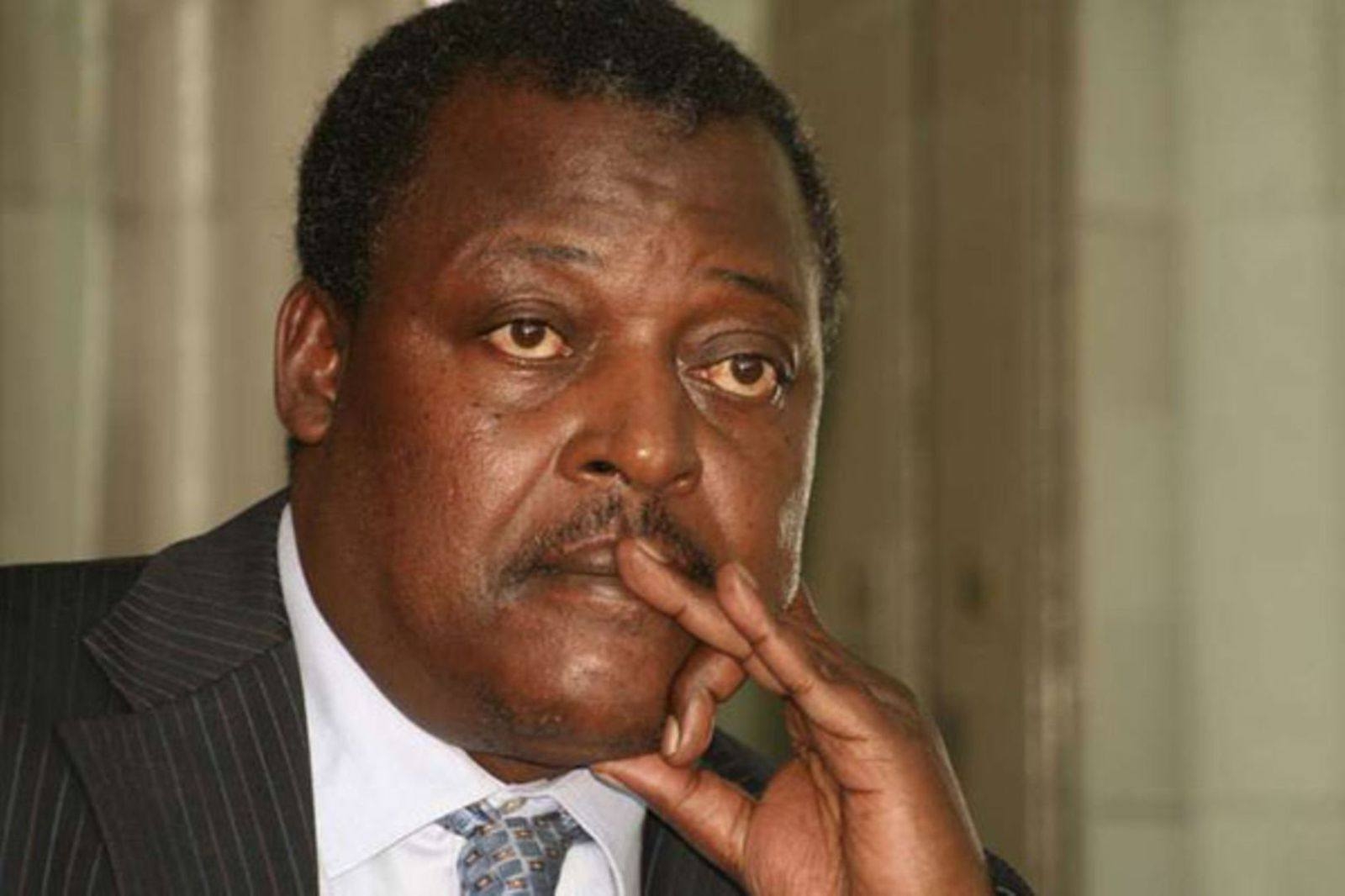

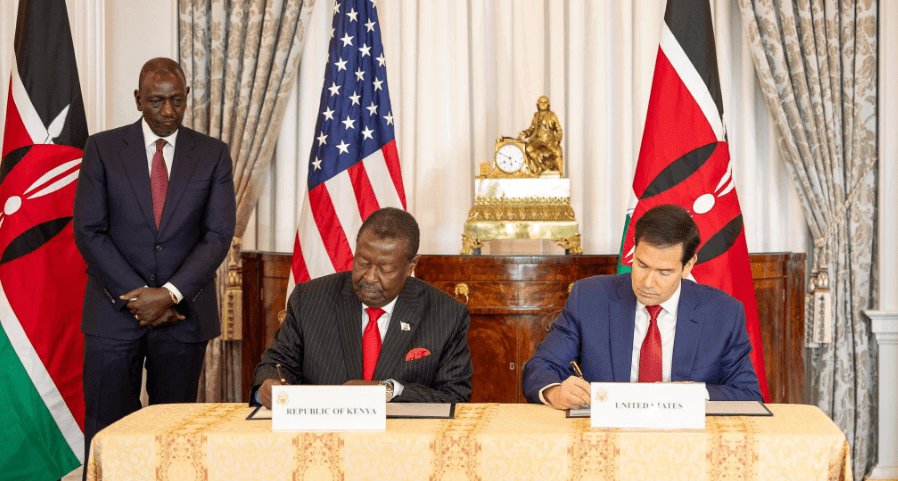

President William Ruto assents the Privatisation Bill, 2025 into law /PCS

NAIROBI Securities Exchange has reported increased investor interest on state entities set for sale, after the assent of the Privatisation Bill, 2025 into law by President William Ruto last week.

The Privatisation Act, 2025 now sets the ground for the offloading of government entities in a planned sale of key entities and loss-making corporations to boost revenue and reduce reliance on public funds.

The privitisation Act which puts Parliament at the centre of approvals opens the door for uptake by the private sector and public shareholding in government entities, as it moves let go at least 11 parastatals, albeit retaining shares in some.

The 11 targeted entities include profit making-Kenya Pipeline Company (KPC) and other struggling entities among them Kenyatta International Convention Centre (KICC), Kenya Literature Bureau, New Kenya Co-operative Creameries, Mwea Rice Mills and National Oil Corporation of Kenya (NOCK).

Others are Kenya Seed Company Limited, Western Kenya Rice Mills Ltd, Machining Complex, Kenya Vehicle Manufacturers Limited.

The once textile giant– Rivatex East Africa Limited has already been leased to a foreign investor, ARISE Integrated Industrial Platforms, on a 21-year deal.

The main focus is however on the country’s fuel storage and transportation firm–Kenya Pipeline which is set for a public offering (IPO) on the NSE, expected to come earlier than the initial target of March 2026.

Government expects to raise at least Sh100 billion from the sale of KPC alone with the offloading of a 65 per cent stake, retaining 35 per cent.

NSE chairman Kiprono Kittony yesterday said investors have increased interest in the market ahead of the IPO, even as the overall performance looks bullish.

“Investors have shown a lot of interest and the indices are strong. We are just waiting for the government to finalise the process and bring KPC for listing which could even before the year ends. The market is bullish,” Kittony told the Star yesterday.

Official data shows the NSE 20, which tracks the top blue-chip stocks or companies, rose by 1.45 per cent last week to 2,984.54 points, NSE 25 by 2.11 per cent to 4,682.27 while NASI All-Share (which represents the performance of all securities listed on the exchange) went up 2.21 per cent to 176.39.

The N10, which tracks the market’s 10 liquid stocks went up by 0.55 per cent to 1,767.79 with market capitalisation closing at Sh2.78 trillion, a 2.21 per cent increase from the previous week.

