Kenya shilling stability against the US dollar and the recently acquired Eurobond have seen the country ramp up its forex reserves hitting $12.07 billion (Sh1.56 trillion) the highest ever recorded.

This marks a major turnaround a year after the country faced pressure from mounting debt repayments and thinning external buffers.

Latest data from the Central Bank of Kenya (CBK) shows that usable reserves rose to $12.07 billion (Sh1.56 trillion) by October 15, the first time the figure has crossed the $12 billion mark since the Bank began publishing weekly disclosures.

The growth in reserves has partly been boosted by the government’s successful $1.5 billion (Sh193.7 billion) Eurobond issuance earlier this month, whose proceeds were credited to CBK accounts during the first half of October.

The reserves jumped by $1.36 billion (Sh176 billion) in just two weeks, up from $10.72 billion at the start of the month, lifting import cover from 4.7 to 5.3 months.

“The foreign exchange reserves remained adequate at USD 12,072 million (5.3 months of import cover) as of October 15. This meets the CBK’s statutory requirement to endeavour to maintain at least 4 months of import cover,” read the CBK bulletin.

The bond was issued in two tranches of seven and twelve years, signaling renewed investor confidence in Kenya’s external position.

Aside from the Eurobond inflows, other external receipts remained broadly steady. Remittances stood at $419.6 million (Sh 54.2 billion) in September, unchanged from a year earlier, pointing to the fact that the Eurobond proceeds were the main driver of the reserve increase.

The record reserves mark a reversal from recent months of moderate drawdowns between July and September, when the stock hovered near $10.8 billion.

Kenya had been under pressure in 2023 and early 2024, when declining reserves raised concerns over its ability to meet external obligations.

CBK on Monday 20, announced that it is seeking secure vault facilities to store gold as it moves to diversify the country’s foreign reserves portfolio, amid global economic uncertainty and record-high gold prices.

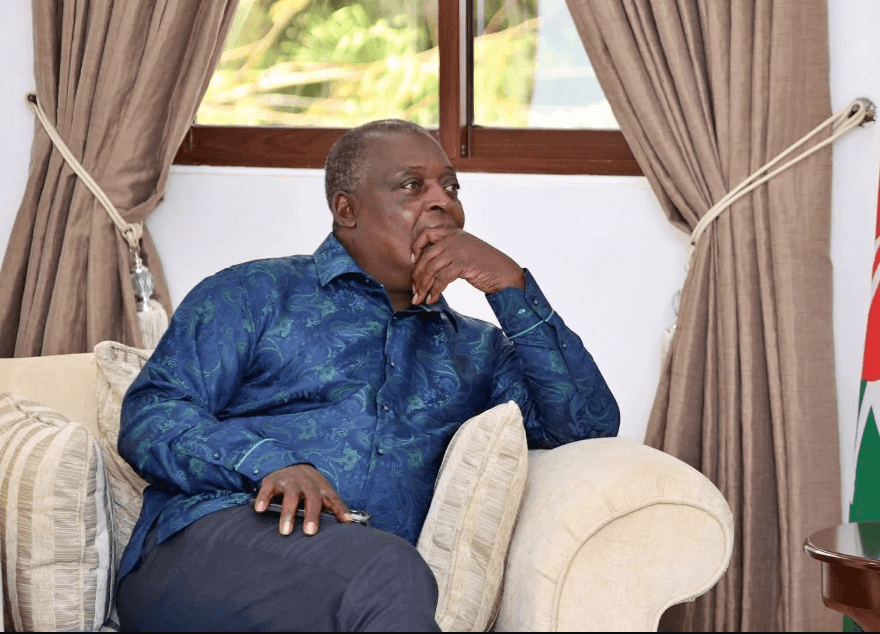

CBK Governor Kamau Thugge told Bloomberg News that the bank has begun discussions with international financial institutions including the Bank of England on the logistics of acquiring and storing the precious metal.

The plan marks a shift in Kenya’s reserve management strategy, traditionally dominated by foreign currencies and government securities, as policymakers look to hedge against currency volatility and safeguard the value of reserves.