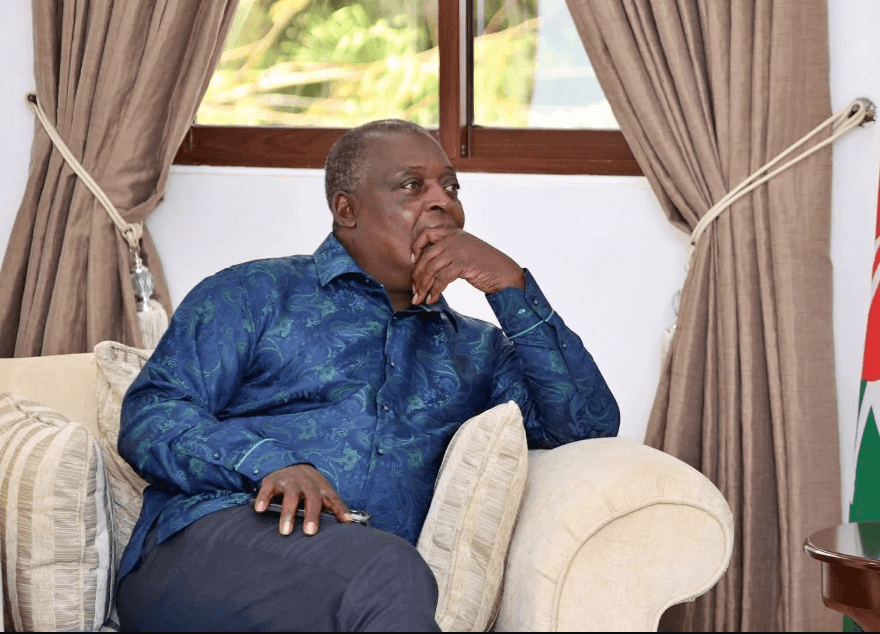

Former Public Service Cabinet Secretary Justin Muturi. (Photo: X/HonJBMuturi)

Former Public Service Cabinet Secretary Justin Muturi. (Photo: X/HonJBMuturi)

Former Attorney General Justin Muturi, who also served as Public Service Cabinet Secretary, has questioned the legality of a new Sh1.2 billion insurance scheme for civil servants.

Muturi says the government’s recent decision to allocate Sh1.2 billion for the settlement of civil servants’ injury and accident claims has sparked serious questions about its legality and compliance with existing laws.

Last week Principal Secretary for Public Service and Human Capital Development, Dr. Jane Imbunya, announced that the government has set aside the Sh1.2 billion in the 2025/2026 financial year to settle claims under the Work Injury Benefits Act (WIBA), Last expense and the Group Personal Accident (GPA) scheme.

The allocation will cater for civil servants’ claims accumulated from April 15, 2024, to date, with the disbursement process beginning immediately under the implementation of the framework to be developed with the supervision of the Director of Human Policy and her office.

“The government is committed to ensuring that civil servants who have been affected receive their rightful compensation. We must create a process that is simple, legally sound, and responsive to the needs of the claimants,” Dr. Imbunya said.

The PS emphasized the importance of establishing a working group comprising officers well-versed in the legal frameworks governing the compensation schemes to ensure an efficient, transparent, and claimant-friendly process.

However, in a statement, Muturi now insists that though the intention may be good, the legal framework does not support the new scheme.

“While the allocation of Sh1.2 billion is intended to address long-standing civil servant claims, the mechanism chosen by the Ministry of Public Service has revived an old problem previously abandoned for being unlawful,” the former AG, who also served as National Assembly speaker for 10 years stated.

Legal experts argue that unless properly aligned with WIBA, the Insurance Act, and the PSSS Act, the initiative exposes the government to litigation, financial risk, and credibility damage.

“The perpetuation of illegality and failure to adhere to the law and constitutional provisions has left civil servants’ claims amounting to Sh7.6 billion unpaid. This includes claims for which the government has already remitted premiums to the Social Health Authority (SHA),” Muturi said.

He added; “The situation, compounded by the inexperience of new officials at the Ministry of Public Service and Ministry of Health, has left next-of-kin and injured public servants desperately begging for benefits that remain overdue despite clear legal and financial obligations.”

Among the issues raised include questions on the legality of the fund, which effectively conducts insurance business outside the legal framework.

There is the second issue of policy reversal, as the new fund may contradict Cabinet decisions that previously dissolved similar funds.

Experts also warn of exposure to litigation, as trustees under the Public Service Superannuation Scheme may be held liable for statutory breaches, and also of fears of fraud and mismanagement, as being without actuarial or regulatory oversight, the risks of abuse are high.

In 2012, the government established a GPA Operations Unit to handle civil servants’ injury and accident claims, while in 2017, the Miscellaneous Amendment Act amended Section 20(4) of the Insurance Act, making it illegal for unlicensed entities to handle insurance business.

The law states that violations attract penalties of up to Sh10 million or 5 years' imprisonment, and following this, Cabinet Memo CAB (17)60 disbanded the GPA Unit, transferring insurance responsibilities to the defunct NHIF.

By 2020, NHIF had secured a legal exemption to underwrite enhanced covers, including COVID-19, in partnership with commercial insurers.

Despite this, legacy claims worth Sh3.93 billion from the disbanded unit remain unsettled, and over Sh4 billion for the period starting from April 14, 2021.