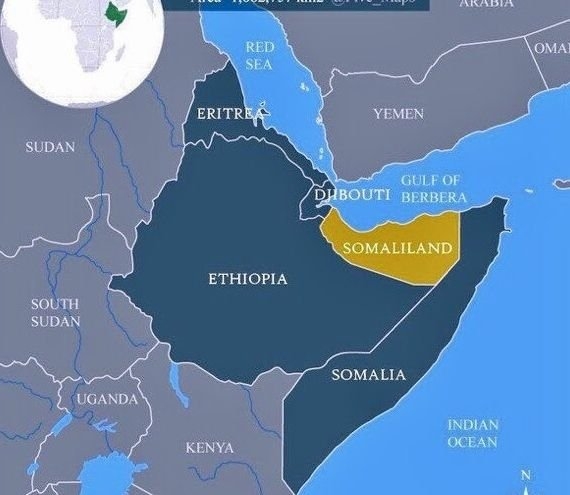

Economic circumstances are tough for most Kenyans, but the negative effects of a global pandemic are not the cause of our financial woes. The pandemic only exaggerated an already existing trend of economic exclusion.

Economic growth remains consistent since the Jubilee administration took office, but Kenyans say their lives are yet to improve.

Latest data from the World Bank put Kenya’s economic growth at 5.7 per cent in 2019, placing the country among Africa’s fastest-growing economies.

However, the lack of inclusive economic growth remains contentious. Central Bank governor Patrick Njoroge acknowledged last year that Kenyan households are yet to feel the impact of economic growth. This manifests itself in the shortage of employment opportunities for job seekers and declining sales for business owners.

Employed Kenyans have to support a large number of unemployed relatives, even while facing uncertainty over the future of their own jobs.

In any case, approximately 84 per cent of Kenyans are either self-employed or working in the jua kali (informal) sector, which is characterised by erratic income, no job security and lack of health insurance.

These circumstances require that each of us take the initiative to cushion themselves from economic shocks that inevitably arise from time to time.

That means arming ourselves with the necessary information and adapting to the changing circumstances we will encounter. "The greatest glory in living lies not in never falling, but in rising every time we fall," said the late Nelson Mandela.

From a personal finance perspective, the good news is that we do not need to reinvent the wheel, in as far as knowledge is concerned.

There are already tried and proven methods of achieving financial resilience and independence.

The most famous of these is compiled in a set of six principles, known as the Six Laws of Wealth.

The Six Laws were first published by American author George Clason in the 1926 book, The Richest Man in Babylon. The book is an international best-seller because it offers easy to implement ideas on personal financial management.

1. Save at least 10 per cent of your income

“Precious treasure and oil are in a wise man's dwelling, but a foolish man devours it,” reads a verse in the Bible. Saving is an excellent way of protecting yourself from financial shocks in future. Money set aside not only takes care of emergencies but is the foundation of building wealth. Everybody should save, regardless of income. Saccos, table banking and chamas are a great way to start a saving culture.

2. Put your savings to work for you. Invest it so it can multiply

“When money realises it is in good hands, it wants to stay and multiply in those hands,” wrote renown Nigerian author Idowu Koyenikan. It is not enough to keep aside money, it is important to put it where it can generate passive or active income. Passive income is from interest-earning accounts, rental income and dividends from shares. Active income is generated by selling goods and services.

3. Avoid debt; the poor pay interest, while the rich earn interest

”Debt is not a tool; it is a method to make banks wealthy, not you,” says Dave Ramsey, author and motivational speaker. Borrowing is unavoidable in the modern world but should be done carefully for productive purposes. With loans now easily accessible through mobile phone applications, the temptation to borrow is high, but money borrowed must eventually be paid back — with interest.

4. Avoid get-rich-quick schemes

“The promise of easy money is but a wolf's trap laid out for sheep seeking taller grass,” wrote James Jean-Pierre, an author. Moneymaking schemes that offer exceedingly attractive returns are, in reality, schemes for extracting cash from unwitting victims.

Examples include double-your-money tricks, popularly known as wash-wash, fake mineral deals and fake government tenders. Multi-level marketing schemes such as Crowd 1, Earnsmart and Bitcoin-related ones lure people with promises of quick returns that never materialise. Multi-level marketing programmes are legal, but as a recent article showed, most people end up losing money in those ventures.

5. Invest in yourself by acquiring knowledge and skills to increase your earning power

“Knowledge is power. Information is liberating. Education is the premise of progress in every society, in every family,” said the late Kofi Annan. In this context, education means striving to become an expert in one’s respective occupation or trade. It is also about getting the right information to make good decisions in financial management. Furthermore, the world is constantly changing and one needs to stay up to date to remain relevant, whether in business or in employment.

6. Safeguard your wealth with diversification and insurance

“Never depend on a single income. Make an investment to create a second source,” advises American investor Warren Buffet, who was the world’s richest man for many years.

Most owners of small businesses are already diversified by running multiple businesses.

This not only boosts income but also provides a cushion in case one type of business is closed.

For example, bars and schools were closed in the immediate aftermath of the Covid-19 pandemic. Sadly, proprietors who did not have alternative sources of income are going through very difficult times.

The purpose of insurance is to protect your wealth from theft, destruction or from getting depleted during personal emergencies, such as illness.

“Buying insurance cannot change your life but prevents your lifestyle from being changed,” says Chinese entrepreneur billionaire Jack Ma. “Medical bills from can wipe off an entire family’s savings they have built for decades.”

Paying insurance premiums might seem like an added expense, but a good insurance policy can provide you with the safety net you need to safeguard your savings.

Apart from the Six Laws of Wealth, the book Richest Man in Babylon offers other interesting guidelines, such as, Seven Ways to Cure an Empty Purse, and the Five Laws of Gold. The practical guidelines are as relevant today as they were 94 years ago, when the book was published.