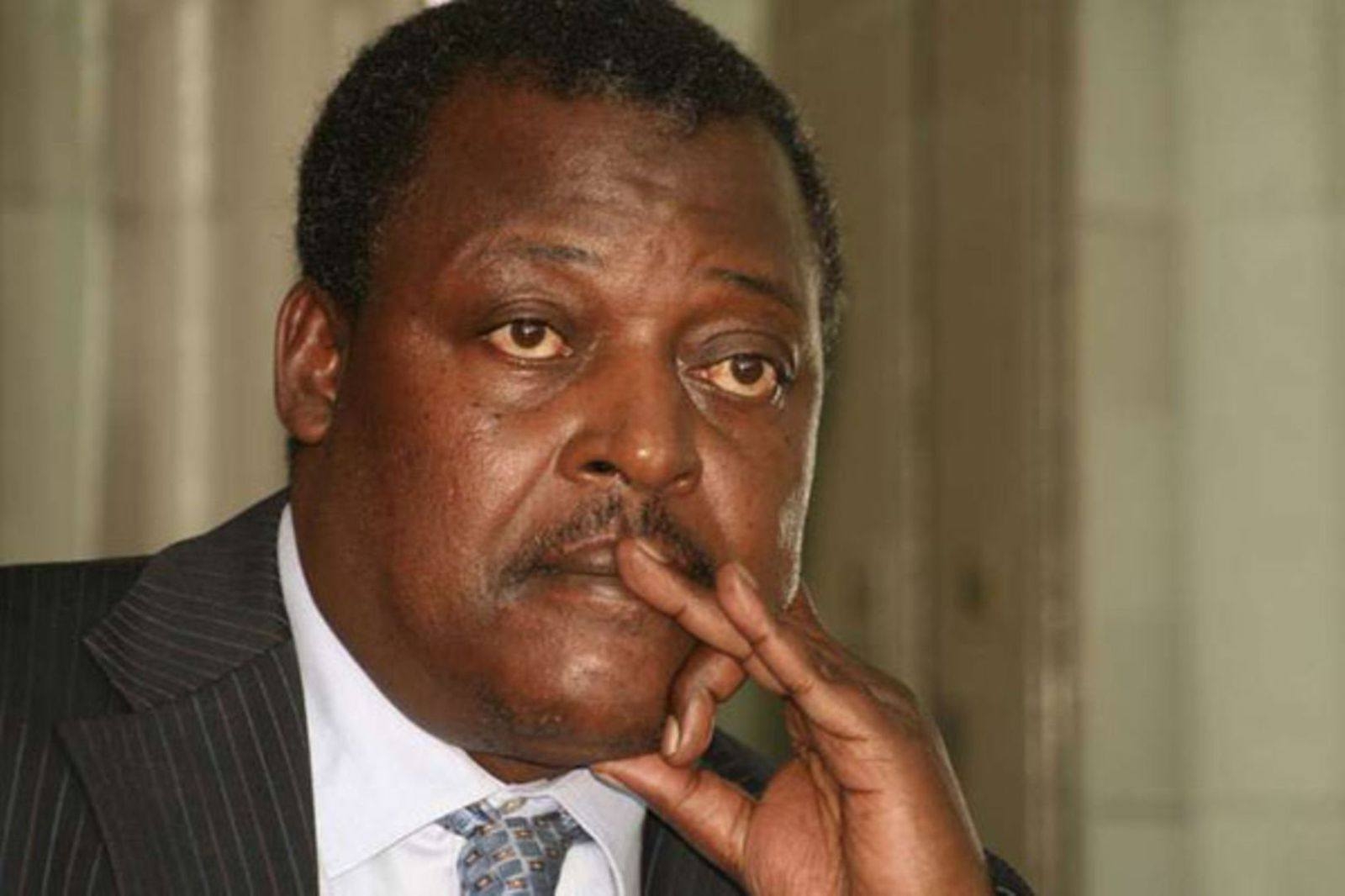

CIB Bank Kenya CEO Abhinav Nehra / PHOTO Victor Imboto

For many businesses, choosing the easiest option to make money and grow their enterprise operations is usually top on the agenda, and they are willing to go every mile to achieve just that.

However, this is not how CIB Bank Kenya CEO Abhinav Nehra thinks businesses should operate.

Nehra says banking institution opting to channel their investments into state securities, rather than lending to businesses, doesn’t spur market growth

He is a boss who believes in doing what is rights and following the correct channels even if it will involve losing his best employees.

The Star caught up with Nehra, the CEO whose deal breaker would be lack of integrity by an employee especially in the banking sector, on how the bank is gearing up to achieve its planned tier one status by 2030.

From table discussions with debtors, to eyeing a tier one status in the next five years, he breaks down how the bank is managing to run with ‘almost zero’ bad loans in an environment that cracking under the weight of bad debt.

How did you come to lead CIB?

I’m a career banker with 35 years’ experience across all continents except Latin America. I spent over 22 years with Citibank in global roles, later served as CEO of a bank in Kuwait, and held senior board positions at UBA in Lagos and Ecobank.

I also consulted in Africa and led Network International, a payments company, before joining CIB. CIB is the third most profitable bank on the continent and is now expanding into sub-Saharan Africa.

Given my 15 years in Africa, Kenya was a natural starting point—thanks to its innovative regulator, strong fintech ecosystem, and being the global pioneer in mobile money with M-Pesa. For me, this is an opportunity to build something unique for Kenya and the wider region.

How different is the Kenyan market from others you’ve worked in?

