Kenyans can breathe a sigh of relief after the National Assembly rejected a controversial proposal in the Finance Bill, 2025, that would have handed KRA sweeping powers to access taxpayers’ private financial data.

In its official report, to be officially tabled at the National Assembly, the Finance and National Planning committee declined to amend Clause 52, which had proposed to repeal Section 59A (1B) of the Tax Procedures Act.

The clause would have given the taxman unrestricted access to trade secrets and personal data such as mobile money and bank transactions.

Amending it would have effectively removed current legal safeguards and opened the door for the KRA to obtain financial and trade data without sufficient oversight.

The committee’s rejection, it said, has been grounded on constitutional and legal considerations.

“The committee previously deliberated and concluded that such a provision does not meet the constitutional threshold set under Article 31 (c) and (d) of the constitution which guarantees every individual the right to privacy,” it reads.

The constitution, it said, guarantees the right to privacy, including protection against unnecessary disclosure of personal information.

Further, the committee chaired by Molo MP Kuria Kimani cited Section 51 of the Data Protection Act, which outlines the limited circumstances under which such privacy exemptions may apply.

They argued that the existing provisions under Section 60 of the Tax Procedures Act already allow Commissioner or KRA officers to access relevant data, but only with a court-issued warrant, ensuring checks and balances.

“The current legal framework provides adequate tools for tax enforcement while upholding constitutional rights. Removing these safeguards would undermine public trust and breach privacy guarantees,” the committee noted in its report.

The committee reiterated that judicial oversight and legal boundaries must guide any expansion of tax enforcement powers, aligning Kenya with global standards in data privacy and governance.

The committee’s report is now set to be tabled in the National Assembly for full House consideration.

KRA had defended the proposal arguing it would allow it to track transactions in real-time and reduce tax evasion, noting that only half of KRA PIN holders file their returns.

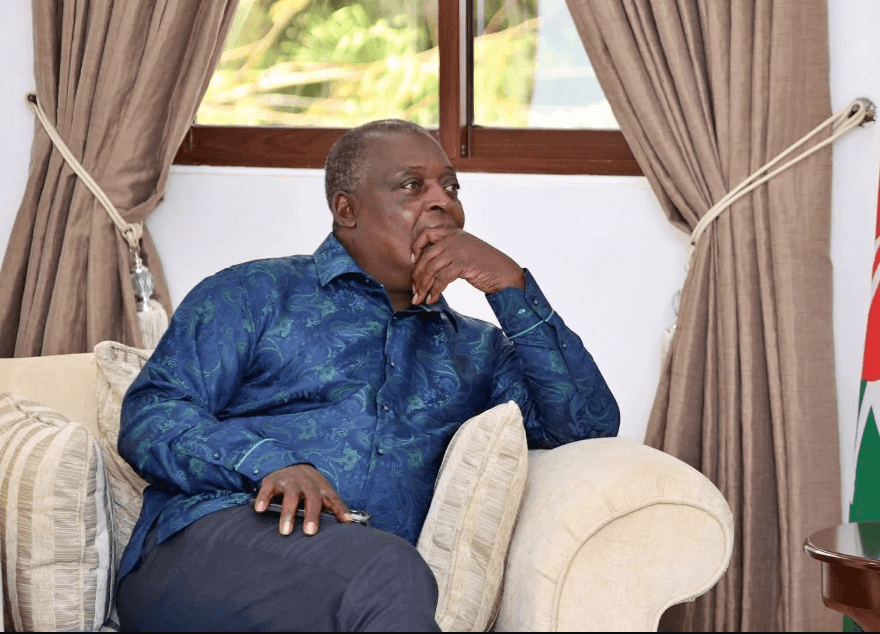

The authority’s chairman, Ndiritu Muriithi pointed out that this would help enhance revenue collection.

KRA is expected to collect Sh2.76 trillion in ordinary revenue to support the 2025/26 Sh4.3 trillion budget, with income tax being the largest contributor.