By NASHON OKOWA

If you want to know that a nation’s economy is doing well, check the consumption of cement. This is nearly a cliché statement in the training circles of the built environment practitioners.

Even so, there is a general consensus among scholars of a tightly close relationship between the growth of the construction sector and the growth of a country’s economy.

Throughout this year, various data has consistently pointed to reduced cement consumption in our construction sector. Let me take you slightly back, our construction sector has been on an inexorable decline for the last near decade, since 2015.

According to data by the Kenya National Bureau of Statistics

(KNBS), the construction sector growth in the year 2015 was 13.9%, 2016 -

9.2%, 2017 - 8.4%, 2018 - 6.9%, 2019 - 6.4%, 2020 – skip due to COVID, 2021 –

6.7%, 2022 – 4.1%, and 2023 – 3.0%.

That is a decline in growth of 10.9% in the last near decade, between 2015 (13.9%) and 2023 (3.0%). And it doesn’t end there; all indications are that we likely to have further declined growth in 2024.

What is happening in the construction sector?

Let me try and make some sense of it, but before I do that, permit me to say something that I have written so much about over the years: this sector is ripe for some radical reforms and regulations to avoid choppier waters.

However, the brutal and unsaid truth is that this sector is unable to reform itself. It is just too fragmented to perform a collective about-turn on how it does business and break out of a vicious circle of doing the same thing day after day.

The industry is desperately waiting for cavalry from private clients and government, but both seem to have their hands full with their own problems; private clients are today more concerned with the viability of their investments and are taking extraordinary, even dangerous steps to achieve this, government, on the other hand, is in the quandary of competing political priorities.

The much-needed radical surgery remains a pipe dream as the industry's decay and plummet continue.

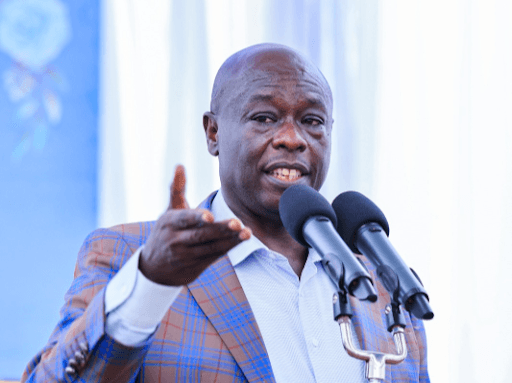

Back to why I think we are in such an insidious decline, first is the cost of construction. Throughout the Uhuru administration, 2013 to 2022, there was no scintilla effort to rein in on the ballooning cost of construction.

You’d have hoped that even with the onset of the affordable housing agenda in 2017, much-needed attention would have been put into lowering the cost of construction; hardly anything was done from an industry perspective. The Ruto administration hasn’t made anything better when it took over in 2022.

The administration took the example of the predecessor’s indifference to the rising construction cost and not only did nothing to address it but worsened it as well.

Our cost of construction is recklessly high, unsustainable, and a chronic pain to this sector’s growth. With such a high construction cost coupled with the blasphemous land prices you see around and in a closed buyer’s market that our real estate currently is in, what meaningful returns can an investor make? It is becoming a tough market for most investors in real estate, and many are starting to opt for other investment ventures.

Next is taxation, that is closely linked to the rising cost of construction. At every slightest opportunity this administration has gotten, they have increased our cost of construction. As diligent and active students of our industry, many of us warned of the negative impact the Finance Act 2023 would have on the construction sector.

Look at what it has done on material prices like cement over the last year. For an industry that probably imports 70% of its materials because of unavailability and high prices of locally produced ones, it was foolhardy to impose the 10% import levy.

Capital gain tax was tripled early last year from 5% to 15%. Historical researches showed that it would slow real estate investment, but we continued despite our concerns. It is not just the unpredictability of these taxes but brutal indifference by the proponents.

The government’s appetite for local borrowing is another reason why I think we have this drastic decline growth in the construction sector. Tell me, who is going to invest in construction and real estate with a government bond interest at 18%? Is there impetus for an investor or even a bank to loan our money to the construction sector when it can sit pretty while investing in such government high-interest bonds and bills with?

I do real estate market and financial feasibility on a near daily basis. You will have to be ruthless, extremely ruthless, with your execution to get 18% annualised return interest. Most fall below 18% mark, hence the preference for bonds over real estate by investors.

How about foreign contractors?

Closely tied to this is the trend of corruption beneficiaries to buying properties out of the country, unlike previously when they would put it in the local market.

The construction sector is the biggest beneficiary of corruption. Every stolen money ended up in buildings, land or properties buying. Seemingly there is a trend to buy properties in Dubai, UK etc. They steal and don’t even have the shame to invest locally. On foreign contractors, the majority of the mega projects are with foreign contractors who repatriate nearly everything.

We somehow expect the industry to grow with some dubious law that only 30% of these megaprojects be given to locals; that could probably be supply of ballast. By the way whoever came up with that law deserves the guillotine.

There are other plethora reasons why we are in such an inexorable decline in the construction sector that those tower for me. We need to urgently and incessantly reflect on these issues.

Probably we could start with releasing part of Sh167 billion in construction-related pending bills to jumpstart the industry. A plummeting, continued plummeting constriction sector is pitifully dangerous to our country’s economy.

The writer is a construction manager, author and Director at Beacon Africa