Kenya Bankers Association (KBA) has warned that 24 banks face collapse if they will be forced to increase core capital from Sh1 billion to Sh10 billion in three years.

Appearing before the Finance and Planning Committee of the National Assembly, KBA said the move will directly impact 7,000 employees.

The association further warned against additional charges on financial transactions, stating that the effect will affect interest rates charged on loans.

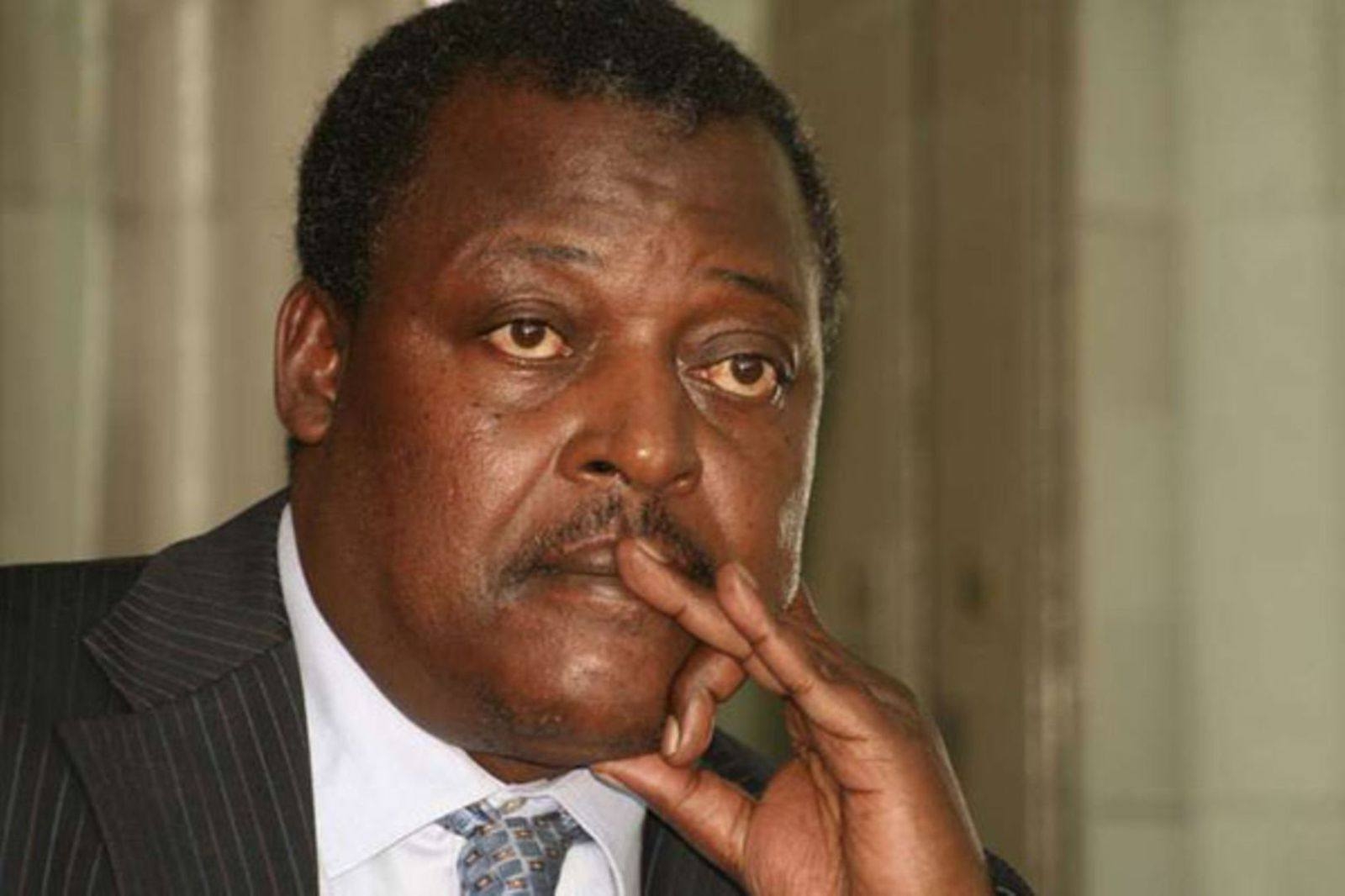

KBA acting chief executive officer Raymond Molenje told the Kimani Kuria-led committee that the 24 banks extend loans to the tune of Sh539 billion to the private sector.

“That is about 13 per cent of total loans extended by all banks to the private sector,” he said.

Molonje further noted that with the collapse of 24 banks,

some 627 rental premises will be subjected to closure.

“We are requesting if we could consider progressively implementing the measure in eight years so that we can get to Sh10 billion by the year 2032,” he advised.

He further argued the move would not serve the purpose of strengthening the financial sector. “It will work counterproductively because Kenyans and businesses will not be served,” he added.

However, lenders have faced criticism for reducing credit to

the private sector, particularly to Micro, Small, and Medium Enterprises

(MSMEs) and SMEs, while instead directing their capital into lucrative

government bonds for higher yields.

The National Assembly is conducting public participation hearings on amendments to various tax laws amid concerns over an attempt to leave out some regions.

The Finance and National Planning committee is seeking

public views on six Bills, including the Public Finance Management (Amendment)

(No. 3) Bill, 2024, Public Finance Management (Amendment) (No. 4) Bill, 2024,

Public Procurement and Disposal (Amendment) Bill, 2024.

Others are Business Laws (Amendment) Bill, 2024, Tax Procedures (Amendment) Bill, 2024, and Tax Laws (Amendment) Bill, 2024.

Deliberations are expected to shape the economy, including the formulation of the 2025/2026 budget-making process.