Kenya Ports Authority’s plan to offer end-to-end logistics services is skewed to favour specific companies, industry players now say, amid rising concerns that the deal is a threat to a huge section of port stakeholders.

This, as fresh details, emerge of KPA management bypassing the board as it moved to make key decisions on port operations, including the planned end-to-end logistics services for transit market customers using the Port of Mombasa.

KPA under the current strategic plan 2023/24- 27/28 plans to partner with stakeholders to deliver cargo to the customers, in a move it says is meant to improve efficiency and overall turnaround time.

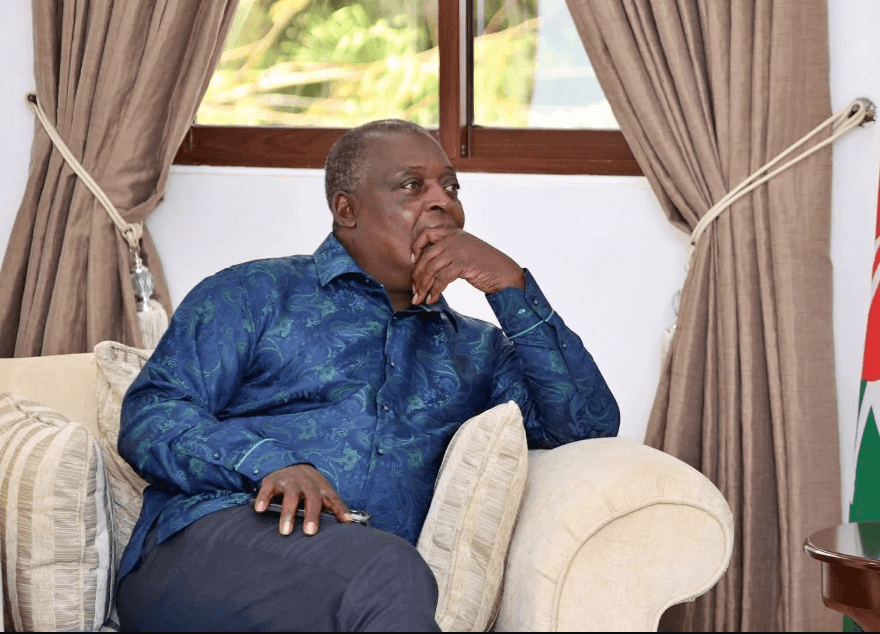

“KPA will provide end-to-end logistics services for transit market customers from Port of Mombasa to the destination, a move that will improve efficiency and reduce cost of doing business,” managing director William Ruto said.

However, it is now emerging that there has not been concurrence within the board, as management moves to push for pre-qualification of companies to work with.

“There has not been any concurrence....but influential people are behind the scheme which stands to benefit some specific companies,” an internal source told the Star.

This means the management is holding the process close to its chest even as it insists on having advertised to have partners on-boarded.

“This thing was advertised last year,” Ruto told the Star on the telephone, even as he affirmed that it would be optional to use the KPA service plan.

He said there was nothing strange with KPA pushing for effeciency.

Management is keen to partner with global shipping lines and a section of regional firms to offer end-to-end logistics services targeting the transit market.

This means KPA wants to be involved in both cargo handling at the Port of Mombasa and earn from clearing the goods and transportation, with reports of strategic companies being lined up for the project.

“We want to give them an option where importers can bypass brokers and ensure timely delivery and returns which means lower freight costs and avoiding demurrage costs. We are just facilitating,” Ruto told the Star.

Already, KPA has engaged Chinese international container transportation and shipping company –COSCO shipping lines, a subsidiary of COSCO Shipping Holdings, whose general manager for global investment, Frances Tan, visited the port of Mombasa last week.

However, the move which is also seen to have a potential negative impact on the Standard Gauge Railway freight services, as specific road transporters benefit, has been opposed by several port stakeholders.

It is likely to affect over 100 contracts that are in place for last-mile cargo delivery with major transporters in the country, from Inland Container Deports of Nairobi and Naivasha.

According to the Kenya International Freight and Warehousing Association (Kifwa), the move is a threat to local firms as it will favour multinationals with financial muscles, with shipping lines expected to seal off the business from the point of loading at international ports to the last mile.

Kifwa, the umbrella body of more than 1,200 clearing and forwarding agencies in Kenya and an affiliate of the Federation Of East African Freight Forwarders Associations (FEAFFA), has threatened a major strike if KPA goes ahead and implements the plan.

“They will see the mother of all strikes,” national chairman Roy Mwanthi said.

He said KPA would be overstepping its mandate by going into last-mile services.

KPA is a wholly owned state corporation established through an Act of Parliament in January 1978.

It is mandated to manage and operate all scheduled seaports along Kenya’s coastline and Inland waterways.

This includes Mombasa, Lamu, Kisumu, Malindi, Kilifi, Mtwapa, Kiunga, Shimoni, Funzi and Vanga.

KPA also manages the Inland Container Depots in Nairobi and Naivasha.

“Unless the law changes, KPA should stick to its mandate which is to operate, maintain, manage and develop ports within the country. It has no business engaging in provision of logistics services,” Mwanthi said.

In the new plan, KPA is keen to see goods delivered to the doorstep of a client straight from the Port of Mombasa either through a bill of lading or merchant haulage, at an extra fee.

Kenya Transporters Association was expected to hold a board meeting to deliberate the move by KPA that would throw hundreds of its members off-balance.

“We shall issue our position. There is a board meeting this week,” CEO Mercy Ireri told the Star last week.

The association is yet to give its official position even as individual companies express concerns of being denied business if the plan is effected, despite KPA insisting it targets only the transit market.

This is Uganda, South Sudan, Rwanda, DR Congo

“We are looking at the transit market. The local market is up to them to do business the way they want,” Ruto told the Star.

The move by KPA is linked to an earlier attempt by global shipping lines to take over the local clearing and forwarding and last-mile cargo delivery business, which led to a major strike by clearing agents in May 2022.

According to the Shippers Council of Eastern Africa (SCEA), the vertical integration model will see shipping lines handle freight, local warehousing, clearing and forwarding and last mile cargo delivery.

This is a strategy that allows a company to streamline its operations by taking direct ownership of various stages of its production process rather than relying on external contractors or suppliers.

According to Kifwa, the more than 1,200 Kenyan based clearing and forwarding firms could close if international shipping lines and KPA venture into last mile business.

This puts slightly over 10,000 jobs on the line where on average, a clearing firm employees at least 10 people according to Kifwa.

Shippers have supported the plan. However, stakeholders need to be involved for it to succeed.

“The end-to-end solutions being mooted is welcome and will most probably be achieved through partnerships and cooperations with discussions with Kenya Railways on service delivery and pricing structure,” said Agayo Ogambi head, policy and advocacy, SCEA.

Others that must be involved, he said, are shipping lines and agents on management of empty containers and a framework agreement with transporters for last mile transport services, from the Naivasha Inland Container Depot to the specific transit countries.

“The port must be efficient and competitive. A lot of investment has be made and its now timely for shippers and consumers to derive benefits from the investment,”Ogambi said.

“KPA and all stakeholders must work together to address the ports and corridor inefficiencies. A competitive port and corridor is a boon to all. Shippers, agents, transporters and the national and regional economies.”

Foreign-owned shipping lines control 92 per cent of Kenya’s international trade.