Tullow Oil is now hoping the government will make a timely decision on the Turkana oil project, even as it pushes to secure a strategic partner by end of this year.

This, amid concerns that delays in approval of its Field Development Plan (FDP) by the government could impact a final investment decision.

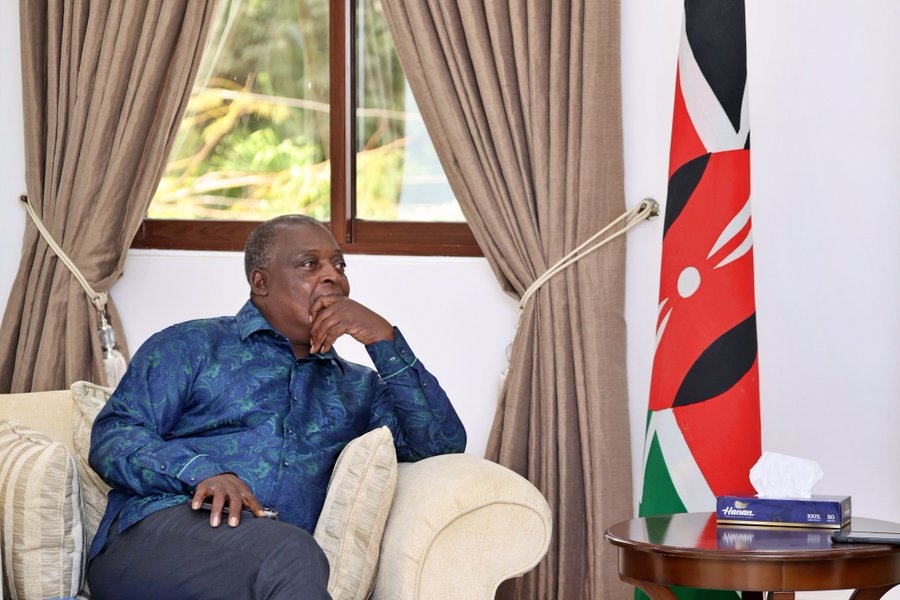

The ministry is expected to make a decision on the FDP by the end of this month, according to earlier indications by Energy Cabinet Secretary Davies Chirchir, which will then be subjected to approvals by Cabinet and Parliament.

This will conclude if Kenya is interested in pursuing or dropping the Turkana oil project.

If the project continues, then the government will have to give its input on how Kenya’s crude will be handled by the investors.

This includes the planned construction of the 852 km Lokichar-Lamu pipeline for transporting crude oil from Turkana to Lamu port, for export.

“Tullow remains exposed to erosion of its balance sheet and revenues due to oil price volatility, unexpected operational incidents, cost inflation and failure to deliver targeted farm downs of exploration assets and Kenya,” the firm said in its recent annual reports.

A revised FDP was submitted to the government in March for approval, in line with the licence extension conditions, amid continued engagements to ensure timely approvals.

The FDP is based on a life of field resource of 585 million barrels gross, initial plateau production of 120,000 barrels of oil per day and capital investment of $3.4 billion (Sh491.5billion) to first oil.

The FDP approval process, including ratification by parliament, is expected to conclude later this year.

“Kenya continues to remain an important asset in Tullow’s development portfolio, with the potential to add material resources and create value for shareholders,” CEO Rahul Dhir said.

Meanwhile, Tullow is pushing to bring strategic partners on board which will unlock more capital for commercialising the Kenyan oil project.

Tullow assets in Kenya covers blocks 10BB, 13T, and 10BA in the South Lokichar Basin and is operated by Tullow Kenya BV.

This follows the exit of joint venture partners–Africa Oil Corp and Total Energies in May this year, a move said to have given Tullow flexibility in negotiations with strategic partners.

Tullow has since described the recent withdrawal of the Kenya Joint Venture Partners, as “ due to differing internal strategic reasons.

It left Tullow with no option but to assume a 100 per cent equity position.

Indian Oil Company–ONGC Videsh Limited (OVL) is among those reported to be interested in taking up a stake in the British firm’s Kenyan assets.

ONGC Videsh is reported to be seeking clarity before making an investment decision.

“Several interest parties including India’s ONGC Videsh Limited have expressed their interest in coming on board as a strategic partner in the development of our Kenyan asset,” Tullow Kenya BV managing director Madhan Srinivasan, told the Star.

All prospective strategic partners remain engaged and detailed farm-out discussions continue with a number of companies.

“Whilst the process has taken longer than expected, Tullow remains focused on securing a strategic partnership this year, ” he said.

Failure to secure a strategic partner would however impact on its ability to progress the Kenya project to final investment decision and unlock value, the firm’s leadership noted.

The government has however remained supportive of the project, giving hope on the future of Kenyan becoming a net crude oil exporter.

According to CS Chirchir, the government is in talks with Chinese and Indian investors to put capital in the project, as it reviews the final investment.

He said Kenya would continue to back Tullow's push for commercial oil production in Turkana, despite the timelines shift to beyond 2027.

Taking full control creates more optionality, gives Tullow more flexibility in the ongoing process to secure strategic partners, creates a simpler Joint Venture Partnership, and streamlines project delivery, according to Dhir.

National Treasury has also in recent times called on industry players, led by the Petroleum Institute of East Africa (PIEA), to formulate modalities of partnering with the Kenya Kwanza Administration to invest in the oil pipeline.

This is through a Public Private Partnership initiative.

“I envision the government having minority shares to facilitate private-sector-led administration and management of this project to benefit from the efficiencies provided by the private sector. This will have benefits for the region and lower costs,”Ndungú said at a PIEA vent in Nairobi.

The institute is the professional body for the oil and gas industry in the region.

Ndungú called on PIEA to forward incentives it requires to mobilise Foreign Direct Investments in upstream activities to exploit the existing oil and gas reserves within the country and tap into their immense benefits once exploited.

This even as the country builds up investments in renewable energy.