Money market regulators and agencies will make the final judgement on players who contravene anti-money laundering regulations in proposals contained in a new Bill.

This is among the new reforms that the different entities are pushing to be included in the Anti-Money Laundering and Combating of Terrorism Financing Laws (Amendment) Bill, 2023.

Financial Reporting Centre (FRC) in submissions to the Departmental Committee on Finance and National Planning, said it had included Law Society of Kenya among the institutions that will now compel their members to report proceeds of crime.

Central Bank of Kenya, Capital Markets Authority, Financial Reporting Centre, Kenya Bankers Association will also get powers to whip non-compliant members.

If enacted into law, the new changes will see FRC, the anti-money laundering agency, granted power to show the instances under which it might request for the revocation of a reporting institution's license.

“We seek an amendment to section 36 of the principal Act to ensure that the LSK regulate, supervise and enforce compliance for Anti-Money Laundering (AML), Combating the Financing of Terrorism (CFT), and Countering Proliferation Financing (CPF) for lawyers, notaries and other legal professionals,” reads the Financial Reporting Centre submission to the MPs.

Based on the national risk assessment report and the risk profile of the country, Kenya faces heightened terrorism financing risks from neighbouring countries with active terrorist groups.

The pressure from global partners for the regulator to strengthen anti-money laundering measures has seen CBK advocate for stricter penalties for designated reporting agents found in violation of the Proceeds of Crime and Anti-Money Laundering Act and its Regulations.

The proposed changes will subject non-compliant members to penalties not exceeding Sh5 million for a violation, with natural persons facing a maximum penalty of one million shillings.

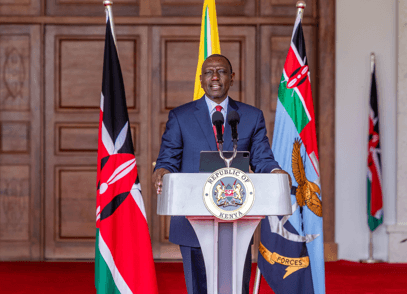

“Changing the cited clauses will give CBK the powers to penalise financial institutions for POCAMLA violations and violation of regulations, guideline and instructions issued under the CBK Act. This will enhance effectiveness of anti-money laundering and combating of terrorism financing laws,” CBK governor Kamau Thugge told the MPs.

The Kenya Bankers Association however raised issue with the proposal to revise the current $10,000 requirement for bank customers to disclose source of the funds.

Instead it wants the figure placed at an equivalent of Sh1 million regardless of the dollar exchange rate at any given time.

However committee vice chairman Benjamin Langat, argued that revising the amount upwards will increase the liquidity in the market and questioned why the sector players are opposed to this.

Among the new changes will also see crypto currencies controlled under the different agencies once a framework is complete.

Currently there has not been a clear boundary between CMA and CBK on who should control the digital assets.

“We have engaged ourselves as the financial sector under the National Treasury and very soon we will agree on the policy since different aspects of crypto fall in different sectors and therefore is just [a matter of] agreeing,” said CMA head Wycliff Shamia.

In the recent past Kenya has made major strides in anti-money laundering and combating of terrorism financing, including the establishment of the Asset Recovery Agency (ARA) and the Financial Reporting Centre (FRC).

![[PHOTOS] Three dead, 15 injured in Mombasa Rd crash](/_next/image?url=https%3A%2F%2Fcdn.radioafrica.digital%2Fimage%2F2025%2F11%2Fa5ff4cf9-c4a2-4fd2-b64c-6cabbbf63010.jpeg&w=3840&q=100)