other issues under review include whether CBK’s accounting officer submitted mandatory procurement reports to the Treasury CS and PPRA and whether Kenyans received value for money.

“The committee should analyse the 2005 and 2025 currency printing tenders in terms of transparency, competitiveness, and cost, including a breakdown of the 2025 contract value compared to past pricing,” Omtatah said.

The panel is expected to recommend measures to strengthen accountability, curb abuse of classified procurement procedures and safeguard public resources.

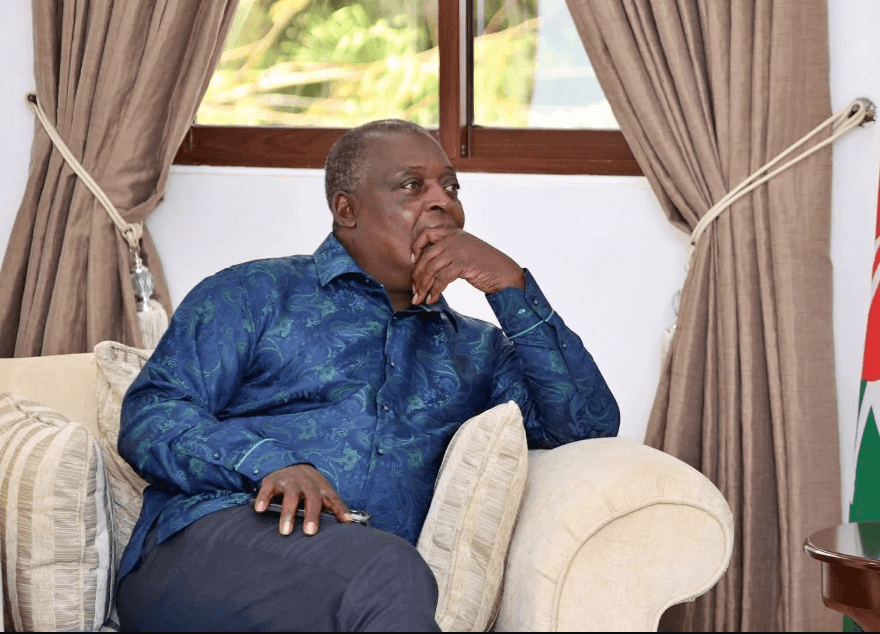

CBK governor Kamau Thugge, when appearing before the National Assembly’s committee, defended the direct procurement of G+D.

The German firm was contracted to print 2.04 billion currency notes with a combined face value of Sh689 billion—down from the 2.35 billion notes in the 2019 series.

These include 460 million pieces of Sh50, 690 million of Sh100, 260 million of Sh200, 170 million of Sh500 and 460 million of Sh1,000 notes.

The Sh1,000 notes are already in circulation, with others to follow.

Thugge told MPs that CBK opted for classified procurement due to the sensitivity of currency printing and the urgency of replacing worn-out notes, warning that a stockout would have destabilised the economy.

“In mid-2023, CBK determined that a shortage was looming, especially for Sh1,000 notes. We applied for classified procurement to avert a crisis. A stockout would have severely impacted price stability and the exchange rate,” he explained.

He said the decision was approved by the National Security Advisory Council, the Cabinet, the Treasury and the Attorney General.

“It is the mandate of the CBK to ensure the right amount of money is in circulation,” Thugge said, noting that the contract with De La Rue had expired in January 2023.

Auditor General Gathungu, however, maintained that CBK flouted procurement laws by failing to appoint a special committee and by denying PPRA the opportunity to monitor the process.

“In the circumstances, management did not fully comply with the Public Procurement and Asset Disposal Act, 2015 and the attendant regulations,” she stated.