(There are people who took Sh500 and then disappeared. The loss is yours. You should get your act together. By now, you would be taking Sh50,000, but because you took Sh500 and defaulted, you are still struggling with that Sh500. Use your common sense, please.”

The President, however, assured that there would be no coercion against those who defaulted.

He said borrowers can repay at their own pace and resume accessing the fund when ready.

“That Sh500 you took and disappeared with—no one is coming after you, relax. Just get your act together. Once you’re back on your feet, come and take Sh1,000, and from there you will keep growing step by step,” he added.

Ruto emphasised that the Hustler Fund was designed to help small traders, boda boda riders, mama mboga, and youth starting small enterprises scale up gradually.

He noted that the model allows borrowers to build creditworthiness over time, moving from low-value loans to higher ceilings as long as repayment is consistent.

Midway through his address, the President highlighted the NYOTA Program, which was launched to empower young people with skills, mentorship, and opportunities to enter income-generating activities.

The initiative combines training, access to credit, and enterprise support for youth from vulnerable backgrounds, offering them structured pathways to economic independence.

The disbursement of the Sh5billion grant targets 100,000 youth across the country.

He encouraged young people to enrol in the program, describing it as an extension of the government’s commitment to expanding financial inclusion and improving livelihoods.

The President further urged beneficiaries to make prudent use of both Hustler Fund and NYOTA opportunities, citing his own upbringing and humble beginnings.

He recalled how he once sold chicken by the roadside before rising to national leadership.

“I used to sell chicken at Sh13 or Sh17, but now I stand before you and tell you I have many chickens. I do not want to say how many. But I want to encourage you that you can start small. There is a future,” he said.

Ruto also dismissed the notion that small loans are insignificant.

“There are those who will tell you that Sh50,000 cannot do much, but I want to appeal to you that if you think wisely, Sh50,000 can make a difference in your life and grow your business,” he said.

Nyota is a five-year initiative, supported by the World Bank, aimed at increasing employment, earnings and promoting savings among youth.

It has four main components, which are improving youth employability, expanding employment opportunities, supporting youth savings and strengthening youth employment systems.

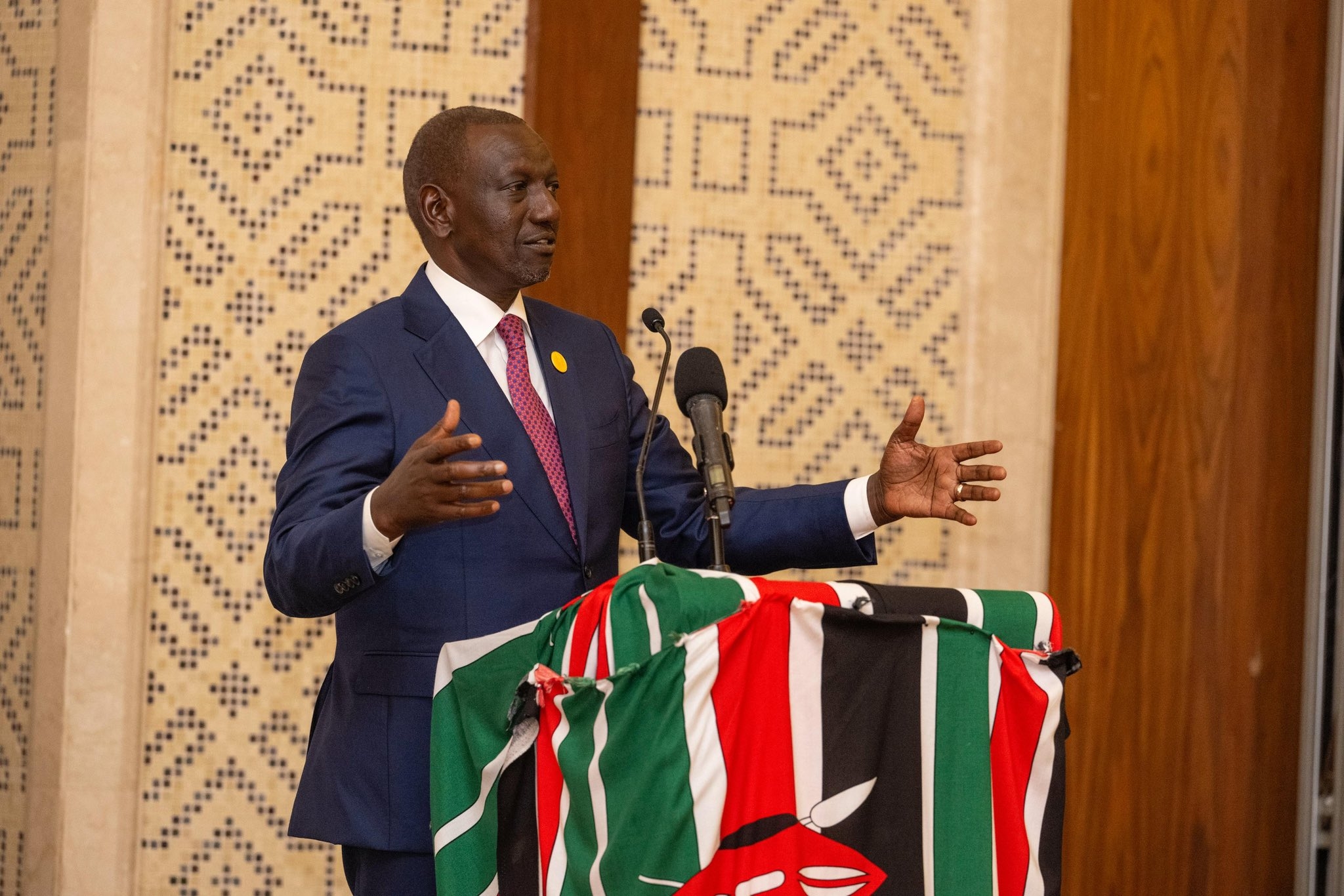

President William Ruto, during the launch of the NYOTA program, at Mumias, Kakamega, on November 7, 2025/PCS

President William Ruto, during the launch of the NYOTA program, at Mumias, Kakamega, on November 7, 2025/PCS