Kenya’s annual debt obligation will rise to Sh1 trillion in 2019-20 for the first time in history, exerting more pressure on the country’s fiscal plan.

According to the Budget Statement for 2019-20 presented in Parliament, the country is expected to spend Sh1.1 trillion to repay loans, out of which Sh366.4 billion will be interest.

The report shows the government will incur an interest of Sh215.4 billion on domestic debt and a further Sh150.9 billion on external loans during the year. Nairobi county’s debt has risen to Sh66.6 billion from Sh56.5 billion in July 2017. This is a 17.9 per cent increase in a year.

According to the Country’s Fiscal Strategy paper 2019-20, drivers of the high debt include an increase in penalties on statutory debt, updating of creditor’s register, unpaid suppliers and contractors due to underperformance in revenue collection. There was a recent report which stated that each student in the university has at least one loan from either of the online money lending apps.

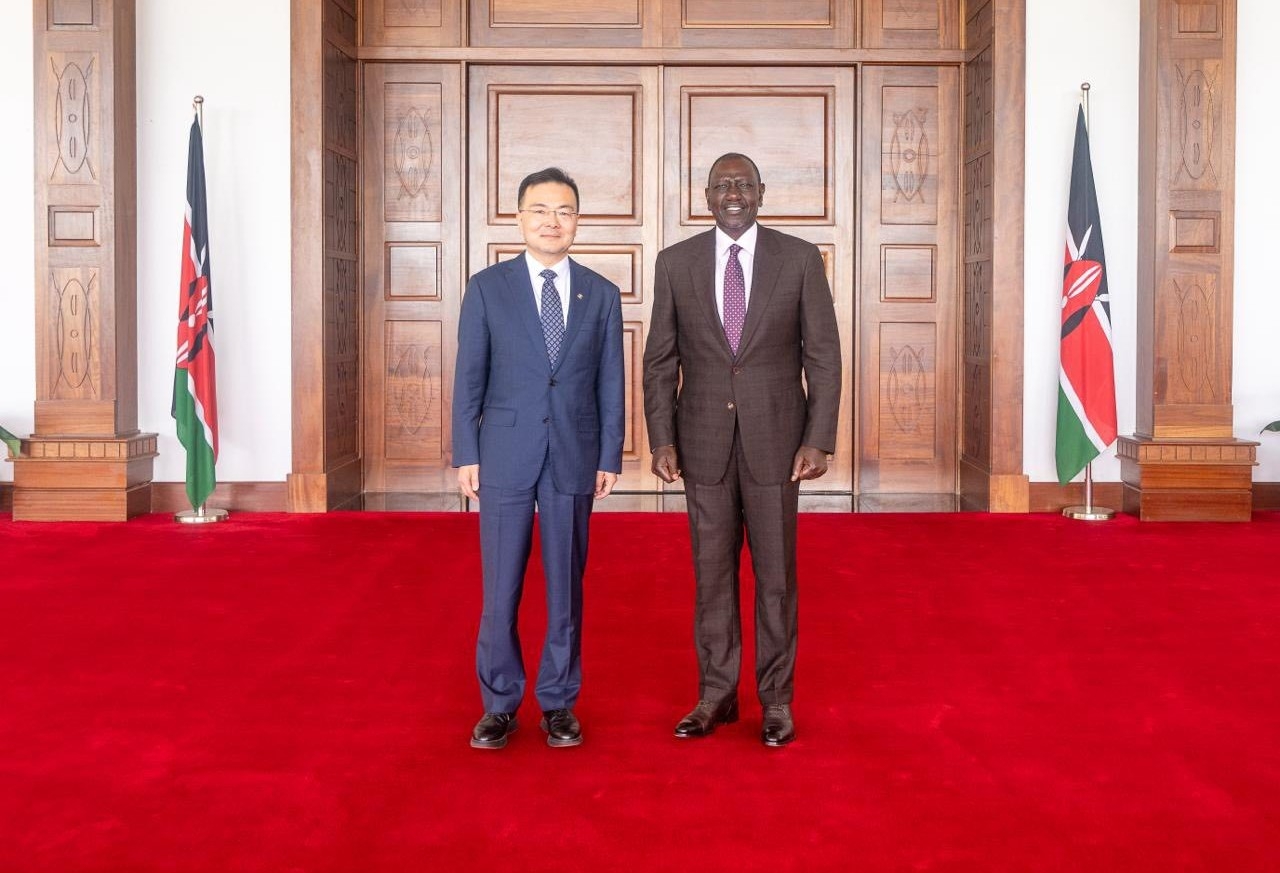

Most Kenyans struggle to pay these loans and borrow again to sustain themselves. Recently, there was a story that Kenya was taking another loan for SGR from China. Already, there is a loan which she is paying heavily. It is high time Kenyan experts educated people on the management of loans and debts and how they affect people’s lives.

if a loan is taken for a development purpose and one can pay it successfully that is okay. Let TV talk shows invite experts on loan management and debt to educate people on the pros and cons of taking loans. Let them talk about savings, investments, budgeting and debt management so that Kenyans can grow to avoid risks.

This will ensure Kenyans are not borrowers but also savers.