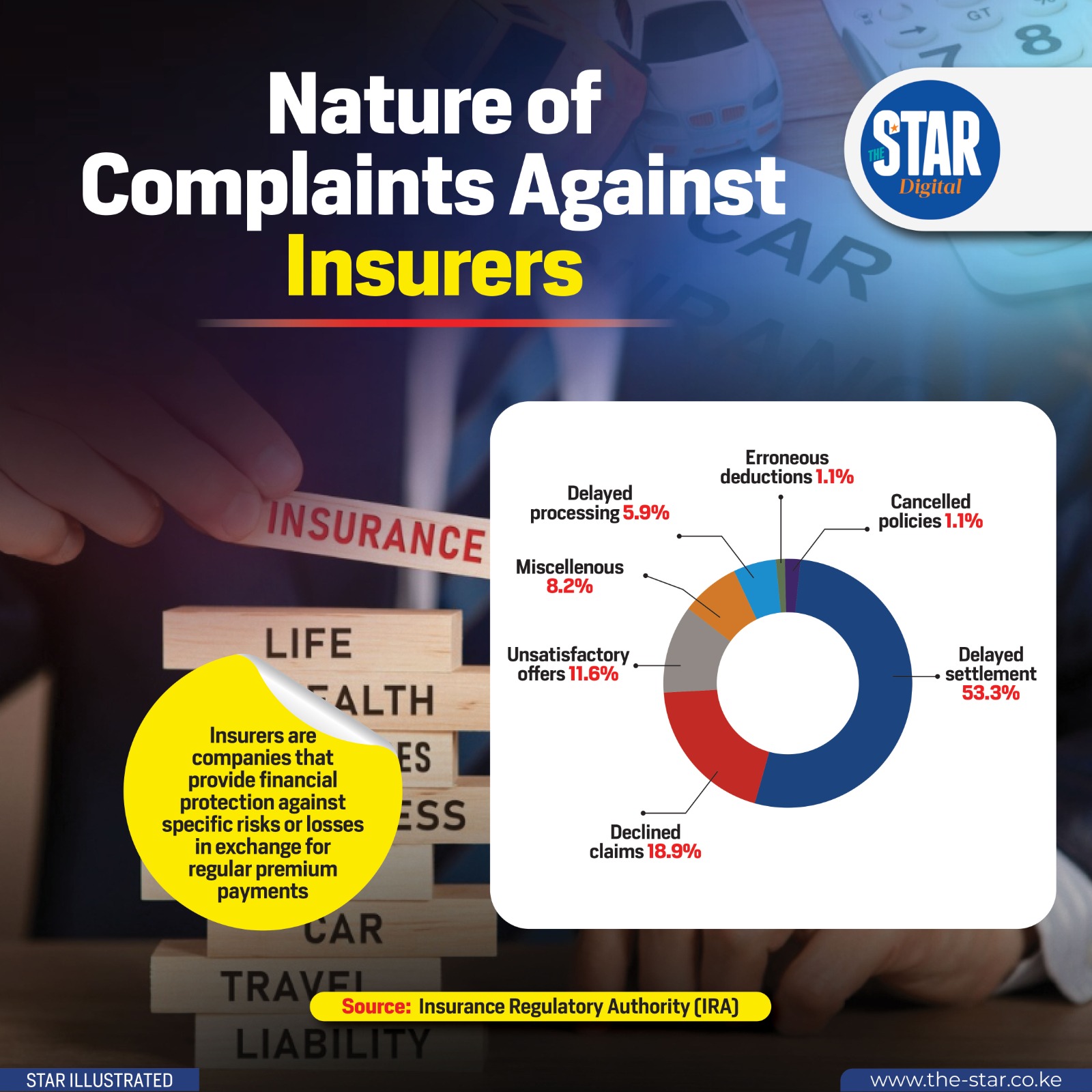

An analysis of complaints lodged against insurance companies reveals that delayed settlement is by far the most significant point of friction for customers, accounting for a massive 53.3% of all reported issues.

This indicates that once a policyholder files a claim, the administrative speed of payment becomes the primary source of frustration.

The second most common complaint, though a distant second, is declined claims at 18.9%, where customers are dissatisfied with the insurer's decision to reject their application for compensation.

Following this, unsatisfactory offers make up 11.6% of the complaints, highlighting discontent with the payout amounts proposed by the companies.

The remaining complaints are distributed across smaller categories: 'Miscellaneous' issues total 8.2%, 'Delayed processing' stands at 5.9%, and 'Erroneous deductions' and 'Cancelled policies' each register a minimal 1.1%.

Overall, the data clearly pinpoints slowness in payment as the top priority area for improvement within the insurance industry.