Kenya is very similar to India in terms of progression, with an open and innovative regulator. The Central Bank’s support for fintech—M-Pesa being the best example—makes Kenya Africa’s most advanced market.

Compared to places I’ve worked like Ghana, Nigeria, and Francophone Africa, those markets are still far behind in banking innovation.

Since acquiring Mayfair Bank, how has the journey been?

Very good. We bought 51 per cent in 2020, then took full ownership in 2023, and I joined in early 2024. Today, we’re deposit-surplus, lending, and have one of the lowest non-performing loans in the country.

To give you a very clear example, today we are hugely surplus on our deposits. We are starting to lend. Our balance sheet, our NPLs are one of the lowest, you know, in the country.

We are cleaning the book. We are setting up some very good processes. We have launched a shared services platform with regard to technology, operations and some of the backend services.

So, for us, I think it's a very, it's been a very interesting journey for me. And now we are absolutely ready to take the next leap of growth as far as concerned.

Kenya is a strategic investment for CIB. The CBK’s KSh3 billion capital requirement has already been met, so the focus now is executing our growth strategy—and we’re ready for the next leap.

It's not only about capital. In fact, to tell you that we were supposed to meet a 3 billion threshold capital as put by CBK. That capital has already come to us in July.

So, capital is not a concern for me at all. For me, it is how do we put the strategic plan in place and how do we grow. And that's already happening.

You mentioned having the lowest NPLs while many lenders are struggling, what are you doing differently?

Our NPLs are far below any tier-three bank. For legacy loans, we resolve issues by negotiating with clients rather than going to court.

That helps us really resolve it rather than spending substantial kind of time and money into going into courts and fighting those legal battles.

For new lending, our model is cash-flow based, not asset-based. Since 2022, our 30-month portfolio has recorded almost zero NPLs.

This means we can support SMEs with strong business models—even if they lack collateral, like flower exporters or merchants with steady receivables.

Now, to tell you the truth, because we follow a model which is very different from any Kenyan bank which is based on cash flow lending, right? Our portfolio of the vintage of almost 30 months which is since 2022, we have almost zero NPLs.

So, which even tells us that we are leaving a lot. I believe in the philosophy that if we have a zero NPL, I think we are leaving a lot on the table.

Now, there are reasons to that where we were being very conservative. But our model is very clearly, the way it is different from other banks is that we don't follow a strictly asset-based lending model. We follow it on a cash flow lending.

There are concerns that risk-based pricing is causing volatility. What’s your view?

I don’t see volatility. The regulator and government have done well to lower deposit rates from about 16 per cent to 8 to 9per cent. This will spur borrowing, unlock opportunities across sectors, and drive economic growth. It’s a positive step, not a destabilizing one.

How do Kenyan operations differ from Egypt’s, and what new thing are you bringing to the local market?

CIB is a 50-year-old institution, the most profitable private bank in Egypt, and listed in London, New York, and Cairo—proof of its strong governance. Our success there is even taught in top business schools.

We’re now bringing those best practices to Kenya, making it our hub for Africa. We’re replicating Egypt’s advanced systems like the T24 core banking platform and leveraging long-term global partnerships with Visa, MasterCard, IFC, and others to fast-track growth here.

In fact, I had a very interesting call with one of the large global players on the insurance side, which is also present in Kenya. So, we have done a global agreement with them. So, what we bring here is some of our global relationships to fast track our business in Kenya.

We are leveraging those relationships and those guys have trusted us for a very long time in Egypt. And they are more than happy to support us in Kenya.

You spoke about the next leap of growth. What specifics define that?

A year ago, we weren’t lending—today our loan book has grown significantly through a unique cash-flow lending model, rare in sub-Saharan Africa. Our focus is corporate and SMEs, while selectively entering retail with products like a payroll proposition and the “everyday saver” account that pays daily interest.

We’re essentially adapting CIB’s proven Egyptian model to Kenya, adding local innovations to fit the market.

So, these are the kind of things, we are bringing, uniqueness in terms of our lending proposition, in terms of our processes, in terms of our products and in fact, in terms of some of the sales practises which we are bringing in the market.

Kenya and Egypt have strong trade ties, especially in tea. How are you leveraging this to grow operations?

Supporting Egypt-Kenya trade flows is a core focus. Egypt is the largest importer of Kenyan tea—over $100 million (Sh13 billion) annually, and with our two branches in Mombasa, we capture much of that trade.

During the 2023 currency crisis, we offered exporters payments in Egyptian pounds while settling in dollars, which proved very attractive.

Beyond tea, we’re also facilitating manufacturers using COMESA and AfCFTA benefits for example, products made in Egypt and white-labelled for Kenya, and vice versa. So, we are really taking advantage of those trade flows.

We target probably 40 to 50 per cent of revenues would be coming in from that segment. That's an advantage because that's kind of a monopoly business for us. A very niche monopoly business because we are the only Egyptian bank in the country.

Local banks have been resorting to government securities as safer havens denying Kenyans access to these loans, what’s your view on this?

We do things differently. We don't, kind of retreat into the shell of government securities and invest there and that. We go out and lend in the market.

We go out and, you know, pitch for customer deposits based on customer service, So, that has helped us and we will replicate the same model in Kenya. So, we will remain focused on traditional banking

Looking ahead, what will CIB term as having been successful?

I think our, my goal by 2030 is to be a tier one bank. A profitable tier one bank which is regarded in the country very similar to the journey we have taken in Egypt. A multinational brand which people would love to bank with.