During the week, the total market turnover of the top five companies was Sh1.04 billion, accounting for 68.63 per cent of the total turnover. The top five companies by market turnover were Safaricom, KCB, KPLC, Equity and KenGen.

Meanwhile, the Privatisation Act 2025, which replaces the 2005 Privatisation Act and establishes the Privatisation Authority to implement the programme in place of a Commission, mandates Treasury CS to identify and provide policy direction on matters related to privatisation.

The process, which has to be approved by Members of Parliament, must also allows public participation and ensure transparency and accountability, efficiency and sustainability and cost effectiveness and value for public resources.

“During the formulation of the privatisation programme, the Cabinet Secretary shall make appropriate consultations with persons who are likely to be affected by the privatisation of a public entity,” the Act reads in part.

The law also requires that persons with expertise in fields relevant to the entities to be included in the privatisation programme, organisations representing persons who are likely to be affected and members of the public.

The Cabinet Secretary will be required to submit a privatisation programme to the National Assembly for approval, accompanied by an explanatory memorandum.

MPs will then consider the privatisation programme within sixty days of receipt guided by criteria for principles of public finance under Article 201 of the Constitution, principles of good governance, the criteria for identification of entities and any other relevant consideration.

A privatisation programme shall be valid for a period not exceeding eight years from the date of gazettement.

If, on expiry of the programme privitisation has not been completed, the Cabinet Secretary may include the affected entities in another privatisation programme formulated and approved.

The methods of privatisation shall include initial public offer of shares, sale of shares by public tender, sale resulting from the exercise of pre-emptive rights, or other method determined by the Cabinet.

This means Cabinet can override all other provisions and approve a direct sale.

Civil society and policy analysts have raised concerns that some clauses could expand state power and limit civic freedoms.

The Privatisation Act, for instance, enables the government to sell state-owned enterprises without requiring fresh Parliamentary approval, a move many economists say weakens public oversight and could open the door to politically driven asset sales.