Betting firms are headed for tougher times next year as MPs intensify efforts to tighten rules of their operations in the country.

The National Assembly Sports Committee, in a new amendment to the Gaming Bill, 2019, is bidding for further tax charges it wants implemented before June.

The report, due to be adopted, says firms will be charged a gaming levy at 1 per cent of its total revenue for the period, monies which must be paid by the 20th of every month.

Those that will fail to comply risk being fined Sh200,000 in measures taken to raise money to fund the National Gaming Authority’s operations.

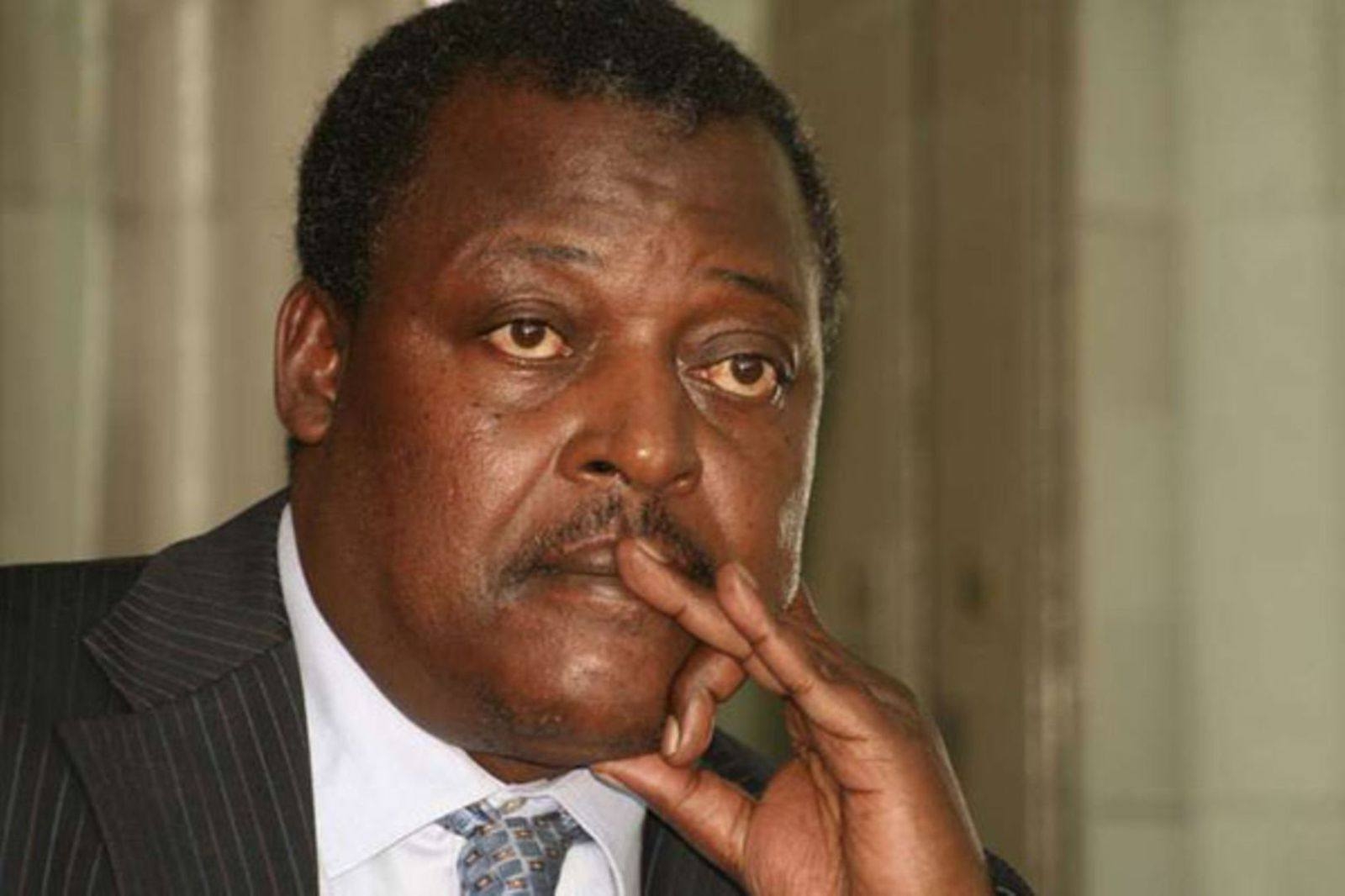

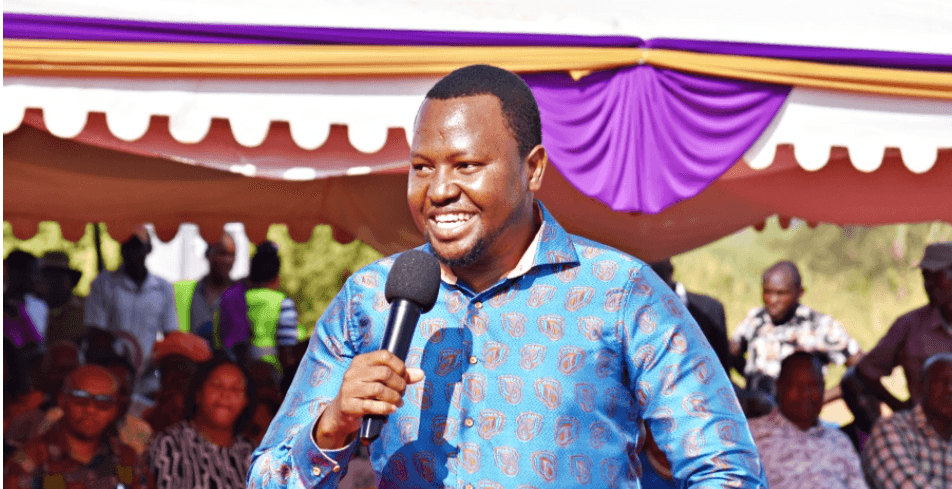

Committee chairman Victor Munyaka (Machakos Town MP) told the Star yesterday that they’d push for the bill to sail through to effect changes.

“It was a priority business before we broke for recess. We will fast-track it when the House resumes to effect the tax measures this financial year,” the lawmaker said.

The report, which followed public participation on the Gaming Bill, has also recommended the introduction of taxes on betting advertisements.

The media relies heavily on the promotional materials for revenue, hence is likely to be dealt a blow by the proposed 35 per cent tax on betting ads.

Such a tax would have to be paid to the Gaming Authority – to be run by a board, which will also approve every gaming advertisement.

Betting firms’ renewal fees have been reduced to a cycle of a year, translating to higher costs much as MPs say the charges have reduced.

For instance, online gaming renewal fee was pegged at Sh30 million every three years but that has now changed to Sh15 million per year.

Non-online bookmakers will part with Sh5 million instead of the earlier proposal for the same amount in a three-year cycle.

Totalisators will attract a renewal fee of Sh1 million per year, prize competition (Sh500,000); non-online gaming (Sh3 million), amusement prizes (Sh500,000), while premises licences will be renewed at Sh3 million every year.

