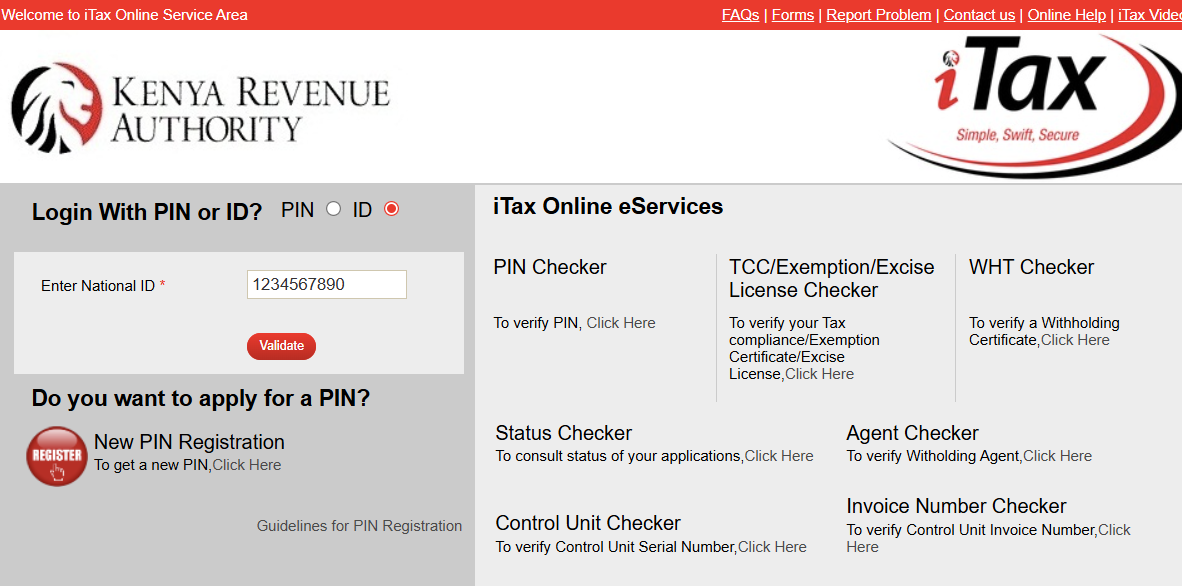

KRA iTax portal with ID login option.

KRA iTax portal with ID login option.

The Kenya Revenue Authority has unveiled a new login feature for its iTax platform that allows Kenyans to access tax services using their national ID numbers.

The user-friendly tax system is expected to ease the burden of tax filing for millions of Kenyans and KRA hopes it will encourage compliance through simplified processes.

Previously, access to iTax services required users to log in using their Personal Identification Number (PIN) only.

While the PIN option remains active, taxpayers can now choose to log in using their national ID numbers—an everyday identifier most Kenyans are more familiar with.

KRA said the decision was informed by user feedback showing that ID numbers are easier to remember and more frequently used in daily identification.

“This move is part of an ongoing campaign by the authority to simplify tax processes, enhance user experience, and promote a more customer-centric approach to tax administration,” KRA said in a statement issued on August 4.

By introducing the ID number as an alternative, KRA aims to reduce friction in accessing iTax services and increase uptake of digital tax platforms.

It is also seen as a solution to common login issues, especially for taxpayers who frequently forget their PINs.

“By offering multiple login options, KRA is also addressing issues related to forgotten PIN numbers, a common challenge among taxpayers,” the statement said.

“The introduction of the ID number login is therefore viewed as a significant step toward removing barriers that discourage voluntary compliance.”

KRA added that the change is part of wider reforms to modernise tax administration and build a system that puts the taxpayer at the centre.

The authority has been working to streamline systems, simplify procedures, and leverage technology to make tax processes more accessible.

The iTax platform is a central part of Kenya’s tax system, used by individuals to file returns, make payments, apply for compliance certificates and carry out various transactions.

Improving access to the platform is expected to support KRA’s efforts to expand the tax base by making compliance easier and more convenient.

The development coincided with KRA recording 117.2 per cent growth in betting excise tax, collecting Sh13.2 billion in the 2024-25 financial year.

The taxman said the boost was driven by real-time monitoring and system integration with betting firms.

“KRA will continue to listen to taxpayers and make changes that reflect their needs and experiences,” the statement read.