KENYA is

losing more than Sh9 billion in potential revenue (taxes and levies) to illicit

cigarettes trade, a new report now indicates, with almost all of these products

being smuggled into the country.

The newly released findings from a study conducted by international research company Kantar indicate that the illicit cigarette trade in Kenya has soared to a record high, with more than one in three cigarettes sold in the market not paying taxes.

Last year, the value of

smuggled and

This alarming situation calls for drastic, multipronged action to seal the loopholes and protect legitimate business in Kenya, industry players now say, with BAT Kenya calling for urgent action by the authorities to tackle and mitigate the profound implications of illicit trade in cigarettes.

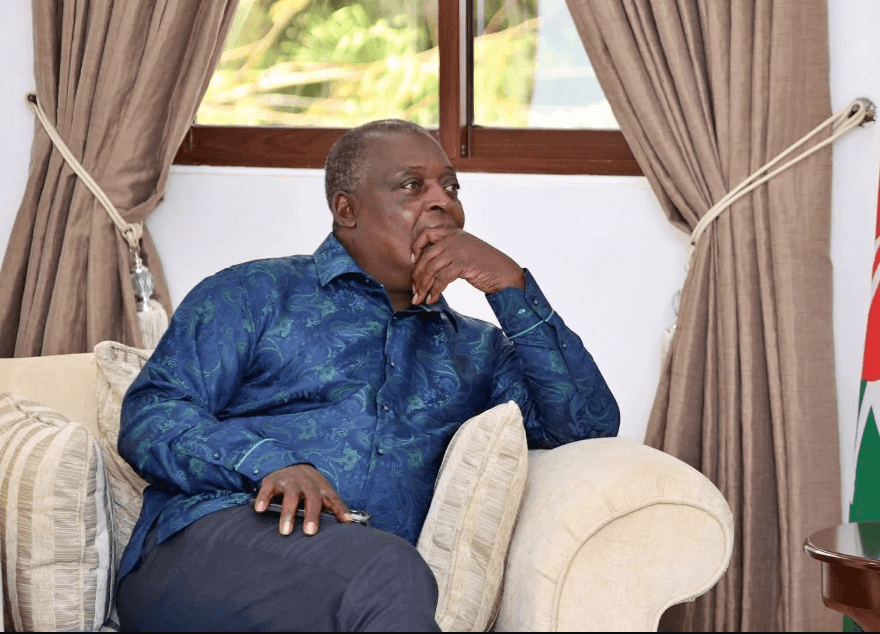

“This alarming rise in illegal cigarette trade is not only depriving the Kenyan government of vital revenue needed for the country’s economic stability, but is also undermining the security and livelihoods of thousands of Kenyans in our value chain,” BAT Kenya managing director said Crispin Achola.

The growth in the number of illicit cigarettes sold also shows that the illicit cigarette market in Kenya moved from 27 per cent just a year ago, to the current unprecedented 37 per cent, with the government missing on a substantial amount of revenue that could be channelled towards development programmes and public services.

“In response to this recent data and dire situation, BAT Kenya is calling for urgent action by the authorities to tackle and mitigate the profound implications of illicit trade for both Kenya and the broader region,” said Achola.

Most of the illicit cigarettes entering the Kenyan market are smuggled in from neighbouring countries, highlighting the cross-border nature of this illegal trade.

“The illicit trade in cigarettes is not only an economic issue, it is a matter of national security and public interest,” said Achola.

Every illicit cigarette sold represents an increase in organised crime and a threat to legitimate local businesses and jobs, according to experts.

Anti-Counterfeit Authority report also shows that in general, Kenya loses more than Sh153 billion in potential tax revenue annually to illicit trade, with counterfeits accounting for about Sh40 billion, mainly cigarettes, alcoholic drinks and electronics.

Counterfeit products also pose potential health risks to consumers as they are not made to the specifications of the original manufacturer, are not subject to quality control tests, and often fail to perform as intended, which could result in catastrophic failures with potentially fatal consequences.

The trade in counterfeits is also linked to funding and fuelling organised crime across economies, with Kenya hugely impacted by the vice.

And while BAT Kenya commends the efforts thus far of Kenyan authorities and their regional counterparts to address illicit trade, it said enhanced action is needed to curb the “dangerous trend.”

"It is critical that all stakeholders work together to eliminate this problem and protect the interests of Kenyans. Our commitment to addressing this issue is unwavering,” said Achola.

“The battle against illicit trade is not one that any of us can afford to fight alone. It requires a united front from all sectors, including government, security forces, private sector, media and the public, to ensure a more secure future for Kenya.”

Kenya Revenue Authority has been using the Excisable Goods Management System (EGMS) on alcoholic drinks and cigarettes, first implemented in 2013, to detect fakes.