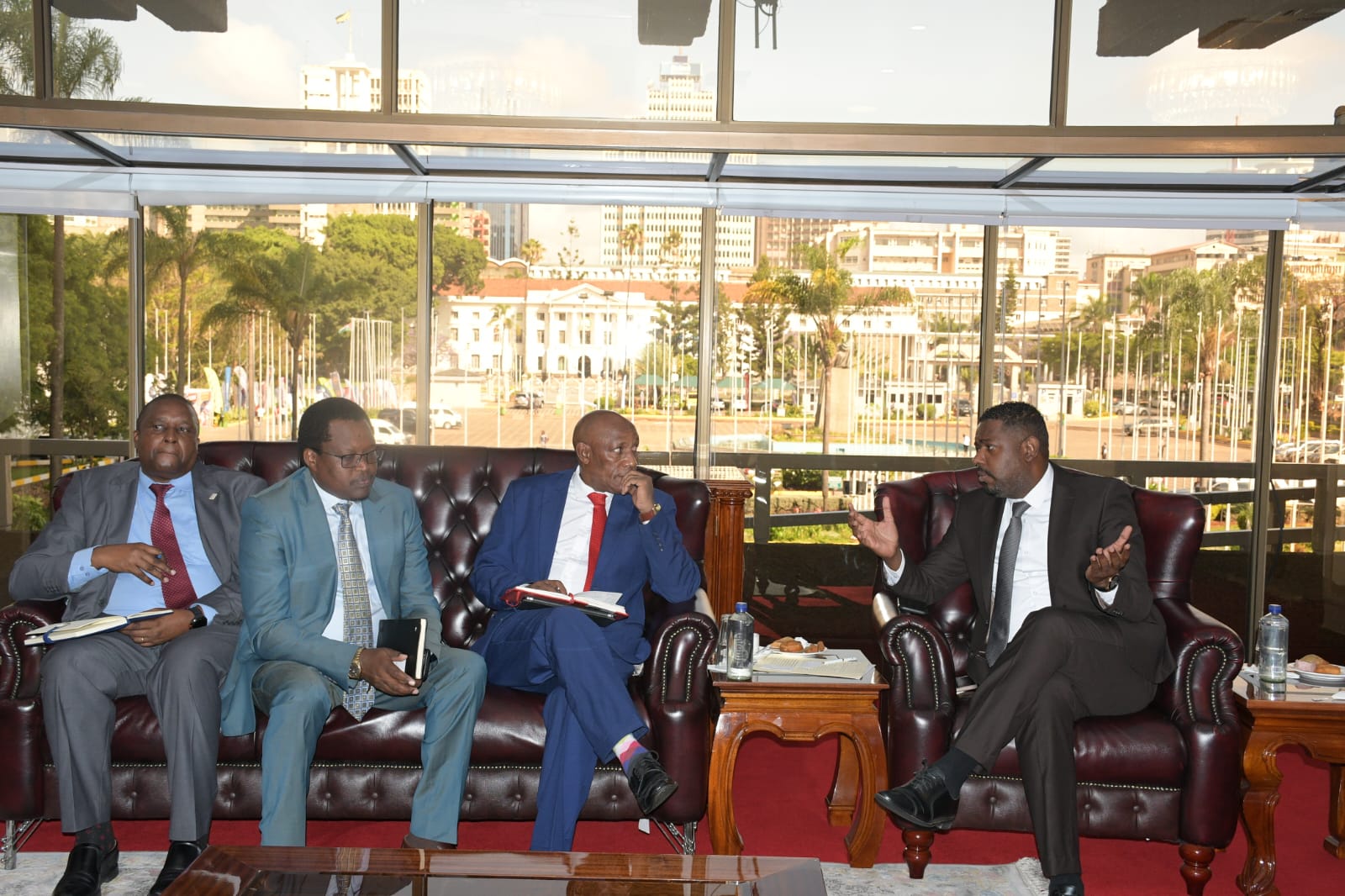

Public Service Superannuation Fund’s Obed Mbuvi, CEO Jonah Aiysbei, Chairman of the CBK Pension Fund Dominic Mwenja and Principal Secretary, State Department for Investment Promotion, Abubakar Hassan Abubakar, during the GIF dialogue with the World Bank and pension partners.

The government is seeking to raise at least $160 million (Sh20.7 billion) from institutional investors and development finance institutions to anchor the rollout of the proposed Green Investment Fund (GIF), a new vehicle aimed at accelerating climate-resilient investments across the country.

The target was announced during a high-level dialogue convened by the State Department for Investment Promotion, the World Bank, and major pension industry players, as stakeholders fine-tuned the fund’s structure ahead of its planned launch.

The meeting, chaired by Principal Secretary Abubakar Hassan Abubakar, brought together key players including the Central Bank of Kenya (CBK) Pension Fund and the Public Service Superannuation Fund (PSSF) two institutions that jointly control more than half of Kenya’s Sh2.5 trillion pension industry.

According to the ministry of investments both funds expressed strong interest in committing capital to the Green Investment Fund, marking a significant show of confidence from the country’s most influential institutional investors.

Through the Kenya Development Corporation (KDC), the government has already committed $40 million (Sh5.2 billion) as seed funding and is now looking to leverage this to attract an additional $160 million (Sh20.7 billion) in follow-on investments.

“Kenya has the tools to turn perceived frontier risk into a bankable, investment-grade reality. Your capital is not just fuel—it is the ultimate vote of confidence that Kenya is open for strategic, high-impact business,” said Abubakar.

“Let us form a coalition of the willing one that demonstrates that Kenya’s pension capital can power national development and global climate action.”

The plan is to eventually scale the GIF into a billion-dollar platform capable of financing green projects in sustainable transport, agriculture, waste management and other climate-aligned sectors.

The fund is structured as a private sector-led, independently managed vehicle supported by the World Bank through the Kenya Jobs and Economic Transformation (KJET) project.

It aims to provide long-term capital to growth-stage enterprises with strong environmental credentials.

PS Abubakar said the GIF aligns with national frameworks such as Vision 2030, the Green Economy Strategy and Implementation Plan, the Climate Change Act, and the recently launched Kenya Green Finance Taxonomy.

The GIF plans to deploy equity and quasi-equity investments of $2 million (Sh258.7 million) to $6 million (Sh776.1 million) per enterprise.

According to the ministry, the endorsement by the CBK Pension Fund and PSSF was one of the clearest indicators yet of rising investor appetite for green finance.

“The fund will serve as a catalytic platform that leverages both public and private capital to finance sustainable enterprises while creating jobs and strengthening Kenya’s competitiveness,” said CBK Pension Fund Chairman Dominic Mwenja.

World Bank Global Director for Finance, Competitiveness and Investment Niraj Verma said Kenya’s leadership in designing a blended-finance vehicle aligned to global ESG standards, promising continued technical support and risk-mitigation tools to draw in more investors.

The stakeholders discussed expanding engagement with pension trustees nationwide, exploring specialist fund structures such as those targeting the marine economy and finalising the GIF’s governance framework.

PS Abubakar urged more pension schemes to participate, saying Kenya has an opportunity to lead Africa in mobilising domestic capital for climate action.

With government backing, World Bank support and growing pension sector interest, the Green Investment Fund is fast emerging as a cornerstone of Kenya’s sustainable finance agenda—one expected to attract billions and position the country as a regional leader in green investment.