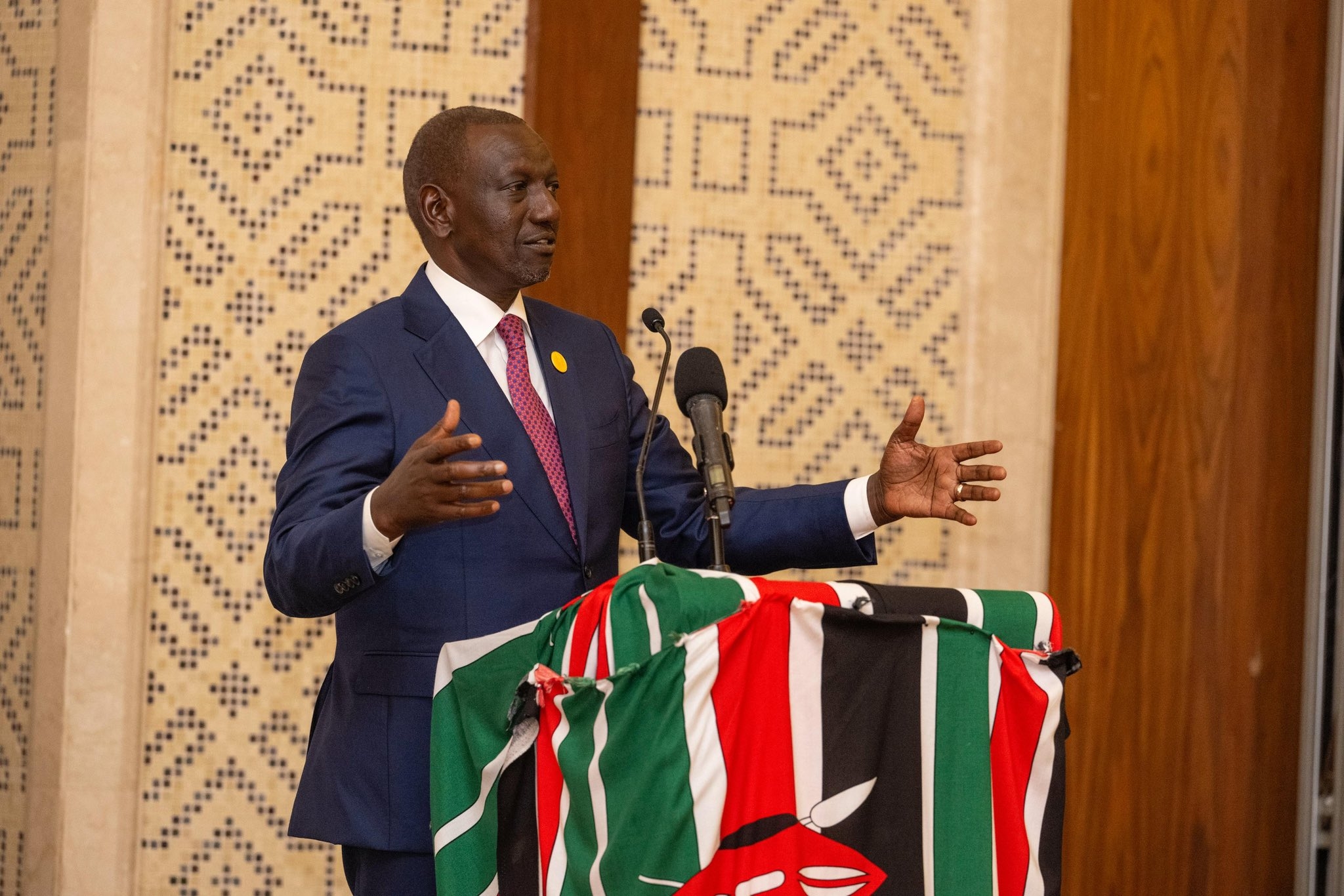

Trade CS Lee Kinyanjui, Retrak Chairperson Rupen Shah and CEO Wambui Mbarire during a meeting at the Ministry’s office in Nairobi/ HANDOUT

Trade CS Lee Kinyanjui, Retrak Chairperson Rupen Shah and CEO Wambui Mbarire during a meeting at the Ministry’s office in Nairobi/ HANDOUTThe government and the private sector have agreed to convene a multi-sectoral forum that will unlock the retail sector’s full potential as a pillar of Kenya’s economic growth.

According to Investments, Trade and Industry Cabinet Secretary Lee Kinyanjui, part of the reforms that will be looked into include streamlining the business licensing process and cutting the multiple licenses needed to run a business.

Some businesses, such as supermarkets, require one to have between 18 to 25 licenses, a survey in the retail sector shows.

The findings, according to the Retail Trade Association of Kenya (Retrak), raise questions over the country's commitment to ease the cost of doing business.

Speaking during a meeting with Retrak leadership led by chairman Rupen Shah and CEO Wambui Mbarire, the CS affirmed the government’s commitment to continue creating a conducive business environment both for local investors and Foreign Direct Investments.

“Kenya provides a stable environment for businesses for the long term, and the government has a large appetite to implement reforms that will promote investment in the country,” CS Kinyanjui said.

The multiagency meeting to address retail sector concerns will include County CECs of Trade, Council of Governors, which represents all the 47 counties, security, Kenya Revenue Authority and Music Copyright Society of Kenya.

There have been concerns over duplication of process by the national and county governments, with all seeking revenues. Counties have also been charging retailers and manufacturers fees on moving products to the different markets.

During the meeting, retailers also raised security concerns, noting that the sector has been heavily hit by recent demonstrations, where businesses worth billions were looted and burnt down.

In attendance were County Supermarket owner Annabell Njambi, Peter Kago of Naivas, among others.

Required documentation in the retail sector includes the mandatory single business permit and fire inspection certificate, while others are based on business operations and include fish trade license, Kenya Bureau of Standards certificate, dairy board inspection, NEMA certificate, Pest Control Product Board, Liquor license and seed selling certificate.

Retailers also require the Music Copyright Society of Kenya (MCSK), Kenya Association of Music Producers (KAMP) and Performers Rights Society of Kenya (PRISK) approvals, at a fee.

Further, they must have the Pharmacy and Poisons Board approval, signage permit, Energy Regulatory Commission (ERC) license for sale of LPG, Loading Zone and Sign Board approvals, as well as a Cook License.

The CS, who also visited Tatu City, the 5,000-acre mixed-use Special Economic Zone (SEZ) on Monday, held talks with investor,s including conversations around the successful implementation of Kenya’s Special Economic Zones framework, to attract foreign direct investment in Kenya.

“With shifting global economic geopolitics, Kenya is increasingly becoming an investment destination for international companies, and SEZs like Tatu City offer a perfect plug-and-play opportunity for such firms,” Kinyanjui said.

Firms setting up operations SEZs benefit from a range of incentives, including a 10 per cent corporate tax rate for the first 10 years and 15 per cent for the following 10 years, compared to the standard 30 per cent.

Businesses also enjoy VAT zero-rating on goods and services and exemptions on import duty and stamp duty.