The government’s decision to award a Sh17.7 billion liquefied petroleum gas (LPG) storage and handling facility contract in Changamwe, Mombasa, to a Nigerian firm has sparked sharp criticism from lawmakers, who have likened the deal to the controversial Adani agreement.

The project, initially slated to be developed by the Kenya Pipeline Company (KPC), will now be constructed and operated by Asharami Synergy, a subsidiary of Nigeria’s Sahara Group, under a 31-year lease agreement.

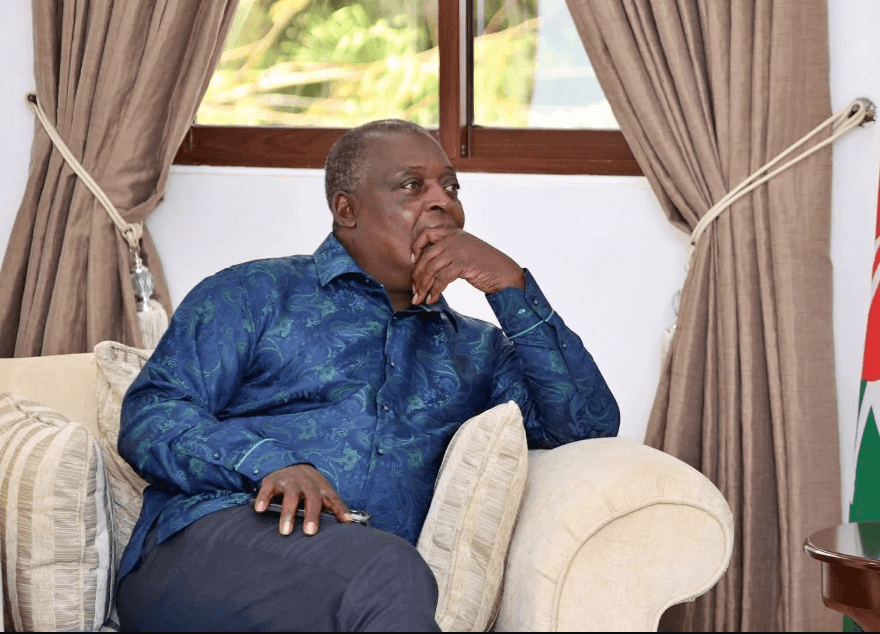

The revelation has triggered fierce outrage in the Senate, with members of the Energy Committee grilling Energy Cabinet Secretary Opiyo Wandayi over the decision.

Lawmakers questioned why the project was removed from KPC and criticized what they termed a lack of transparency in the procurement process.

Originally, KPC had planned to install a 30,000-metric-tonne capacity facility to store LPG from the Kipevu Oil Terminal Jetty. In its project brief, KPC stated:

“The proponent has undertaken a preliminary estimate of the total project cost using experienced consultants. The project is estimated to cost Sh17.73 billion.”

Pakistani firms R&E Modern Technologies and Petrochem Engineering Services were listed as project consultants.

However, the plan has shifted significantly. CS Wandayi confirmed that Asharami Synergy had been awarded the contract following Cabinet approval, which encouraged the Ministry of Energy to pursue private sector participation for the project.

Defending the decision before the Senate committee, Wandayi said the Kenya Petroleum Refineries Limited (KPRL) had received authorization from the National Treasury to use a Specially Permitted Procurement Procedure, as outlined in Section 114A of the Public Procurement and Asset Disposal Act.

According to Wandayi, six companies were invited to bid: Total Energies Kenya, Rubis Energy Kenya, Galana Energies, Gulf Energy, Vivo Energy, and Asharami Synergy.

Only two companies—Gulf Energy and Asharami Synergy—submitted proposals, and following evaluation, Asharami’s bid was found to be responsive and was awarded the tender.

Busia Senator Okiya Omtatah demanded full disclosure of all received proposals and questioned whether proper procedures were followed in leasing the 23.19 acres of public land on which the facility is to be built.

Wandayi responded: “The law was followed in the leasing of the 23.19 acres of public land, with approvals granted in line with established procedures, in accordance with National Treasury Circular Number 1 of 2025 on leasing public assets.”

He added that the lease was approved through a strategic directive involving multiple government institutions, including KPC, the KPRL Board, the Office of the Head of Public Service, the National Land Commission, the Office of the Attorney General, and the National Treasury.

Despite the government’s defense, lawmakers continue to demand greater transparency over the project's procurement and long-term implications.

The development comes at a time when the government has been struggling to lower the high cost of cooking gas.

In February 2023, petrochemical company Eleven Energy sought approval from the National Environment Management Authority (NEMA) to set up a gas storage facility in Mombasa.