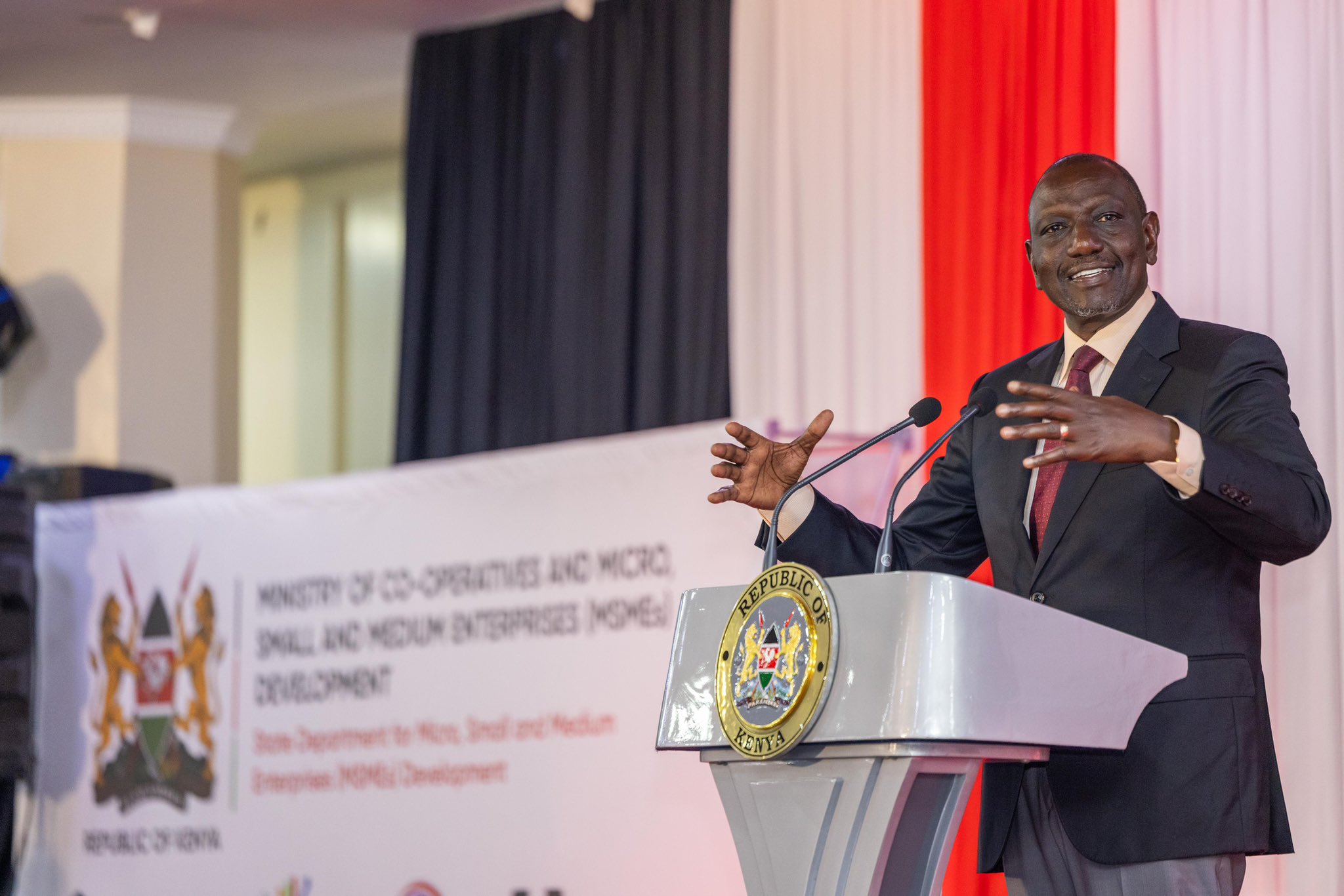

President William Ruto speaks at the Kenyatta International Convention Centre, Nairobi, during the World MSME Day, June 27, 2025. /PCS

President William Ruto speaks at the Kenyatta International Convention Centre, Nairobi, during the World MSME Day, June 27, 2025. /PCS

President William Ruto has announced significant progress in the government’s flagship financial empowerment programme, the Hustler Fund.

According to Ruto, the fund has provided affordable credit to over 26 million Kenyans since its inception.

Speaking during the World MSME Day celebrations at the Kenyatta International Convention Centre (KICC), Ruto revealed that a total of Sh71 billion has been disbursed through the initiative, which aims to support small businesses and individuals previously excluded from formal credit systems.

“Through the Hustler Fund, we have given affordable credit to 26 million Kenyans. To date, it has disbursed Sh71 billion and mobilised close to Sh5 billion in savings,” Ruto said.

He noted that the savings component of the fund is helping to build a financial cushion for millions of low-income earners, laying the foundation for long-term economic empowerment.

The Hustler Fund, officially known as the Financial Inclusion Fund, is a flagship initiative introduced by Ruto on 30 November 2022.

It was launched as part of the Kenya Kwanza administration’s bottom-up economic transformation agenda, aimed at promoting financial inclusion and empowering low-income earners, informal traders, young people, and small business owners.

At its launch, Ruto stated that the Sh50 billion annual kitty would be directed towards supporting micro, small and medium enterprises (MSMEs).

The fund operates through four main products: personal loans, group microloans, SME loans, and start-up loans.

Individual borrowers can access loans ranging from Sh500 to Sh50,000 at an annual interest rate of 8 per cent, repayable within 14 days.

Group and SME loans offer larger amounts and longer repayment periods.

In addition to providing credit, the fund encourages a savings culture by automatically allocating 5 per cent of each disbursed loan into a savings account, split between short-term savings and a long-term retirement scheme.