Gaming security fees will cost Sh50 million for casinos, online gaming (Sh200 million), lottery (Sh200 million), non-online bookmakers (Sh30 million), totalisator (Sh10 million), prize competitions (Sh20 million), while non-online casinos will cough out Sh100 million.

Tougher times also await the media in a proposal to bar endorsements by persons posing as bet winners.

“A person shall not hold himself out by advertisement, promotion, notice or public placard with the aim of enticing members of the public to participate in gaming,” the report reads.

“A person shall not display any written or printed placard or notice relating to any form of game of chance in any shape or form that’s visible in a public street.”

A gaming tax at 15 per cent of the gross gaming revenue paid to the Kenya Revenue Authority (KRA) by 20th of every preceding month will also be charged.

Lawmakers have further proposed that the Gaming Authority be given powers to prosecute any offences related to betting.

“An officer duly authorised in writing by the Authority may conduct prosecution of any offence under this Act,” the report reads.

The Authority will have powers to conduct security checks, vetting, and due diligence in respect of gaming activities.

It will also conduct investigations to enforce the Act, pursue returns, handle complaints against licensees, and impose penalties.

The Sports committee has also recommended the establishment of a Gaming Appeals Committee in place of the Gaming Tribunal.

“Any person aggrieved by a decision of the board may, within twenty-one days from the date of making of the decision, appeal to the committee,” the amendment reads.

“The proposed committee will ensure there is an expeditious resolution of disputes. It will be less costly to operate as it will be meeting on as-needed basis,” Munyaka’s team said.

In what may be the relief for the firms, the committee has proposed to reduce license fees charged on betting firms – mostly by half.

All forms of online gaming will be charged Sh50 million; casinos (Sh10 million); non-online bookmakers (Sh20 million); totalisator (Sh5 million); prize competition (Sh10 million); and private lotteries (Sh15 million).