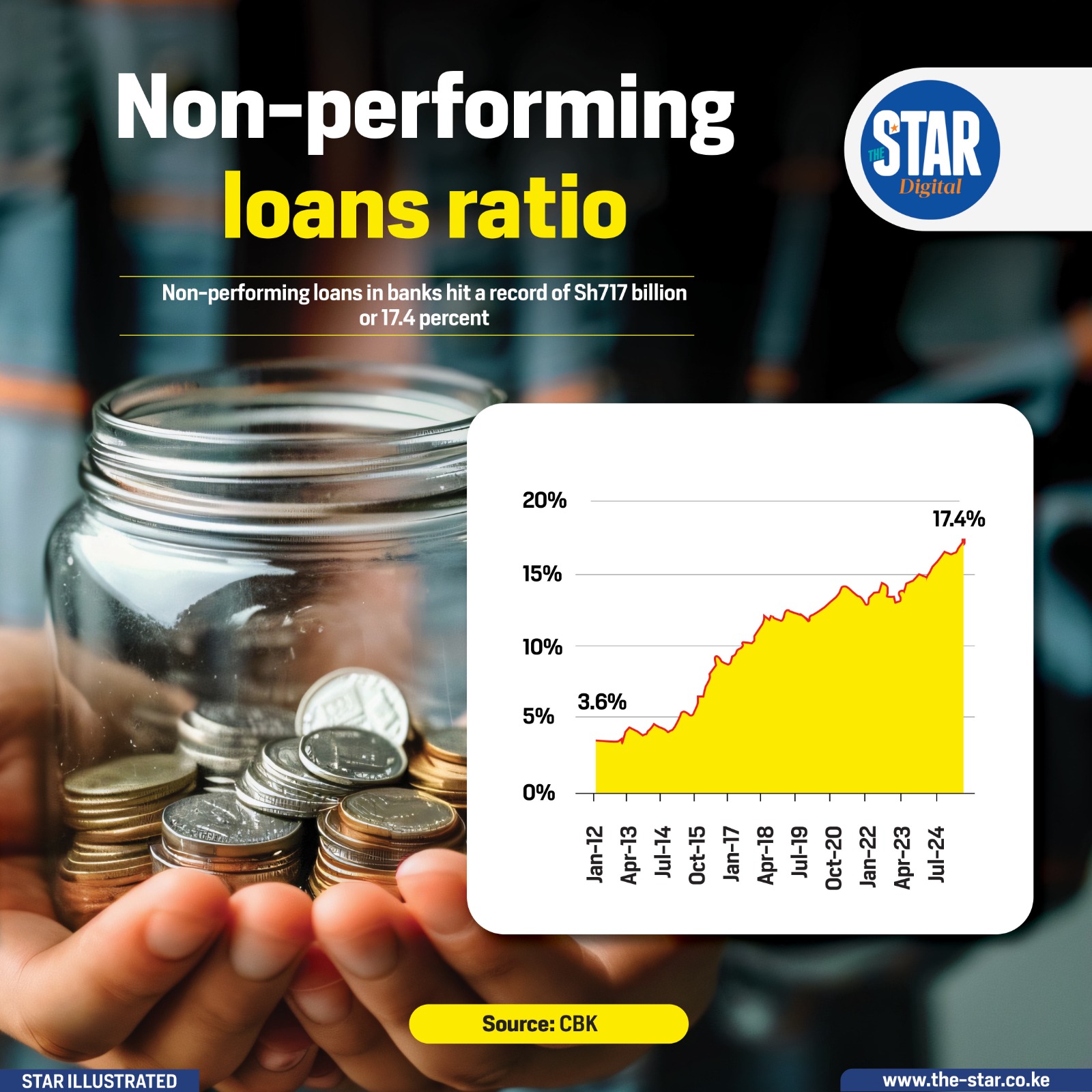

Kenya's banking sector is grappling with a significant challenge as the non-performing loans (NPL) ratio has escalated to a record Sh717 billion, or 17.4 per cent.

This alarming trend is depicted by a rising graph, illustrating a steady increase from a modest 3.6 per cent in January 2012 to its current peak in July 2024.

The consistent upward trajectory over more than a decade signifies growing distress among borrowers, impacting the financial health of banks.

The non-performing loan (NPL) ratio is a key indicator of a bank's asset quality and credit risk, calculated by dividing the total value of non-performing loans by the total value of gross loans, expressed as a percentage.

A higher NPL ratio indicates a greater risk of financial instability for the bank.